- Revenues from electronic payments in Africa are predicted to increase by approximately 20% per year, generating $40 billion by 2025.

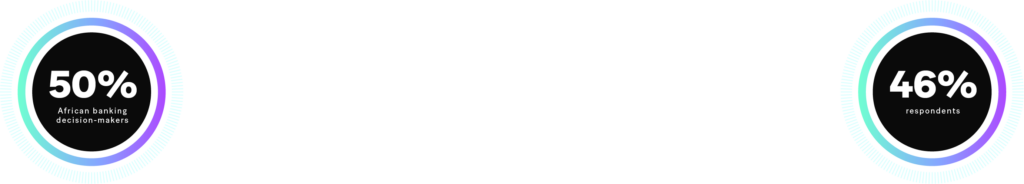

- 50% of African banks confirmed they’re already injecting funds toward blockchain, BNPL and infrastructure modernization. 46% plan to invest in those solutions within the next 12 to 24 months.

Most African banks are already investing or planning to invest in payment solutions: Immediate investment focus is on enabling blockchain, Buy Now Pay Later (BNPL) and infrastructure upgrades. This was highlighted in a 2022 study by Forrester Consulting in partnership with Sopra Banking Software on the future strategy of African banks.

In Africa, where cash is king, what factors are driving banks to invest in electronic payments? What opportunities do the solutions mentioned above represent? And what are the consequences for African banks?

Electronic payments are gathering momentum

In Africa, 90% of transactions are still conducted using cash. However, the dominance of paper money is likely to be challenged, as electronic payments gain ground.

Promise of strong growth

Thanks to advances in technology and innovation, new payment solutions are emerging. These open up additional market segments for banks that were previously out of reach, such as offline channels and providing access to financial services for non-financialized populations.

Moreover, according to a McKinsey study, revenues from electronic payments in Africa are predicted to increase by approximately 20% per year, generating $40 billion by 2025, indicating the growth to come.

Arrival of new players

While banks still play a leading role in payments, non-bank players are positioning themselves in the market. For example, innovative fintechs, tech giants and telecom companies are entering the arena, fueling growth.

They’ve embarked on a race to innovate, modeling themselves on GAFAM (Google, Amazon, Facebook, Apple, Microsoft) and BATX (Baidu, Alibaba, Tencent and Xiaomi) – behemoths offering financial services like Amazon Pay, Apple Pay, Alipay and WeChat Pay (from Tencent).

Interbank electronic groups like GIMAC and GIM and the West African Economic and Monetary Union (UEMOA) are also positively contributing to the situation, by ensuring better regulation and interoperability of transactions in the following ways:

- Normative frameworks.

- Improved management of disputes or claims.

- Strengthening know your customer KYC processes.

- Evolution of regulatory reporting.

- Centralized monitoring of transactional flows.

- Enhanced risk and fraud management.

Banks and e-payments

To maintain their position and remain competitive, banks are investing in the expanding electronic payments sector. Indeed, according to Forrester’s survey of 128 African banking decision-makers, 50% confirmed they’re already injecting funds toward blockchain, BNPL and infrastructure modernization. Additionally, 46% of respondents plan to invest in those solutions within the next 12 to 24 months.

E-payments facilitate payments and transfers

By investing in electronic payments, African banks have the opportunity to make payment systems more efficient and encourage financial inclusion. Below, we explore a handful of examples.

Blockchain

Blockchain has developed independently of cryptocurrencies, driving African banks to invest in the technology and democratize its use. Harnessing the power of blockchain allows banks to strengthen their competitiveness, by accelerating the process of international transfers at reduced costs, while ensuring the security of transactions. It also promotes financial inclusion by offering an alternative to people who don’t have access to traditional banking services.

Modernizing infrastructure

Other payment systems are also transforming the core infrastructure that affects how financial services are delivered, playing a central role in providing universal access to Africans. For example, the rise of mobile transactions is one of the main drivers in recent years, per the World Bank’s 2021 Global Findex Report.

Moreover, the Economic Commission of Africa’s 2022 State of Instant and Inclusive Payment Systems (SIIPS) Report revealed that instant retail payment systems (ISPs) are on a “rapid trajectory”, with 29 active schemes identified and a further 21 under development. What’s more, over 60% of active ISPs are under five years old and undergoing expansion. These dynamics “highlight the critical momentum and focus on digital payments infrastructure”.

BNPL services

To make payment systems more efficient, African banks are strengthening their infrastructure with instruments like BNPL. Although buy now, pay later is still an evolving market, it opens up the following opportunities to banks seeking to bolster their competitiveness:

- Attracts new customers by providing a flexible and innovative payment solution for large items.

- Increases revenue by charging interest and fees for using the service.

- Stimulates market growth by encouraging consumers to purchase more.

Development of e-payments forces banks to evolve

While the rise of electronic payments offers African banks avenues for growth, it also forces them to rethink their business models and how they deliver value to customers.

Payment interoperability

Payment interoperability is becoming crucial for African banks, enabling users to send and receive funds without restriction. To achieve that, they should consider the following:

- Developing interbank payment platforms.

- Partnering with tech-forward fintechs.

- Joining regional payments initiatives.

- Using blockchain technology.

Repositioning of organizations

To keep pace and avoid being overtaken by new entrants, African banks have instilled a culture of innovation and fast learning. Alongside that, a more robust digital strategy is required – the basis of e-payments and a chance to modernize and rethink operations. That involves implementing a collaborative business model via partnering with trusted third parties and developing an ecosystem approach to payment solutions.

Electronic payments and the customer experience

African banks are investing in digital payment solutions that transform how they deliver value. On top of that, collaborative models are gaining traction, changing what it means to be a bank by offering opportunities for growth and revenue through application programming interfaces (APIs) and embedded finance.

But to secure the future of an ecosystem-centered approach, banks must also develop personalized, seamless and reliable digital journeys that meet customers’ evolving needs. This is especially important as competitors vie for their share of the expected $40 billion increase in revenues.

In a world where consumers have a wide choice between banks, fintechs, telecom companies and tech giants, focusing on the customer experience becomes a key differentiator.