Recognized as a top global player by industry experts

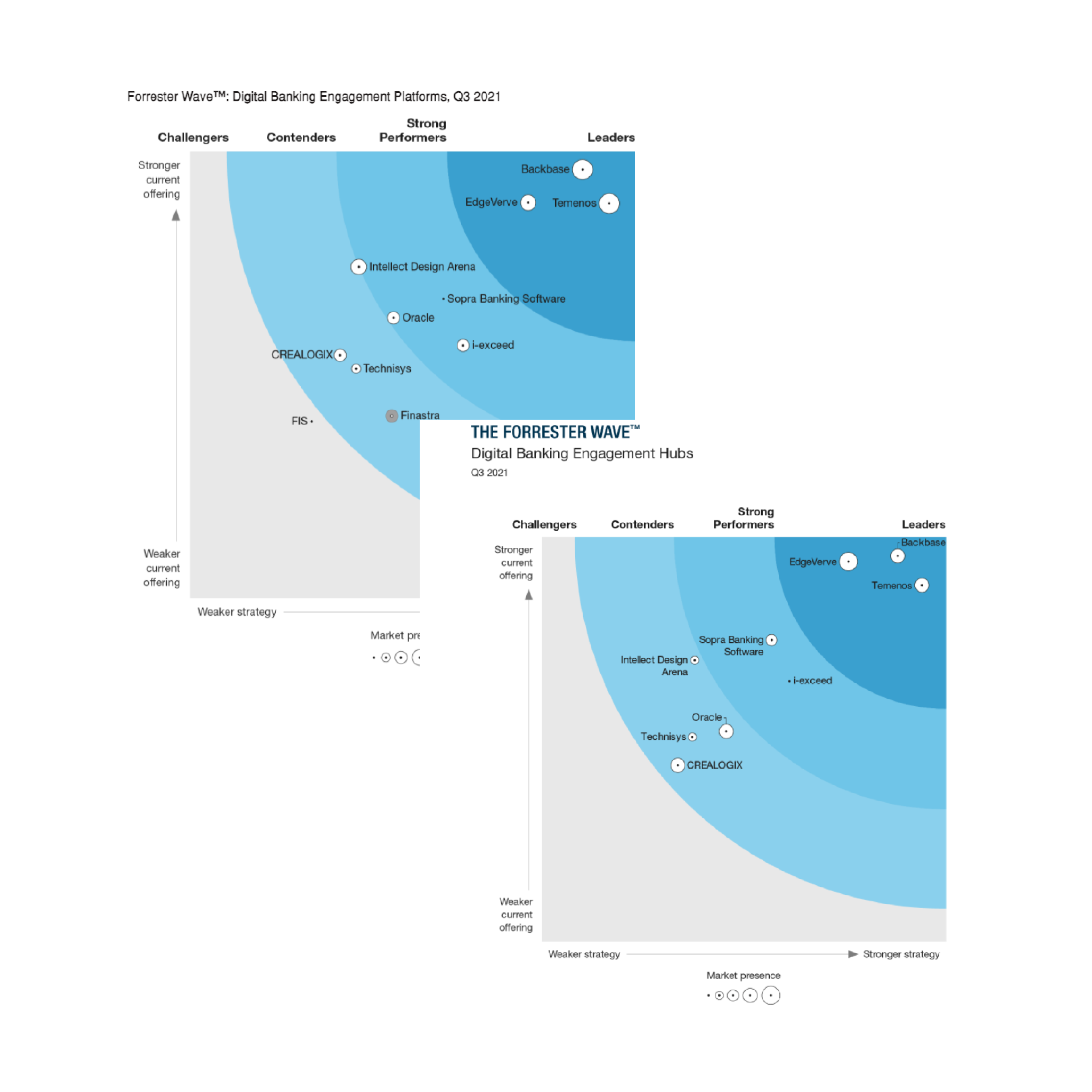

The Forrester Wave™

Digital Banking Engagement Platforms & Digital Banking Engagement Hubs, Q3 2021

Sopra Banking Software places its Digital Banking Suite as a strong performer in ‘The Forrester Wave™ – Digital Banking Engagement Platforms, Q3 2021’ as well as in the new ranking: “The Forrester Wave™ – Digital Banking Engagement Hubs, Q3 2021”. Forrester mentions that the solution ‘offers [a] rich engagement infrastructure’ and highlights that “The solution’s architecture is well defined and broadly uses microservices”.

Leader in Omdia’s Universe: Digital Banking Platforms 2023, with SBP Digital Banking Suite.

“Omdia Universe: Digital Banking Platforms 2023”

Leader in Digital Banking Services recognition of Sopra Steria, our mother company by global analyst firm NelsonHall 2022

“NEAT analysis, Digital Banking 2022”

Top Regional Seller in Western Europe, Forrester

“Use The Pandemic’s Market Impact To Improve The ROI Of Digital Transformation, Q2 2021”

Top 3 in Global Banking Platforms Deals Survey, Forrester

“Use The Pandemic’s Market Impact To Improve The ROI Of Digital Transformation, Q2 2021”, the Extended Deals category

#1 Global Lending System, IBS Intelligence

“IBS Intelligence Sales League Table 2021”

#2 Retail Banking – Core Solutions, IBS Intelligence

“IBS Intelligence Sales League Table 2021”

#2 Retail Banking – Risk Management, IBS Intelligence

“IBS Intelligence Sales League Table 2021”

#2 Most Countries Served with Sopra Banking Platform, IBS Intelligence

“IBS Intelligence Sales League Table 2021”

Top 3 in Global Banking Platforms Deals Survey, Forrester

“The Banking Platform Market Remains Stagnant, Though Smaller Banks Are Turning To Fintechs, Q2 2020”, the Combined Deals category

Strong Performer in Digital Banking Processing Platforms, Forrester

“Forrester Wave™: Digital Banking Processing Platforms (Retail Banking), Q3 2020”

#1 Global Lending System, IBS Intelligence

“IBS Intelligence Sales League Table 2020”

Leader in “Overall”, “Support for New Digital Business Models”, “Professional Services” market segments

“Neat Evaluation for Sopra Banking Software: Mortgage & Loan Services, July 2020” by Nelson Hall

Top 10 Fintechs in Europe, IDC

“Top 10 Fintechs in Europe, 2020” by IDC

#1 Global Lending System, IBS Intelligence

“IBS Intelligence Sales League Table 2019”

Leader in Europe, IBS Intelligence

“IBS Intelligence Sales League Table 2019”

Leader in Core Banking, Forrester

“The Forrester Wave™ Global Digital Banking Platforms, Q3 2018”

Leader in Core Banking, Gartner

“Magic Quadrant for Global Retail Core Banking, Q2 2018”

Download reports

Omdia Universe: Digital Banking Platforms 2023

Omdia examines and ranks the top software in the world based on market impact, solution capabilities, customer experience and market presence. In 2023, we are proud to be recognized as a Leader in Omdia’s Universe: Digital Banking Platforms 2023, with our SBP Digital Banking Suite.

Sopra Steria recognized as a Leader in Digital Banking Services by global analyst firm NelsonHall, 2022

Sopra Steria, a European leader in consulting, digital services and software development, announced today that its Digital Banking Services have been ranked among the “leaders” in the latest NelsonHall NEAT analysis on the Digital Services market segment.

IBS Intelligence Sales League Table 2021

For the fifth year in a row Sopra Financing Platform holds the top spot for specialised lending software globally, comforting our position as a global leader in the lending space. Additionally, Sopra Banking Platform ranked #2 in the Retail Banking – Core solutions as well as in the Risk Management category.

Neat Evaluation: Mortgage & Loan Services, 2020

NelsonHall has identified Sopra Banking Software as a Leader in the “Overall”, “Support for New Digital Business Models” and “Professional Services” market segments. This reflects Sopra Banking Software’s ability to meet future client requirements as well as delivering immediate benefits to its mortgage & loan services clients.

Model Bank for Marketplace Banking

In 2019, Celent recognized Fidor Bank for both its pre-integrated customer marketplace, Fidor Market, as well as its Marketplace-as-a-Service, Efficient Scale. With its people-centric approach and dual marketplace initiative, Fidor Bank provides customers with an enhanced, personalized banking experience.