Globally recognized as the dealer floorplan financing software

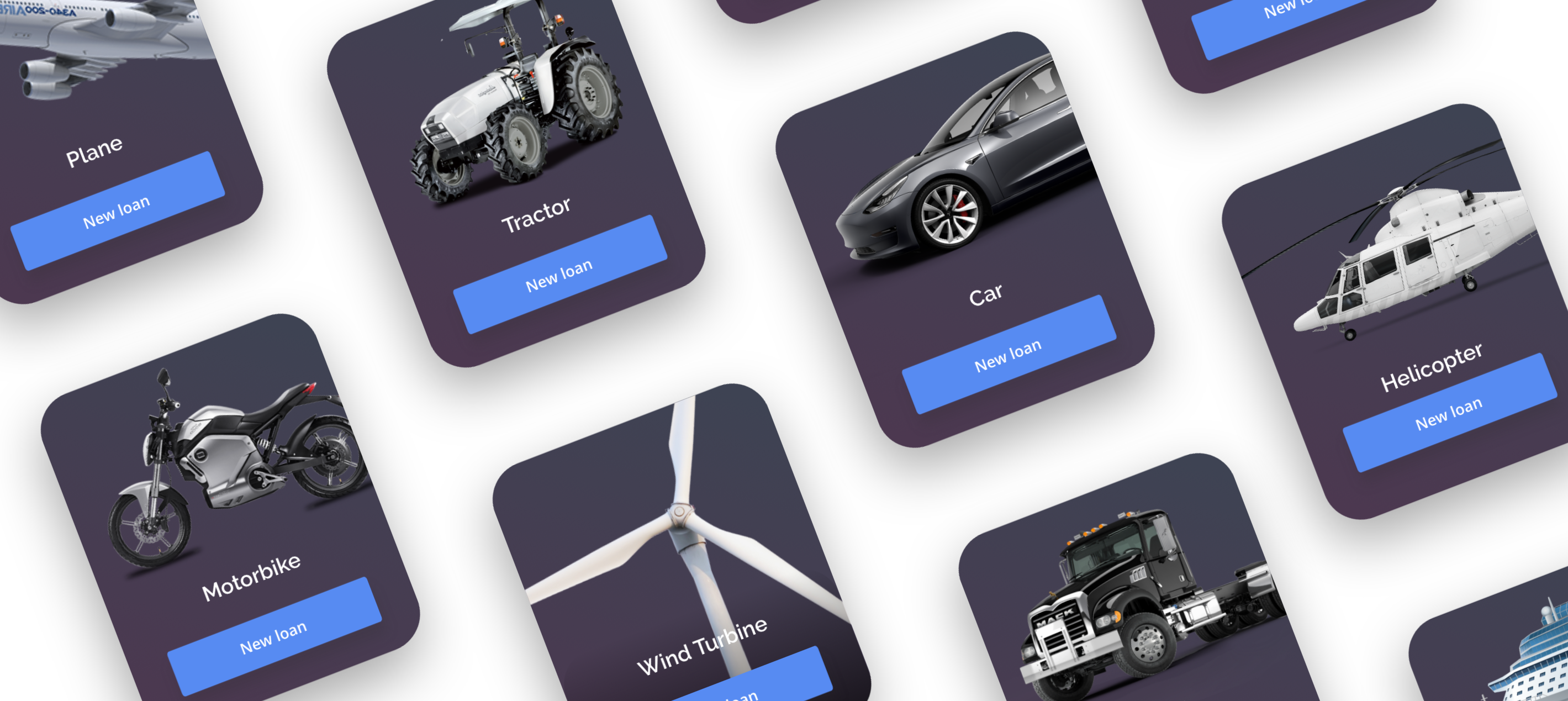

SFP Wholesale Servicing is designed for financial institutions, of all sizes and budgets, who want to provide world-class dealer commercial lending to automotive and equipment dealers, based on over 25 years of wholesale finance experience.

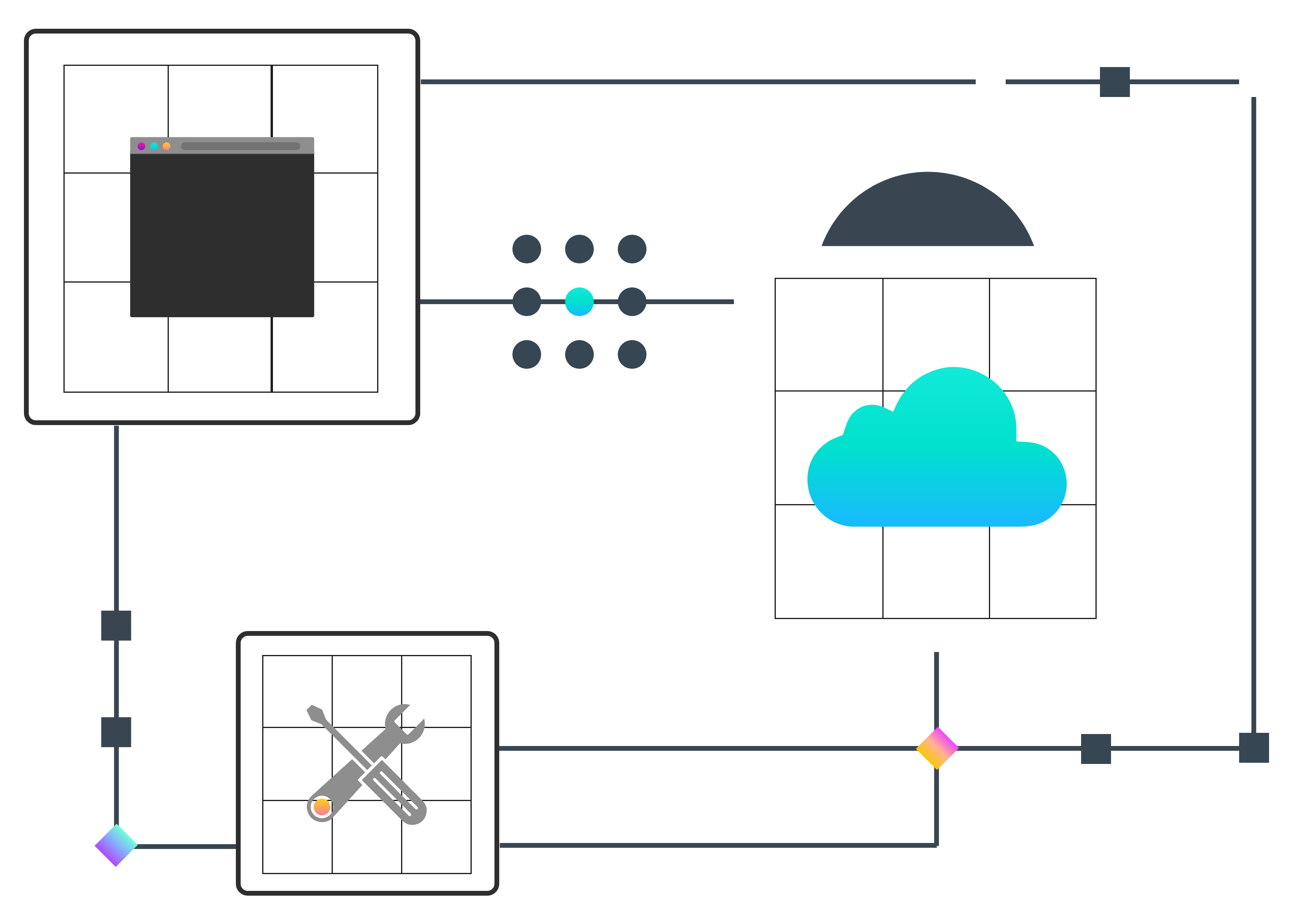

Being cloud-native, SFP Wholesale Servicing can be rapidly rolled out across markets and will scale to a global level, with low set-up fees, low fixed costs, and a ‘pay-per-use’ model which gives a maximum value for money and low Total Cost of Ownership.

An ‘evergreen’ solution delivered with a tailored market package providing standard third-party APIs, it will increase the productivity of your teams by enabling automated workflow implementation, helping optimize business processes to achieve low-touch execution.

- Cloud-native, built for wholesale

- Fast time-to-market

- Low cost of entry

- Evergreen

- High satisfaction for dealer

- Part of a modular platform