Shape the future of banking

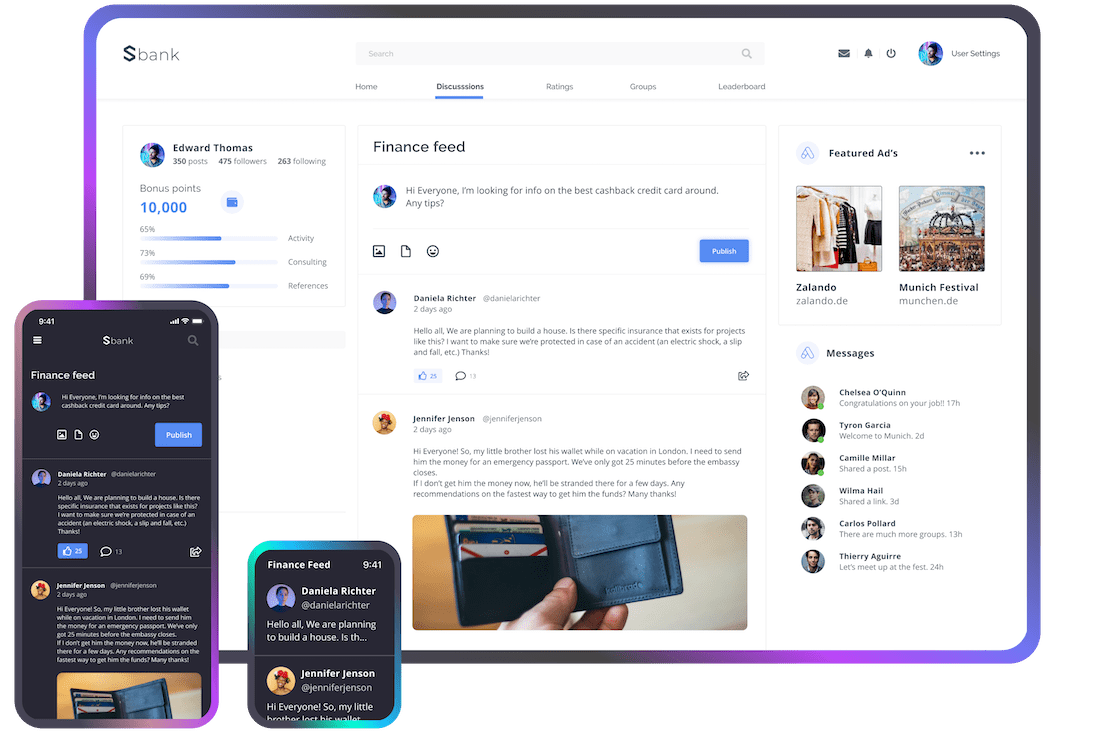

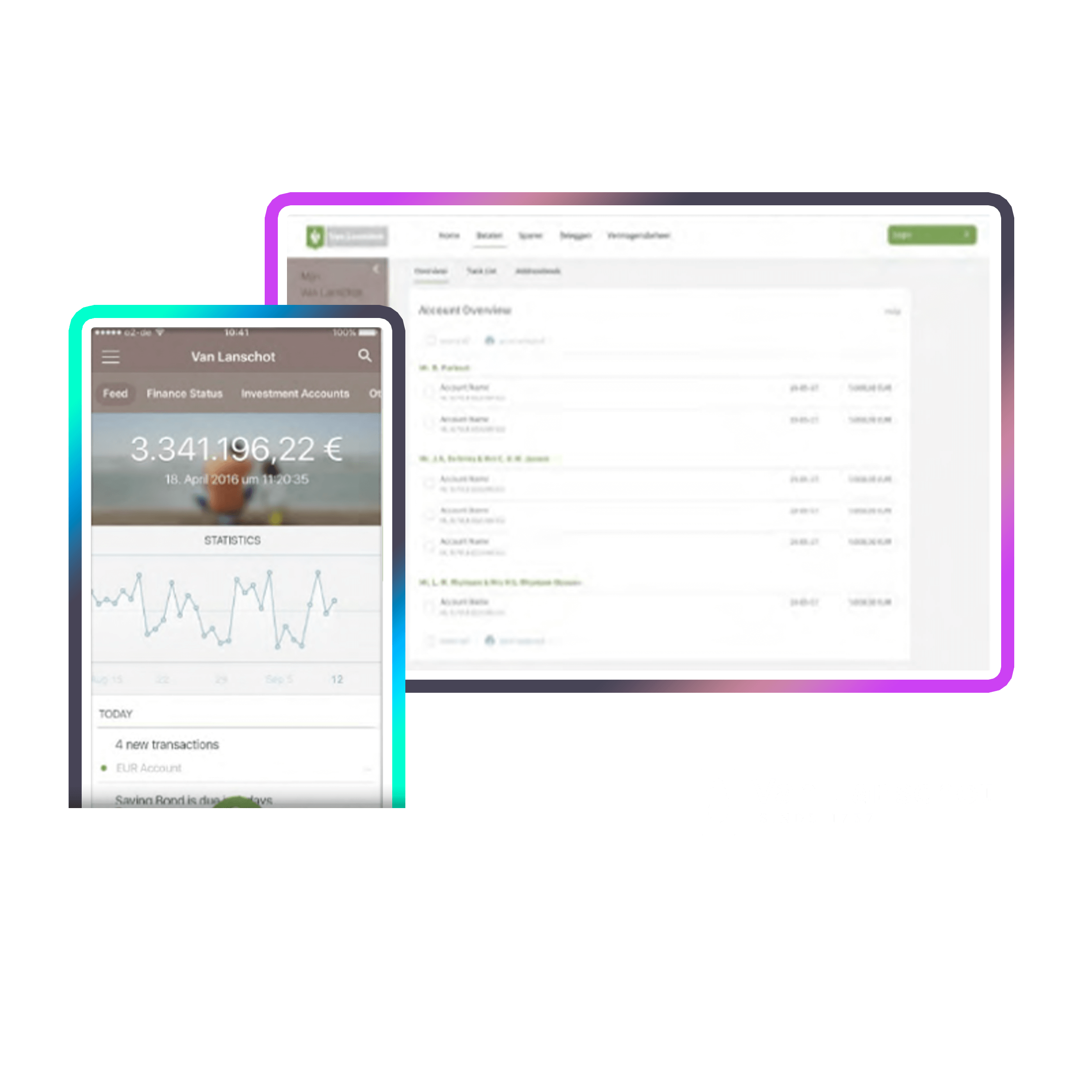

Digital Banking Suite is an open digital banking platform with composable banking capabilities, including an omnichannel customer experience and cloud-native, state-of-the-art middleware.

Core-agnostic and natively integrated with SBS core banking systems, our digital banking solutions can be launched in a front-to-back or a domain-focused way, rolled out component by component across the front, middle, and back layers.

- Modern customer experience, fit for every channel

- Comprehensive library of off-the-shelf banking solutions

- Support for request-to-pay, Instant Payments, ApplePay and Google Pay

- Running on AWS, Axway premium API capabilities

- Compliance and regulatory reporting for KYC, AML, PSD2, and GDPR

- Middleware functionality supported by OpenShift technology