Recently ranked by TechTimes as number one among the top five best Fintech events worldwide, the annual Sopra Banking Summit returns for its second edition. With more than 5,000 attendees already signed up, the event will envision the financial world of the future, by bringing together visionary market leaders covering three key themes: “Achieve operational efficiency,” “Engage your clients” and “Open up your ecosystem.”

“Marketing for banks: CMO Panel on client acquisition,” with Bettina Vaccaro Carbone, Jacques Baudot, Jérémie Rosselli, Beyza Koyas and Angela Mwirigi

As customer acquisition and retention become more data-driven and digital channels continue to play a critical role in customer relations, bank CMOs have to redefine their roles, seeking to exert influence over more stages of the customer journey. In this session, a panel of experts with digital and traditional backgrounds explain how they’re tackling these challenges.

According to Beyza Koyas, Head of Steering Synergies between personal finance and commercial banks at BNP Paribas, what matters most is matching customer expectations with the reality of what the financial institution can offer. For example, the onboarding process, which needs to be simple and fast.

“It’s all about finding the balance between providing the expected level of services to the customer, but making sure we have enough to cover the compliance-related requirements.”

Beyza also highlights the importance of working in digital marketing to follow prospects from their first appearance in the digital channel right through to completion, in order to respond to their needs. In terms of retention, “everything starts with the understanding of the customer needs. The first requirement is the fixed basics category, which is about speed and simplicity and creates a certain level of satisfaction.”

Angela Mwirigi, Director of Financial Services at KCB Group, states that the pain points for the CMOs can be grouped into five different questions:

- How do I onboard these customers effectively?

- How do I retain them?

- How do I make sure their lifecycle with the organization and products is enriching?

- Have we built enough services to retain them?

- How do I lower my attrition rates?

“Because as easy as it is to join digital products, it’s just as easy to exit,” says Angela.

Jérémie Rosselli, General Manager for France & Benelux at N26, supports that idea, saying that “we are now in a world where it’s easy to move from one bank to another, and you are snapping from one product to another. So it’s really critical to work on the retention side and the lifecycle of the customers.”

According to Jérémie, customer acquisition must be data-driven so that banks can understand customer behavior throughout their entire journey.

Do you want to find out more about customer acquisition and retention in banking? The on-demand replay for this session is available following this link.

“The state of SaaS in 2023: trends and strategy,” with Vincent Pronier, Nils Hansma and Lalit Tyagi

This insightful session covers Cloud-first strategies, and the shift in SaaS adoption across banks and financing organizations. Our panel of experts review Sopra Banking Software’s Cloud strategies, its customers’ needs and global partnership programs with on-demand Cloud computing.

Vincent Pronier, Product Marketing Director at Sopra Banking Software, introduces the discussion by talking of the benefits of moving to the Cloud.

“We need more security, more carbon–free operations, a Cloud-native landscape of applications and API micro-services.”

On the current status of AWS coverage in geographical terms, Nils Hansma, Security Assurance Lead at AWS France, states that the company’s worldwide coverage is still developing in a number of regions, including Spain, Switzerland, Australia and India.

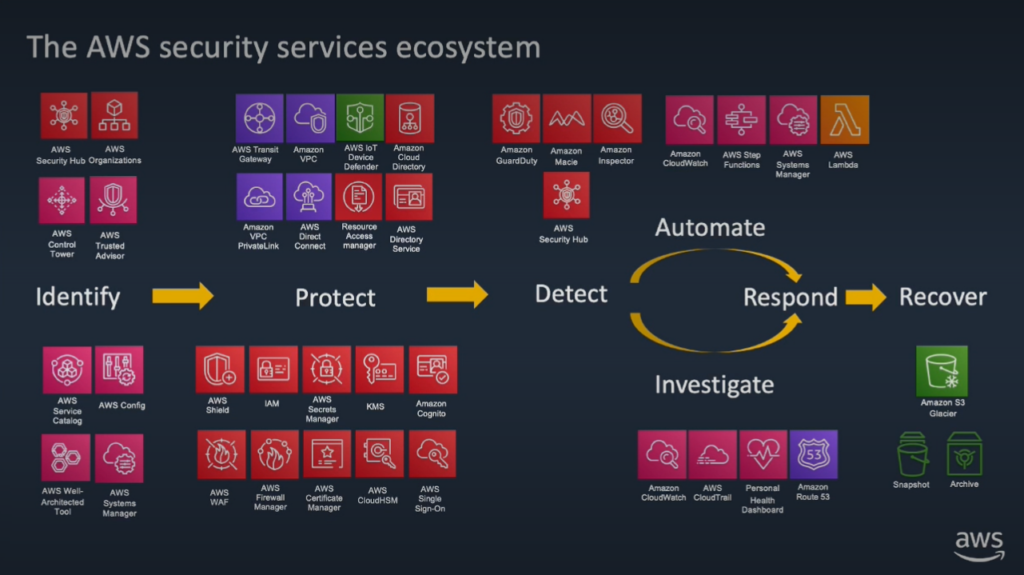

On AWS cloud, customer service is based on “strategic autonomy.” This means that customers have full ownership of their data. Furthermore, customers can change solutions for better autonomy and reversibility. In terms of security, the company develops plenty of different services to follow and protect customer data.

Concerning the green impact of AWS, Nils Hansma says that Amazon has decided to use renewable energy for its AWS services, with a goal of reaching 100% renewable energy by 2030 and having a neutral carbon footprint by 2040. At the same time, AWS is developing new technologies, such as new micro ships which are more sustainable (-88% of carbon footprint) and which use less energy (-83% of power consumption).

Lalit Tyagi, Senior Director of R&D at Sopra Banking India, continues the talk with a quick

reminder of the difference between APIs and SaaS. APIs being “application programming interfaces providing means to security deliver a business capability or data;” and SaaS being “a model for delivering applications or a business value over the internet.”

75% of APIs that are created are used for internal purposes; for instance, to reduce complexity and enable agility, per a McKinsey report. 20% are used for integrations with partners and suppliers, and 5% are used to generate revenue. This provides a means to increase revenue for financial institutions via embedded finance and Banking-as-a-Service. Both can play a role in hosting an ecosystem or a platform from which these services are offered.

Are you interested in AWS cloud solutions, banking in the Cloud or the Sopra Banking Platform? You can find the on-demand replay for this session here.

“How can banks generate revenue from cybersecurity?” with Mohammed Sijelmassi and Fabien Lecoq

This session, covering key themes around cybersecurity, Banking-as-a-Service and consumer trust, is one of the most anticipated events of the 2022 Sopra Banking Summit. Hosted by Mohammed Sijelmassi, Chief Technology Officer at Sopra Steria, and featuring Fabien Lecoq, Chief Technical Security Officer at Sopra Steria, our panelists dive into the current state of cybersecurity in finance, and what it means for banks.

Kicking things off, Fabien gets straight into the current status quo around cybersecurity and banking with some shocking statistics. Fabien says that finance is the second most impacted industry by cybercrime, and that nearly a quarter (22%) of banking customers have been targeted by hackers.

And Fabien gives some insight as to why this number is on the rise.

“Due to the Covid situation, digital transformation is accelerating. As a result, we see that cyberattacks are increasing.”

As Fabien goes on to explain, banks can play an important role in protecting individuals and businesses from cyberthreats.

“The key point is business disruption. Attacks will occur, but banks need to have resilience regarding cyberattacks. It’s a critical area.”

In this sense, cybercrime also offers an opportunity for banks. As both Mohammed and Fabien say, banks have the trust among consumers and infrastructure in place to tackle cybersecurity, and also to outsource these capabilities as a platform service.

As Mohammed notes toward the end of the session, this platformication for banks (also known as Banking-as-a-Service) is an area that many banks have already begun to explore, invest in and, indeed, profit from.

“Today banks are selling much more than just banking products. They are selling bundles or sets of different products together,” says Mohammed.

As outlined by our speakers during the session, this could be a key area for many banks going forward, but one that they will require help with to launch effectively and successfully.

You can find out more about cybersecurity in the financial services industry, as well as what banks can do to help fight cybercrime, by watching the session in full. The on-demand video is available here.

“Platformification of the asset lending ecosystem,” with James Powell, Bettina Vaccaro Carbone and Marguerite Watanabe

In this unique session, our audience is treated to a selection of questions from Sopra Banking’s clients, as well as answers from our dedicated experts.

The opening part of this session features James Powell and Bettina Vaccaro Carbone of Sopra Banking, as well as Marguerite Watanabe, President and CEO at Connections Insights. The three experts introduce this session by discussing the changing nature of the automotive financing sector – including new technologies, the impact of the pandemic and the rising need for sustainable products and services – and how this is creating an exciting and challenging landscape.

But there’s plenty more to this session. It also features a host of Sopra Banking clients who ask pertinent questions about the industry, followed by our experts who provide clear and insightful answers.

For instance, John Mizzi – Founder and CEO for Vero Technologies – asks: Can you share more about how SBS is positioning itself as the primary Cloud-based platform for the auto and asset-lending ecosystem?

Ravi Naicker, Global Commercial Director, answers succinctly, talking about Sopra Banking’s long history of investment in Cloud-native solutions, and how we create a safe path for the transition to Cloud.

And then there’s Liam Quegan, Managing Director or NextGear Capital, who asks: How can Sopra Banking help us drive out friction for our customers and make sure that they are able to succeed in whichever way they want to use our platform and through whichever channel?

David Mercer, Head of Digital Auto Finance, responds by discussing Sopra Banking’s vast array of partner solutions available on our platform. This selection, he explains, gives our clients a series of choices, including how they can speed up and digitize their processes, eliminate waste and friction.

There are plenty more fascinating questions from Sopra Banking clients, as well as answers from our experts.

If you want to watch the session, you can do it by clicking on this link to access the full on-demand video.