Flexible financial engine

Multiple product types, financial structures

Multi-management

Multi-product, entity, currency, country

Digital ready

Library of documented web services

Accounting postings

To financial software

High fit

Built for commercial lending

Self-serve portal

Brandable and customizable

Gain efficiency, lower risk and speed time to value

Loan software that works your way

Streamline all aspects of commercial lending with our flexible loan management solution.

Global experience at your service

Lower project risk by working with the commercial lending automation experts with over 50 years of experience in the Americas, Europe and Asia.

Close loans faster, at a lower cost

Guide users, boost efficiency and free up time with event-driven processes. Healthy loans manage themselves. Dashboards provide visibility and lower risk.

Powerful rules engine

Define any type of rule, product, scoring, pricing and more. Benefit from greater workflow-driven efficiency and compliance.

Multi-currency powerhouse

Lend in one currency, collect in another. A powerful financial engine enables you to manage challenging multi-currency requirements.

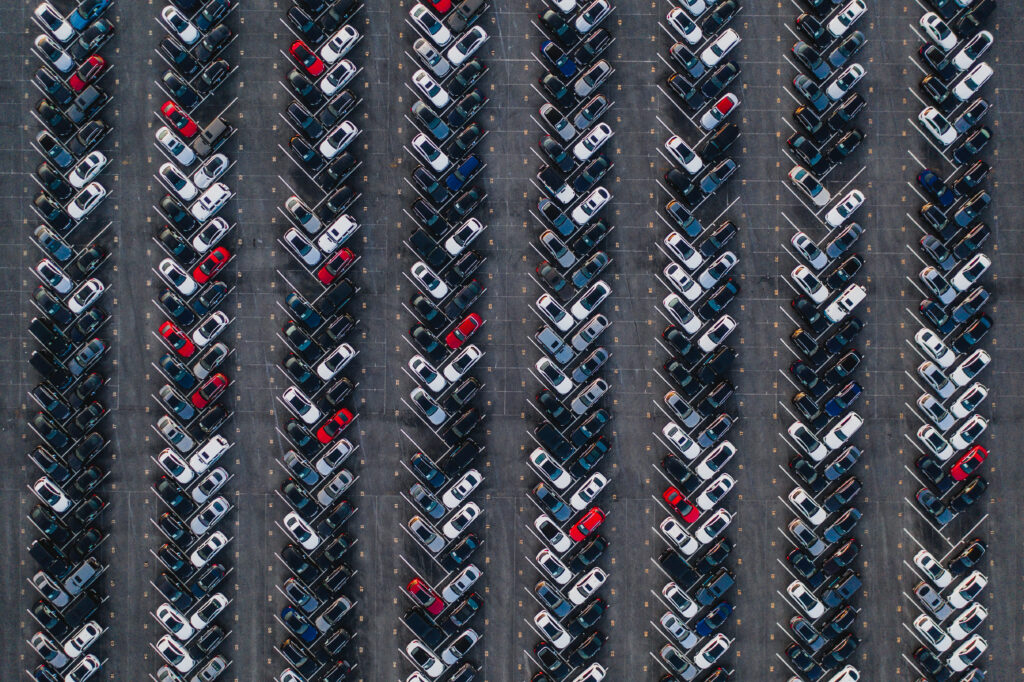

Scale operations securely

Industrialize commercial loan management across portfolios and countries. Digital-ready with an extensive API library. Cloud-ready, scalable and secure.

Simplifies highly structured loan management

Manage every loan on a single platform. Improve control and compliance, lower costs and leave spreadsheets behind.

Support for end of LIBOR

Sopra Financing Platform is ready with support for new rates out-of-the-box and consulting services to ease the transition.

We are actively working with industry and customer groups to align with emerging requirements.

Leverage our experience and expertise

Gain the benefit of proven, best-practices for commercial lending software configuration including nearly 200 standard process flows.

Manage your entire portfolio on one system

We have all the answers you need

Frequently asked questions

How are portals being used to improve customer service in commercial lending?+–

Portals are being used to digitally expose loan management functionality to make credit and the credit process more accessible to customers. From understanding where they are in the loan process to making payments and getting payoff quotes, portals are expanding what’s available on a self-service basis to business customers anytime, anywhere.

Why are some of the lending complexities around multi-currency management?+–

Compared to a single currency environment, a multi-currency environment adds its own set of challenges including: additional business and accounting processes; additional data points to store and track; additional integration points including exchange rates; and more complex reporting and consolidation rules.

What trends are emerging in lending?+–

Lending as a service, data driven lending, optical character recognition, intelligent automation, pay-per-use, and RPA to improve customer UX are just some of the emerging trends we are seeing.

What are some of the benefits of digital transformation for commercial lenders?+–

Digital transformation enables banks and other specialty lenders the ability to consolidate systems, improve efficiency, reinforce compliance activities, and build better customer relationships.