- The legislation aims to make payment transfers faster, more secure, and affordable for consumers and businesses.

- It will require EU payment service providers that offer SEPA credit transfer services to provide instant euro payments within 10 seconds.

- The new rules will enhance the strategic independence of the EU’s economic and financial sector.

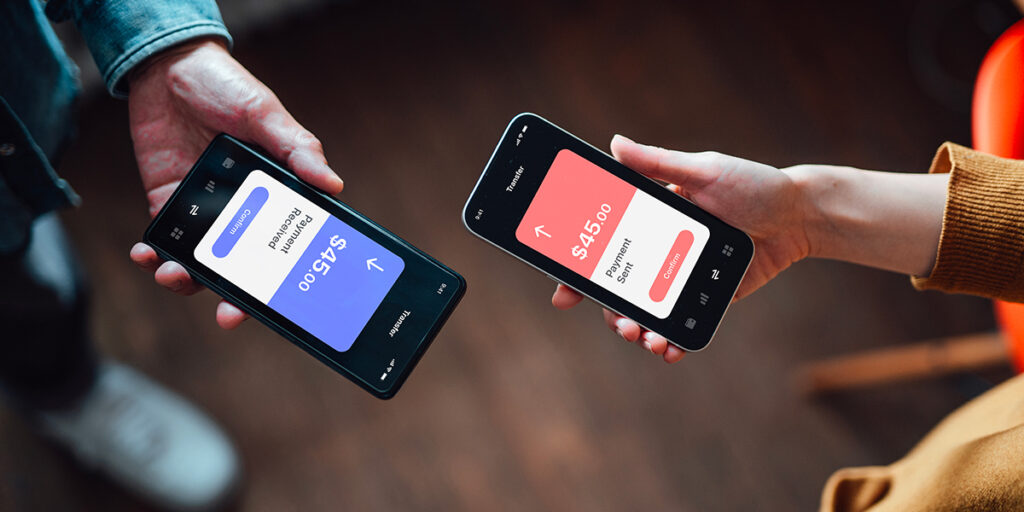

Europe’s payment services industry is set to undergo a significant transformation in 2024 with the adoption of the instant payments legislative proposal by the European Commission. To make transfers faster, more secure, and affordable, the proposal requires all payment service providers offering regular euro credit transfers to offer instant payments, known as “real-time” transfers or SCT Inst in the SEPA region.

The new regulation, set to be adopted in 2024, is a significant step toward creating a more streamlined and efficient payment system, benefitting both consumers and businesses.

During a recent LinkedIn Live session, Sopra Banking Software’s Laurent Hupet, the Payment Solution Offering Director, and Romain Rica, the Instant Payments Product Manager, discussed the critical aspects of the instant payments regulation and why financial institutions need to start preparing for the change now.

Instant payments legislation: background

The initiative is part of the completion of the Capital Markets Union, the economic policy plan launched in 2014, according to a statement by the European Council in May 2023. It seeks to amend and modernize the 2012 Single Euro Payments Area (SEPA) regulation on standard credit transfers by adding specific provisions for instant credit transfers.

In March 2021 and April 2022, the European Council adopted conclusions that focused on the widespread use of instant payments and reiterated its objective of developing competitive EU-wide market-based payment solutions.

According to the European Central Bank, the legislation is also a key goal of the Eurosystem’s retail payments strategy that will benefit both consumers and merchants, allowing for the payment of goods in physical shops, online, and person-to-person transactions.

As a result, the Council proposed the regulation on instant credit transfers in euro to increase their uptake and accessibility for consumers and businesses within the EU and European Economic Area countries.

One of the aims of the legislation is to enhance the strategic independence of the EU’s economic and financial sector by curbing over-dependence on third-party financial institutions and infrastructures. This, in turn, will facilitate the mobilization of cash flows, resulting in benefits for consumers and businesses while enabling the development of innovative value-added services.

According to the Council, the provisional agreement also considers the particularities of non-euro area entities.

What does the new legislation entail?

The new regulation is mandatory and requires EU payment service providers and e-money institutions that offer regular SEPA credit transfers to offer instant euro payments within 10 seconds, 24/7, and every day of the year via all initiation channels. It also ensures that the fees for instant payments do not exceed that of traditional, non-instant credit transfers.

Additionally, banks and financial services companies must verify the match between IBAN account numbers and the beneficiary’s name as soon as possible to prevent possible fraud.

This service must cover all channels, such as mobile and internet banking, and should be provided free of cost for single or mass payments before payment validation. It should be put in place for both regular credit transfers and instant credit transfers. The result can be “match,” “no match,” or “close match.” In the case of a close match or no match, the payer decides whether they wish to proceed with the payment.

The proposal is also expected to remove friction in processing instant euro payments while maintaining the effectiveness of screening individuals subject to EU sanctions. Banks and financial services companies must verify their clients against EU sanctions lists at least daily instead of screening each transaction individually.

The legislation will require reporting the level of charges on instant payments on credit transfers in Europe, as well as payment accounts globally. Banks and payment institutions must also report the rejection rate due to sanction screenings every 12 months.

When will the legislation take effect?

The final version of the regulation is expected to be published in February or March 2024. Banks and non-bank financial institutions have been given different timelines to ensure their systems can support instant payments and IBAN name-checking based on the type of institution and whether or not their operating currency is euro.

The first milestone for payment service providers in the eurozone is nine months after the legislation’s enforcement. Assuming it is enforced in March 2024, by December 2024, banks must be able to do the following:

- Receive instant payments.

- Ensure that the fees for instant payments are equivalent to that of regular credit transfers.

- Have daily sanction screenings in place.

They have 18 months, or until September 2025, to update their systems to send real-time transfers and support the IBAN name-checking process through all channels.

In contrast, banks outside of the eurozone have been given a deadline of 33 months to receive instant payments and 39 months to send them and offer verification of payees. Payment institutions and e-money organizations have 36 months to receive and send real-time transfers.

To avoid penalties, estimated at 10 percent of a bank’s turnover, fulfilling the compliance obligations within the legislation’s specified time frame is crucial.

What challenges do banks face?

Sopra Banking Software has identified three main challenges that banks and financial institutions face in complying with the legislation.

Firstly, within 18 months, they will have to implement the IBAN verification system across the SEPA zone, which requires market unification. The market is fragmented, with various solutions in different markets, such as Sure Pay in the Netherlands and SEPAmail DIAMOND in France.

Secondly, banks not making instant payments must overcome various technical challenges, such as real-time infrastructure, scalability assessments, and real-time fraud prevention, in just nine months to receive instant payments.

Thirdly, banks already making instant payments face challenges such as changes to the rules and a potentially drastic increase in the volume of payments due to the implementation of the legislation and other initiatives, such as the European payments initiative and request-to-pay.

These challenges will require banks and financial institutions to be resilient and scalable and have anti-fraud measures in place – and it is critical to start planning for this now.

How Sopra Banking Software can help

Since 2017, Sopra Banking Software has been a pioneer in the instant payments sector in Europe, having successfully facilitated the first instant payments between two clients in Belgium.

Additionally, Sopra Banking Software is a leading provider of instant payment solutions in the French and Belgian markets. We process approximately 40 percent of instant payments daily in the French market and 15 percent in the Belgian market, while our instant payment solution processes more than 1.5 million transactions daily.

We offer a real SaaS solution for instant payments that allows banks to outsource the challenge of instant payments without impacting their core banking or information systems. We cover all the regulation requirements, from sanctions screening to IBAN name checks to anti-fraud requirements. Our fully modular offer allows banks to choose the services they need. Our cloud-native architecture is based on microservices, enabling dynamic scalability and competitive pricing. Lastly, our solution is secure by design at each level of the application and services.

Partnering with Sopra Banking Software gives banks access to our expertise and knowledge, ensuring successful digital transformations to implement and comply with the instant payments regulation.

For more expert content on industry outlooks and innovation, subscribe to our newsletter or visit our Insights page.