Recently ranked by TechTimes as number one among the top five best Fintech events worldwide, the annual Sopra Banking Summit returns for its second edition. With more than 5,000 attendees already signed up, the event will envision the financial world of the future, by bringing together visionary market leaders covering three key themes: “Achieve operational efficiency,” “Engage your clients” and “Open up your ecosystem.”

“How technology is supporting the Sustainable Transition of the Financial Sector?” with Sheila O’Hara and Claire Ducos

In this French-language session, our audience is treated to talks from Sheila O’Hara, Business Technical Leader for Sustainability at IBM, and Claire Ducos, Director of Banking Consultancy for Sopra Steria Next. Both speakers explain what their companies are doing to improve environmental sustainability across Europe, and how IBM and Sopra Steria Next complement each other in creating an end-to-end sustainability plan for customers.

Claire starts things off by explaining how Sopra Steria itself is improving its in-house sustainability efforts: “Since 2015, Sopra Steria is carbon neutral, and we have made a strong commitment to achieving net zero before 2028.”

And likewise, Sheila says that IBM has similar objectives, and that environmental aims are at the heart of the company’s future strategy: “IBM has also fixed ambitious objectives in terms of gas and oil emissions, and last year we announced our ambition to become net zero before 2030.”

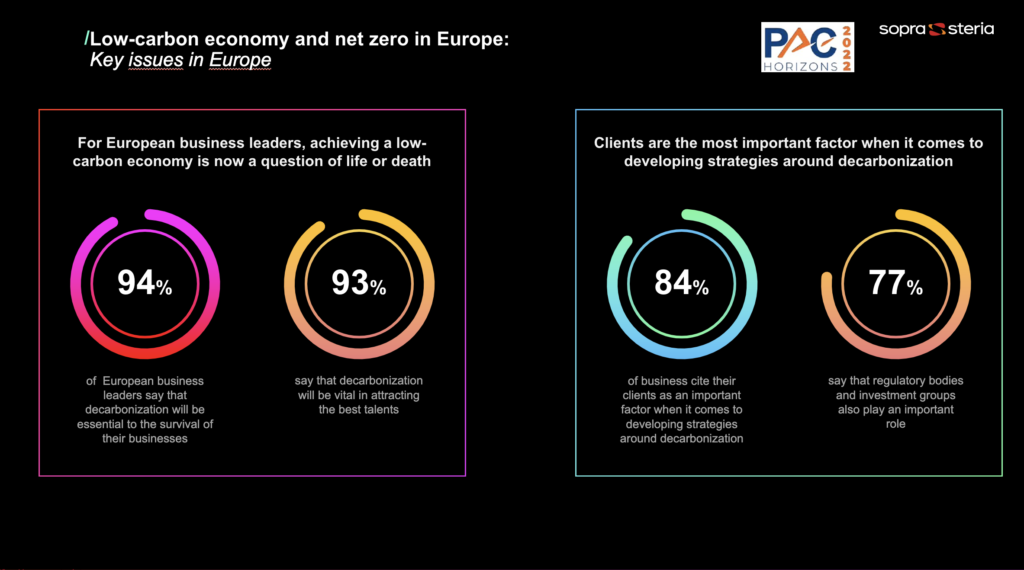

Indeed, it’s an important step for many companies as explained by Claire, who cites research conducted by analyst firm Pierre Audoin Consultants to show that sustainable energy is a key theme for business leaders across Europe.

“94% of European business leaders say that the question of transitioning to sustainable energy is a pressing question for their business, with a special focus on reducing their carbon footprint. It’s the priority of these leaders to reach this goal of net zero as soon as possible.”

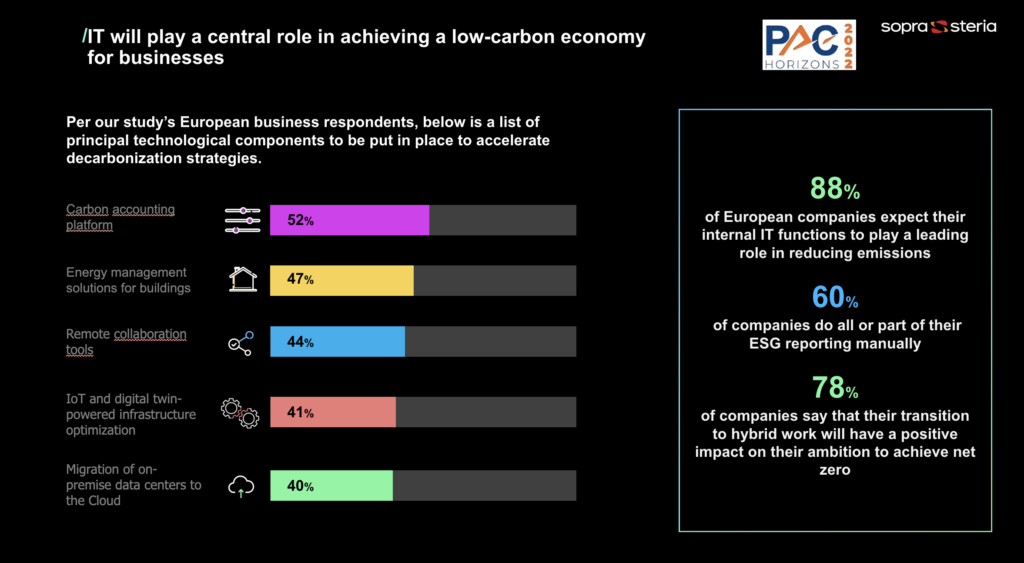

Both Claire and Sheila go on to discuss the efforts that IBM and Sopra Steria Next are making in helping their customers to achieve their sustainability goals. For instance, IBM has a holistic roadmap in place to help clients accelerate their transition toward sustainability, and to put their strategies and objectives in action, as explained by Sheila. She says that it’s important for companies to be able to measure their success and progress with their environmental goals, and also to be able to work with partners to collectively improve their sustainability strategies.

Claire says that Sopra Steria’s solutions around sustainability complement those of IBM perfectly, particularly when it comes to IT transformation. She mentions Sopra Steria’s “Green for IT” solution, which evaluates and measures the carbon footprint of businesses, across their staff and IT systems, allowing them to make informed decisions when it comes to transformation.

If you’d like to learn more about IBM’s and Sopra Steria’s IT strategies, then you can watch the full on-demand video of this session by clicking on this link.

“PayObserver 2022: will EU banks always lead payments?” with Natalie Michel and Nicolas Miart

In the final session of the Sopra Banking Summit 2022, Natalie Michel, Executive Vice President of Strategy at Galitt, and Nicolas Miart, Managing Director of Consulting at Galitt, give a wide-reaching overview of the payments industry

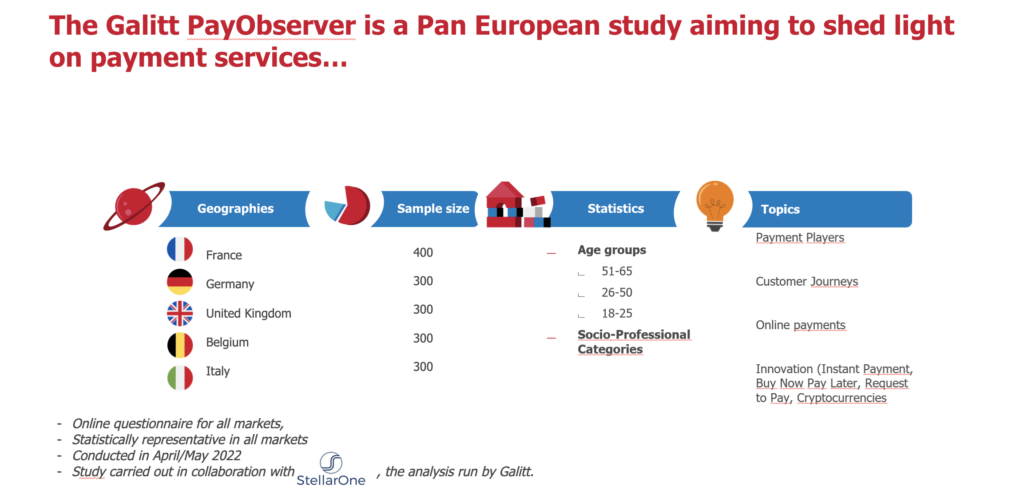

Both Natalie and Nicolas focus on the question of whether banks will continue to lead the payments sector in the future, using an independent study published by Galitt, PayObserver 2022.

This report, as explained by Natalie, helps Galitt and its partners to shed light on payment services and payment providers, and throughout this session, Natalie and Nicolas use key statistics to explain important sector trends.

Some key areas that Natalie and Nicolas dive into are:

- Banks competitiveness next to new industry entrants, such as neobanks, online digital banks and big tech

- The customer journey

- Alternative forms of payment, and the resilient success of the plastic card

- Online shopping

- Payment security

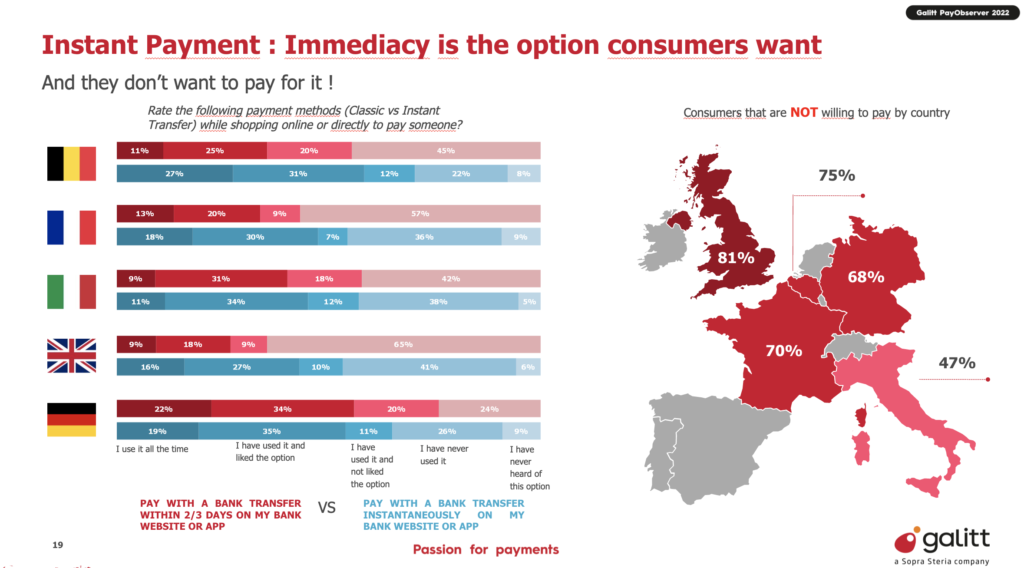

- The hottest payments trends on the market, including BNPL, Instant Payments, Request-to-Pay and cryptocurrency

If you’d like to learn more about these areas, you can access the full on-demand video with Natalie and Nicolas exploring the whole report in detail, here.