[Re]invent your equipment lending operations

Unleashing the power of equipment finance

Our equipment loan software facilitates the front-to-back-office lending cycle for all asset types, covering agricultural finance, specialist or heavy vehicles, yellow metal, energy sector finance, medical equipment, and more.

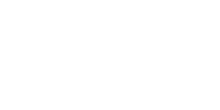

Cloud-native and fully scalable, supported by world-class partners and with infinite scope for integration thanks to open APIs, Sopra Banking Software is an unbeatable ecosystem orchestration partner.

- High availability, evergreen, SaaS solution

- Modern, multi-channel customer experience

- Sophisticated reporting and risk management tools

- Highly secure ensuring regulatory compliance

- A trusted partner with decades of experience

- A comprehensive library of ready-to-go asset finance solutions