Recently ranked by TechTimes as number one among the top five best Fintech events worldwide, the annual Sopra Banking Summit returns for its second edition. With more than 5,000 attendees already signed up, the event will envision the financial world of the future, by bringing together visionary market leaders covering three key themes: “Achieve operational efficiency,” “Engage your clients” and “Open up your ecosystem.”

“IBM Quantum: discovering a hot topic” with Mohammed Sijelmassi, Pierre Jaeger and Barbara Rochet

In this session Barbara Rochet, Corporate Alliance Manager at Sopra Steria, is joined by Pierre Jaeger, Technical Director and Head of Quantum Activities at IBM France, and Mohammed Sijelmassi, CTO at Sopra Steria. In it, our panelists take a look at the practical uses of quantum computing when applied to the financial sector.

The experts consider several use cases, as well as the IBM roadmap in the field of quantum computing. A method to help make your business and IT system quantum ready is also included in the session.

“Quantum technology is not something new,” says Pierre Jaeger. “We use it every day in our cell phones, computers, etc. It is important to say that quantum computers will not replace what you have seen and done with classical computing. Quantum computing solves very hard problems that today we cannot solve with classical computers.”

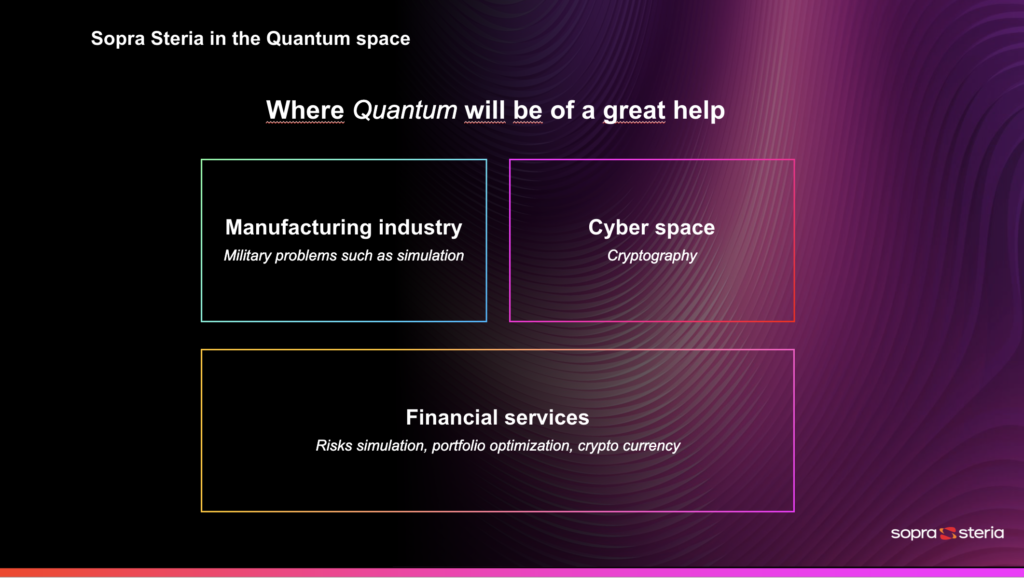

Mohammed Sijelmassi, CTO at Sopra Steria, continues the discussion by stating that: “we believe at Sopra Steria and Sopra Banking that it’s a new technology that is here to stay, because it solves common problems that we are not able to solve at date. For instance, cybersecurity. How quantum computing will help to solve, remove or reduce some of the threats we are facing. There is a large space where we have to learn how we can protect ourselves using quantum computing technology.

“A second example is industries where there are a lot of simulations. How do we simulate aerodynamics in cars? Or a battlefield where we have multiple soldiers and weapons? Those things, you cannot simulate them, not because you don’t have the equation, but because you don’t have the power of calculation.

“The financial sector is also a major space for quantum computing. How do we manage asset portfolios and risk? It is complex from a mathematics perspective, and optimization tools from quantum computing can help.”

Mohammed goes on to say that quantum computing is “maybe not the technology of today, but it won’t be the technology in 10 years either. We believe in the technology, and it’s why we invest in it. It’s something that will increase in the next two to three years, and its adoption will increase. We also believe that it’s an ecosystem, and we should learn from that ecosystem and rely on it to build new disruptive solutions.”

Do you want to find out more about quantum computing, including IBM’s solution and road map? If so, you can find the on-demand replay of this session following this link.

“Taking the best of crypto to retail bank clients,” with Bas Lemmens, Pierre Lahbabi and Magdiela Rivas

Are you interested in learning how banking leaders can best leverage cryptocurrencies, avoid the challenges associated with crypto, manage transactions, and put in place safeguards to provide the best customer experience possible? Then, you need to watch this session hosted by Magdiela Rivas, Global Partner Marketing Manager at Chainalysis, and featuring Pierre Lahbabi, CEO at Galitt, and Bas Lemmens, General Manager at Chainalysis.

Bas starts the session by explaining the latest goings-on in the crypto world, tackling three main subjects: the crypto crash, the stable coins and Central Bank Digital Currencies (CBDC).

“When the financial markets slumps, crypto does, too. And this correlation reflects crypto’s maturity as an asset class. There is a growing number of institutional players involved; there are new financial products being offered; regulatory oversight is developing; and the markets are more efficiently pricing new information. But there is one crucial difference between crypto and traditional finance: transparency.”

According to Bas, “there is an opportunity for the industry to leverage blockchain’s transparency to analyze systemic risks for better systems, and design better rules for the next bull market.”

He goes on to discuss stables coins, saying that “the demand for stable coins is primarily driven by participation by crypto markets and by De-Fi, in particular. Greater clarity on stable coins and on the broader ecosystem will provide certainty, which is needed for the more traditional players, such as banks, to enter the market.”

On CBDC, Bas says, “more than 100 countries are now considering developing or piloting retail or wholesale central bank digital currencies. For example, the European Central Bank (ECB) is in a two-year investigation phase on the design and distribution of the digital Euro, which is scheduled to be completed by the end of 2023.”

The findings of this investigation will allow to the ECB to see whether they issue a digital Euro, whose objective is to deliver a means of payment suited for the digital world. However, there remain a few unanswered questions, such as the potential success of the digital Euro project, how easily it will be adopted by the public, and concerns around privacy and security.

Pierre Lahbabi, CEO of Galitt, explains why it’s important for financial institutions to provide crypto services:

“The answer is very simple, it’s because their clients care about crypto. Crypto is an asset class that can’t be ignored anymore. There are many uncertainties, many developments that are still coming up, but clearly crypto will be part of the future of finance.”

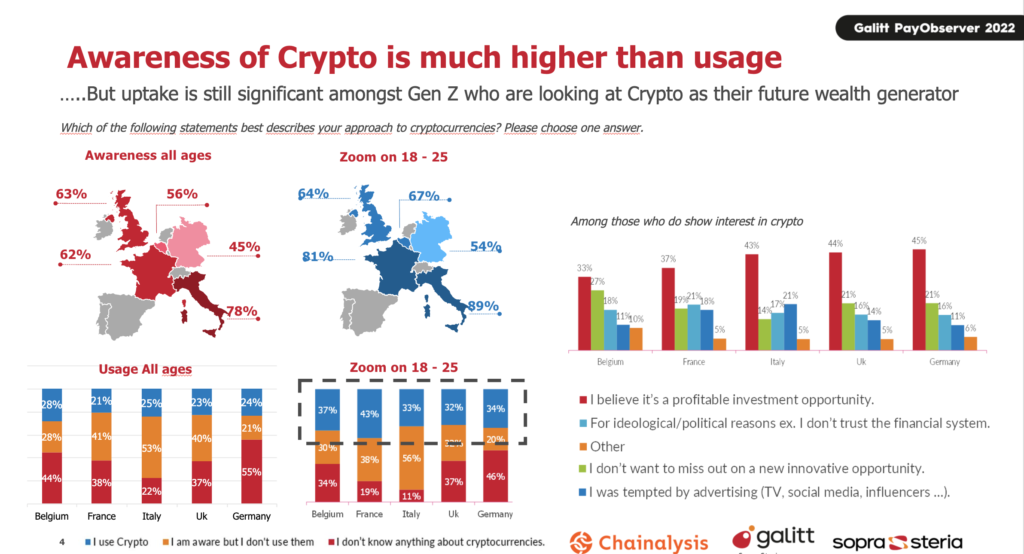

Galitt, which works with financial institutions on a day-to-day basis and advises them on payments, observes a growing interest in crypto. However, in the company’s latest market study on payments, the results on crypto are quite telling:

- More than two-thirds of customers are aware of crypto

- More than 20% of customers have already used or bought crypto.

What we’re seeing is the democratization of crypto. It’s now easier to buy cryptocurrencies than it was a few months before, thanks to new players, general providers of crypto services and digital banks entering the market.

Are you interested in cryptocurrencies and their impact on the banking sector? We have published the full on-demand video of this session here.

“How can banks launch marketplaces?” with Emmanuel Methivuer, Pooja Kothari and Thibault Nguyen de Cossette

In this special session, featuring experts from two of Sopra Banking’s close partners, we dive into the rising importance of marketplaces in the financial services industry, and what it means for banks.

Emmanuel Methivier of Axway kicks the session off by walking the audience through the changing digital landscape, and how the top players have been displaced, notably by the likes of Google, Amazon and Facebook. For Emmanuel, understanding this shift is key to understanding the role of marketplaces.

“In order to analyze to understand how these new entrants have disrupted the traditional hierarchy, we need to understand their growth model. How did startups like Facebook and Google become giants? It’s essential to understand that around this precursor, a complete digital ecosystem has developed, made of startups that have become giants because of the interconnection of their services, taking advantage of the network effect.”

Emmanuel goes on to say that banks can profit from this new landscape through platformization.

“This is where the real business transformation takes place. As commercial banks change their traditional business, they can earn commission on selling services that are not their own.”

However, as Emmanuel says, this opportunity won’t last forever, and the impetus is on banks to act sooner rather than later, to make sure they’re not left behind.

In the second part of this session, Thibault Nguyen de Cossette of Particeep talks about the need to link provider to customer, and how this isn’t always a straightforward task, but one that is vital for the functionality of the marketplace.

He walks the audience through three specific use cases, online account opening, life insurance and loan insurance, discussing the challenges that come with linking provider with end customer and, more importantly, how to overcome those challenges.

“Our API-based solutions allow us to adapt to any situation and challenge, and we at Particeep are willing to help every financial company, whatever size, whatever product, to cope with their challenges. Even if projects may be complex, we see them as a fantastic playground for our developers.”

If you’re interested in watching the full session, then click on this link to watch the on-demand replay of the session.

“Mobility’s new normal: leveraging the ecosystem” with Anna Jacobs, Ravi Naicker, Markus Collet, Marcus Willand and Stephan Reeve

The following speakers deep-dive into the topic of mobility, and why it is becoming an increasingly hot topic for the automotive industry.

- Ravi Naicker, Global Commercial Director at Sopra Banking Software, who previously led the wholesale division of the leading automotive bank in Africa

- Markus Collet, Partner at Corporate Value Associates, specializing in the digital transformation of automotive and financial services

- Marcus Willand, Partner at MHP (a Porsche company), specializing in SAP and mobility

- Stephan Reeve, Managing Director of financial services at Mazda Motor Europe.

During this session, four key issues are discussed: market trends and customer needs; how dealers are repositioning themselves in the new mobility ecosystem; technology shifts and challenges; and new priorities in a changing environment.

One of the key trends we are currently seeing is an evolution from car to customer lifecycle enablement. As explained by Stephen Reeve, “one of the most important challenges is to focus on the customer during all the different types of interactions: ordering, CRM, marketing automation, communication aspects – that must be moved from car focused to customer focused. It’s also important to make sure that the way a company interacts with its customers is done at the right time and adjusted to manage the customer lifecycle in the right way”.

Marcus Willand states that “in mobility we see the exact same movement than in the automotive industry. The customer, as he travels and consumes mobility, will make choices. The freedom of choice will be a central point for convenient mobility in the future. The customer wants to be more independent. We’re moving from a customer centric understanding of mobility to a network understanding of mobility.”

Nowadays, there are different types of players in mobility. Marcus Willand explains that “we see that public transport providers are playing a dominant role in Europe and China. Private mobility providers are also intervening more and more in our lives. We all have seen the rise of sharing and micro-mobility services throughout the world. They also take a portion of this pie. We have platform-based companies like Uber, who catch customers with different offerings and manage to engage with several hundred million customers on their platforms. They will play a major role in the future of mobility.”

Another important insight shared by Marcus Willand during the session is around mobility and the financial services industry: “Each mobility can be also regarded as a financial transaction. So a lot of banks and financial institutes are moving into that sector because it is heavy in terms of transactions. For them, mobility is now a sector of interest, which they need to be part of, or play a role in the future.”

Do you want to know more about this topic? You’ll be able to access the on-demand replay for this session by clicking on this link.