Recently ranked by TechTimes as number one among the top five best Fintech events worldwide, the annual Sopra Banking Summit returns for its second edition. With more than 5,000 attendees already signed up, the event will envision the financial world of the future, by bringing together visionary market leaders covering three key themes: “Achieve operational efficiency,” “Engage your clients” and “Open up your ecosystem.”

“Core Banking: Introducing Sopra Banking’s next-gen platform” with Michel De Bolle, Fabien Oliveira and Vincent Pronier

For the Summit’s opening presentation, our experts introduced Sopra Banking Software’s next-gen core banking platform. Hosted by Michel De Bolle, Chief Product Officer, featuring Fabien Oliveira, Head of Product Strategy SBP, and Vincent Pronier, Product Marketing Director, this session gave customers a sneak-peak at the next-gen platform.

Michel De Bolle began the presentation with a few key numbers:

- 500 million individuals and businesses are being served through the systems that we deliver to our customers, banks and financial institutions

- 5,000 experts within Sopra Banking Software are working to create and produce these systems, for over 1,500 customers in more than 80 countries worldwide.

Below is a list of some of the key drivers that led Sopra Banking Software to develop its new Core Banking platform, as noted by Michel de Bolle:

“We need to be able to deliver software solutions that fully automate these processes, and that these processes must become more efficient for end-users and banks’ employees – to have a really intuitive process that is as fluid as possible.

“Of course, there is also the data aspect. Data is the new gold for banks. Applying artificial intelligence to banks’ data … provides unique opportunities for our customers to construct their customer journeys, to optimize them and to offer products and services at the right moment in the lifecycle of their customers. Data can allow the optimization of marketing campaigns and business processes, so data really is key. It is a key factor in driving new programs.

“Security, clearly, is one of the first concerns for our customers. It is crucial to develop new products on our Sopra Banking Cloud platform with the highest standards in cybersecurity.”

According to Michel, the ecosystem is particularly important, especially for mid-sized institutions, which require more of a Software-as-a-Service approach:

“We now construct our new products operated by design on our platform, but we are still able to deliver these assets in the private Cloud or the public Cloud of our customers. Openness of the system is also a key aspect, and we realize that we can’t do everything ourselves. More and more for certain aspects: market standards that we need to integrate into our ecosystem, but also the fintech solutions and innovations, allowing our customers to really differentiate themselves in the market.”

We believe that by 2025, a banking platform should be ready with the following capabilities:

- Composable services

- Subscription based

- Cloud native

- Software-as-a-Service

If you want to find out more about Sopra Banking Software’s next-gen core banking platform, then you can watch the full replay of this session following this link.

“DBX Benchmark: Transform your bank in 2023” with Bruno Cambounet, Laurence Niclosse, Jacob Morgan and Alice Tetaz

One of the most-anticipated sessions of the week, the digital banking experience benchmark provides a glimpse at Sopra Steria’s latest report, created in collaboration with Forrester and IPSOS. Bruno Cambounet, head of research at Sopra Banking and Laurence Niclosse, director of customer experience for banks at Sopra Steria Next, host the conference and lead the discussion, which also features Jacob Morgan, principal analyst at Forrester, and Alice Tetaz, research director at IPSOS.

A few important findings were shared during the presentation regarding consumers’ banking habits:

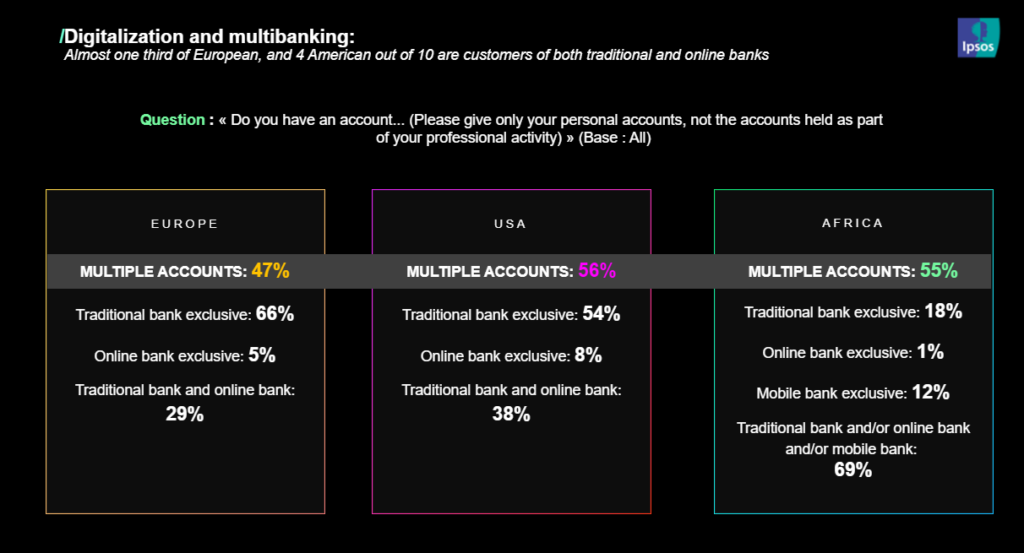

- People tend to have bank accounts with at least two banks – this is the case for 47% of banking customers in Europe, 56% in the US and 55% in Africa

- Online banks cannot currently replace traditional banks. Online banks have a very small number of exclusive customers (5% in Europe, 8% in the US and 1% in Africa). In Europe, two-thirds of respondents say they only have an account with a traditional bank (66% in Europe, 54% in the US, 18% in Africa).

- Banks’ customers are hyperconnected. Three-quarters of them check their bank account at least once a week. Their first means of communication with their bank is via a mobile app, followed by website, and then a human advisor in a physical branch.

Concerning the maturity of banks, the study shows:

- A decrease in readiness across all categories, including process and structure; culture, talent and skills; technology and integration. This is especially the case for smaller banks, which don’t have full capability in engineering functions, or cannot invest the same amount in emerging technology as larger banks do

- One-third of banks are concerned about the economic recession and supply-chain disruption, which impact their business

- A second wave of digital transformation, which is now aligned on cost and efficiency rather than the digitization of the customer experience, products and services

- Smaller banks find it hard to afford and compete for talents, whereas larger banks are going toe-to-toe with tech firms as an attractive employment opportunity

- In Africa, digital maturity is increasing significantly.

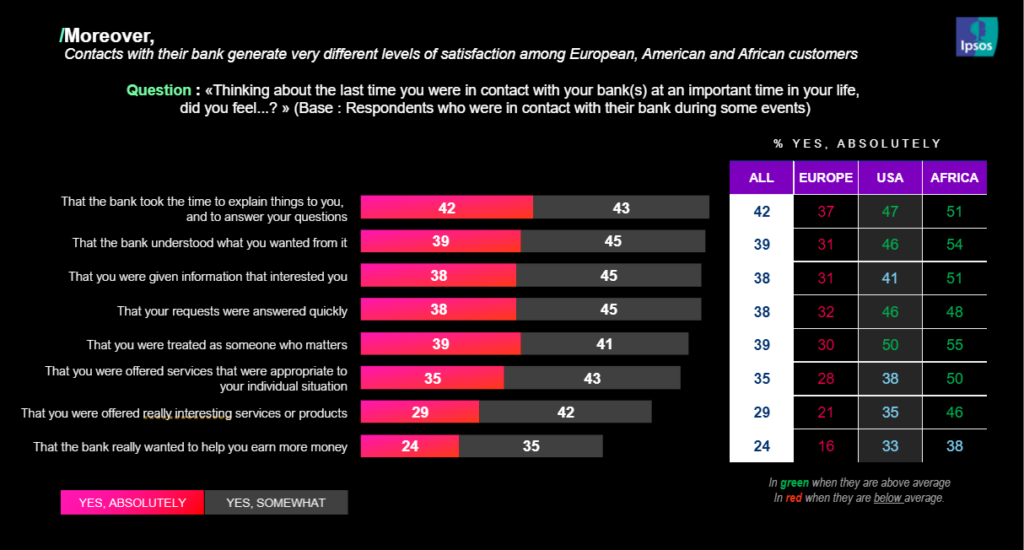

A worrying point to note is that customers who were in contact with their bank report only a moderate level of satisfaction:

- Less than half fully agree that their bank took the time to explain key points and answer questions

- Less than 40% say that their bank fully understood what they wanted and that they are treated like someone who matters

- Less than one-third say that they have been offered interesting offers and products

- Less than one-quarter say that their bank was interested in helping to earn more money.

Do you want to learn more about this topic? The replay of this session is available here.

In the meantime, you can also download our latest white paper on digital banking experience, where we compare results from 2022’s and 2021’s DBX reports.

If you want to watch a complete wrap-up of everything that happened during day one of the Sopra Banking Summit, watch our daily video report by clicking here.