Payments

Revolutionize your payment processing software with our next-generation Payment Factory

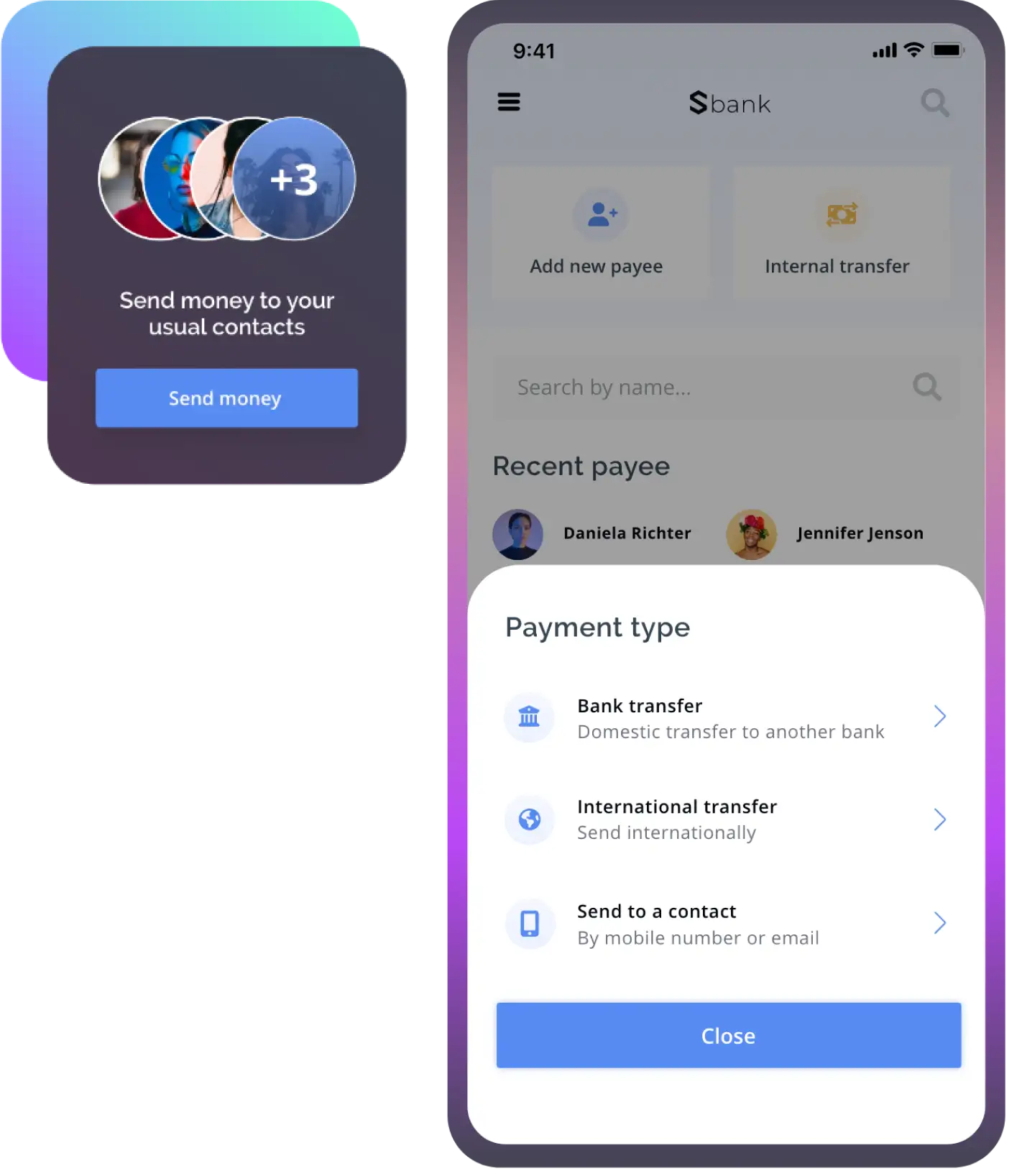

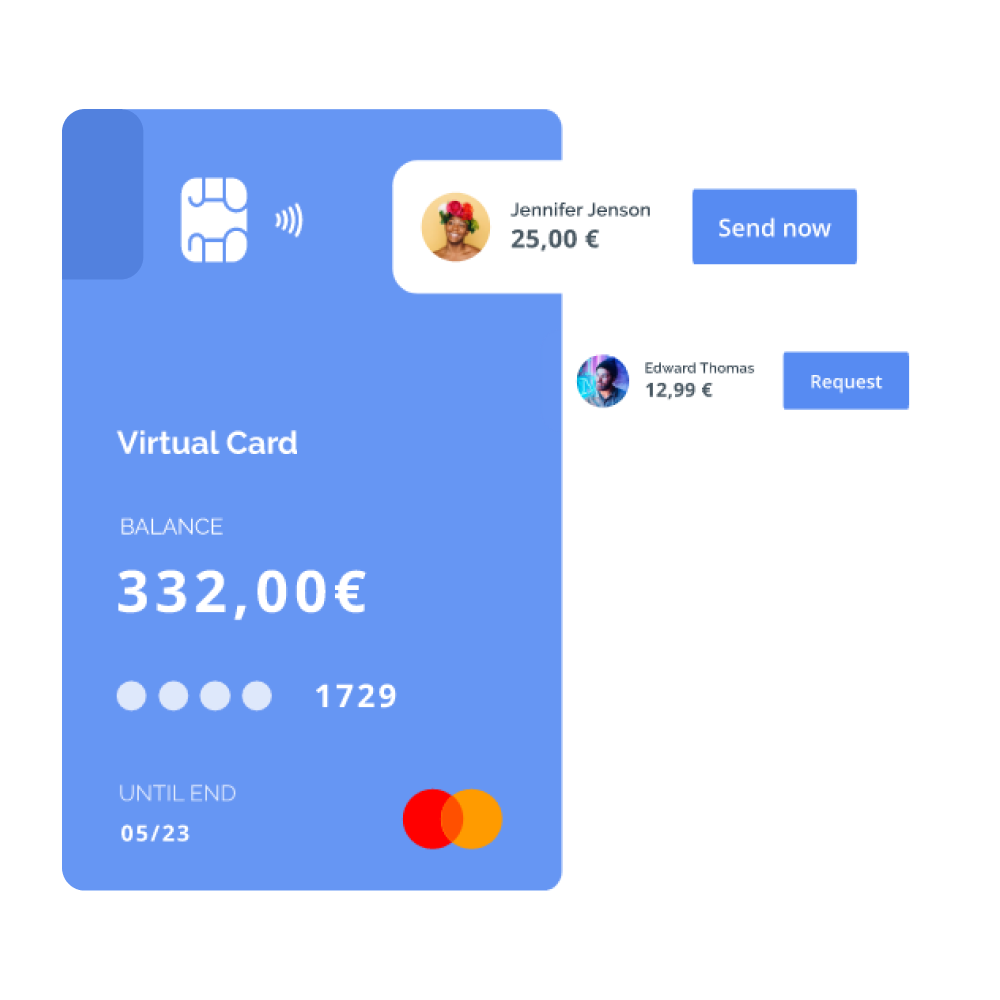

Say goodbye to juggling multiple partners and hello to seamless payments. Our modular payments processing system covers all your needs, making us the only partner you’ll ever need. Services covered:

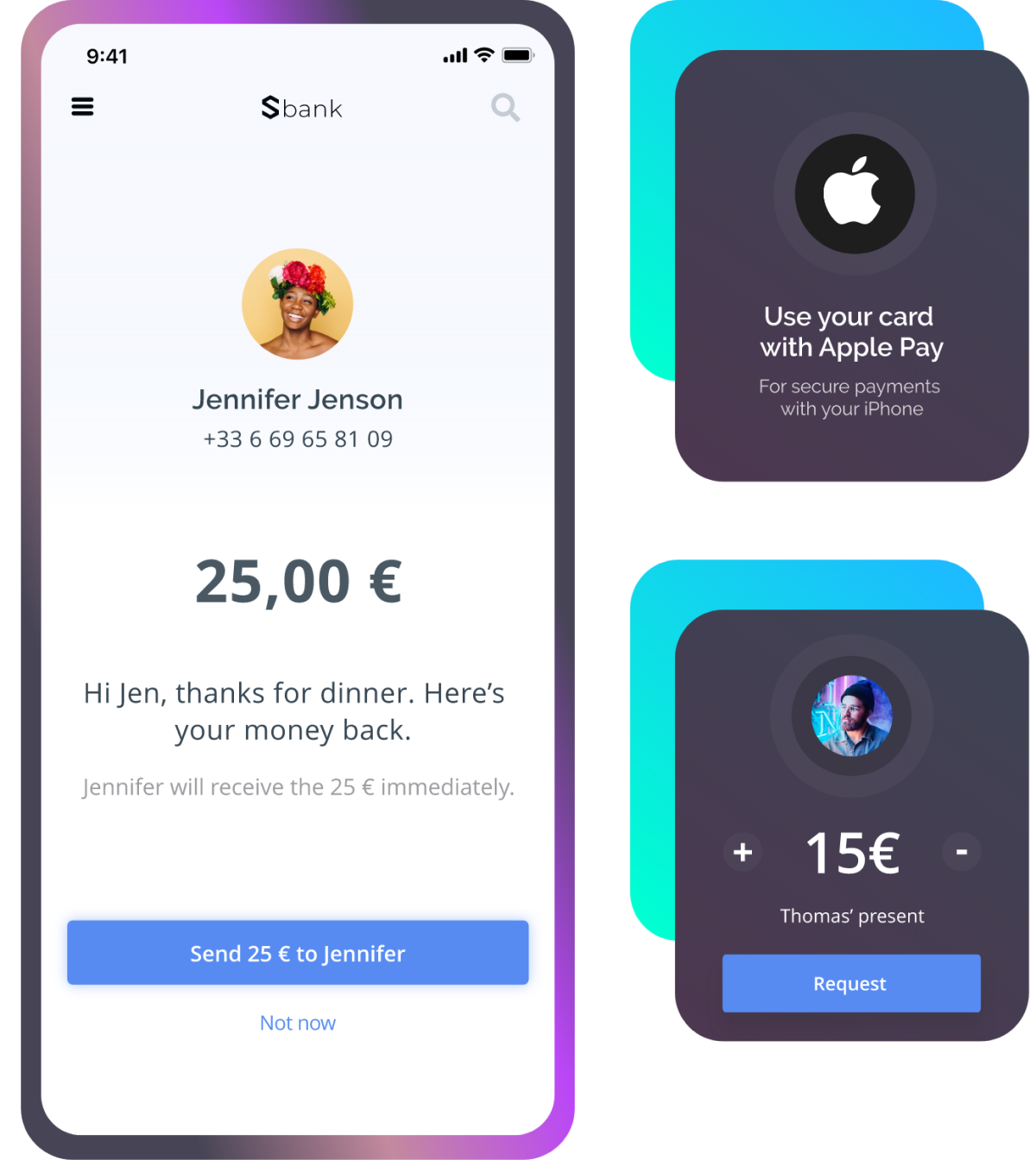

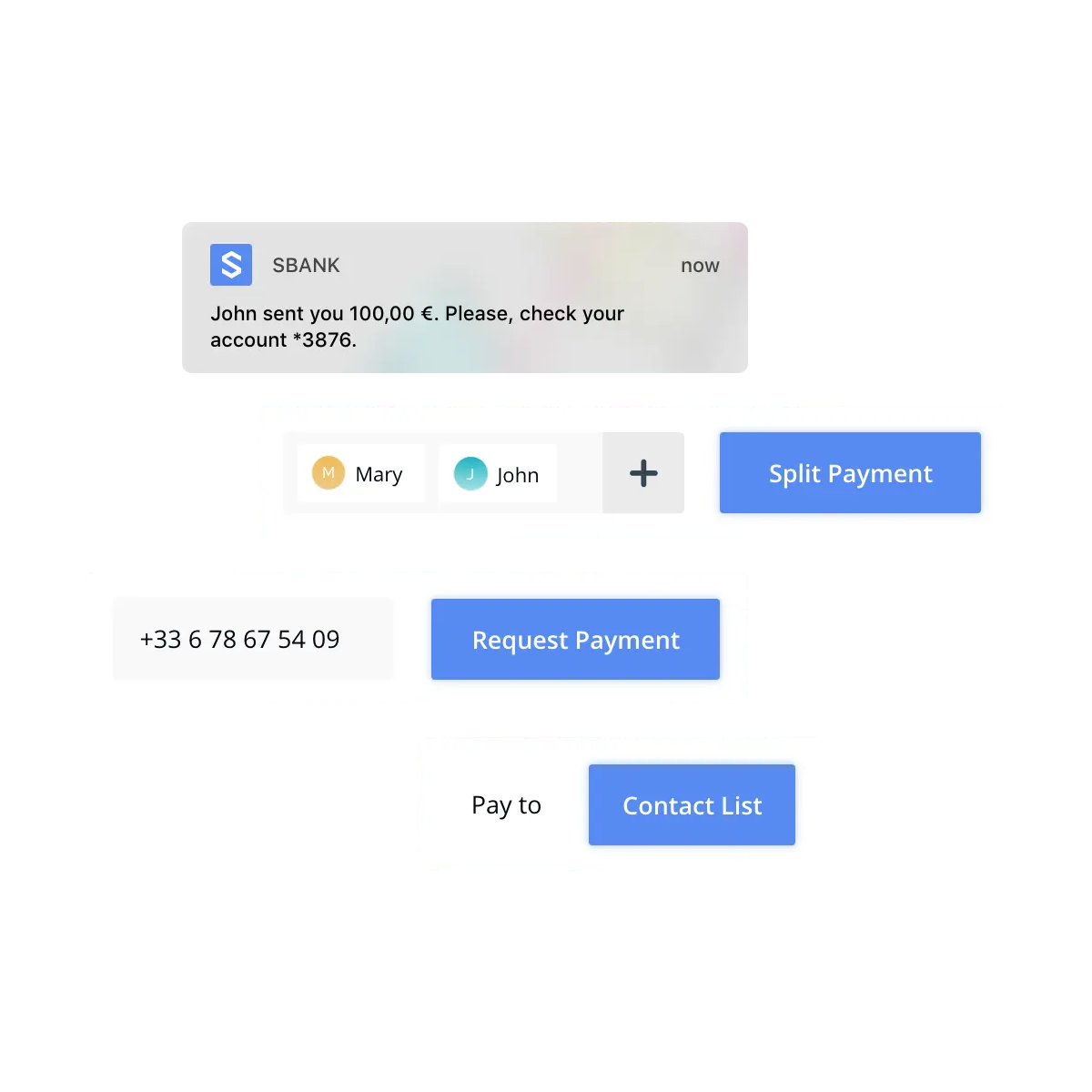

- Request-to-Pay | Allow your customers to seamlessly send and receive payment requests.

- Payment Order | Acquire and enrich payment orders by selecting the best payment scheme.

- Payment execution | A2A payments (SCT, SCT Inst), International Payments, SDD, Standing Order, Forex operations.

- Clearing and settlement | Connect with all major clearing and settlement mechanisms (CSMs) and manage interactions with counterparties.

- Payment reporting | Prepare information related to payment execution to report to stakeholders.

- Fraud and Risk Prevention | Leverage artificial intelligence (AI) to counter payment fraud, money laundering, and the financing of terrorism (AML/CFT).