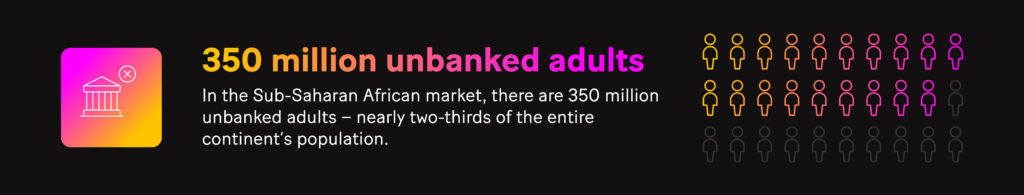

Financial inclusion and microfinance are high on organizations’ agendas, with many focusing on making lending products and services more accessible and affordable to everyone, everywhere, anytime. In the Sub-Saharan African market alone, which this article centers on, there are 350 million unbanked adults – nearly two-thirds of the entire continent’s population. And that number is set to double over the next 30 years.

When it comes to microfinance, financial inclusion players are responding by partnering with trusted third parties to leverage API-first technology and meet unbanked people’s needs. Indeed, as the microfinance market continues to evolve, it’s expected to surpass $300 billion by 2026.

Defining financial inclusion & microfinance

Financial inclusion means having “access to appropriate financial services and effectively using them to safely manage money, save, and invest in financial wellbeing,” says World Bank Lead Economist Leora Klapper. According to the Global Findex Database 2021, about 1.4 billion adults are unbanked globally.

Meanwhile, microfinance refers to providing financial services to low-income, marginalized individuals and those excluded from traditional banking. Microfinance providers offer microloans, credit, insurance, money transfers, and savings accounts.

Financial inclusion and microfinance play a major role in attaining many of the United Nations’ Sustainable Development Goals, including ending extreme poverty, which outlines a 2030 target of “ensuring all men and women, in particular the poor and vulnerable, have equal rights to economic resources, as well as access to financial services, including microfinance”.

Major financial inclusion players

When it comes to financial inclusion, the importance of microfinance is clear to see, yet it’s predicted less than half of African households have access to banking. Several core players are helping remedy that: microfinance institutions (MFIs), Tier 1 banks, neobanks, and telecoms operators. Each is impacted by the following:

- Government and regulator initiatives – for example, the central banks of Nigeria and Ghana “spell out financial inclusion as an objective”.

- Need to develop and extend digital use cases, given 65% of borrowers live in rural areas and 83% work in the informal sector.

- African fintech boom, with the sector projected to hit $65 billion in 2023, a 13-fold increase since 2021.

Addressing financial inclusion & microfinance

Each player has different needs and pain points, be it regulatory compliance, extending their customer base, broadening their offering, or seamlessly integrating microfinance solutions alongside legacy systems.

With that in mind, effectively offering microfinance at scale and improving financial inclusion requires the following:

- API-first financial inclusion platform;

- Full range of financial products;

- Omnichannel capabilities;

- Automated processes.

Sopra Banking Software’s financial inclusion solution

Sopra Banking Platform (SBP) for Financial Inclusion ticks those four boxes and more, offering a robust and scalable platform that equips MFIs, Tier 1 banks, neobanks, and telecoms operators with over 100 modules, including core system components, customer engagement features (accounts, payment, loans, and savings), and risk and compliance capabilities. Clients can start small with a few modules, and progressively increase over time as requirements and strategies evolve – they have full autonomy.

The API integration layer connects to banking platforms, digital channels, and an ecosystem of trusted third-party partners, where it’s possible to leverage services like alternative credit scoring, automated know-your-customer checks, and open banking capabilities. As a result, clients address mass markets using their own channels and expand their reach by attracting new customers and providing hyper-personalized services. Furthermore, our customizable end-to-end solution:

- Deploys as Software-as-a-Service (SaaS) and on-premise;

- Offers real-time 360-degree customer views;

- Stays in tune with new and evolving regulations;

- Extends beyond nano and microloans, up to SME and business loans.

Customer success stories

Live and localized in more than 20 countries, SBP for Financial Inclusion is used by over 30 financial institutions, including the following.

- Crédit Mutuel du Sénégal. With around 1.3 customers, this front-running MFI aims to modernize operations via digitalization. Elhadji Ousseynou Ndiaye, Crédit Mutuel’s Chief Information Officer, says: “Our relationship with Sopra isn’t just supplier/customer: They’re a trusted partner who can support us in our long-term transformation objectives.”

- Advans. This leading microfinance operator chose Sopra Banking Software for several reasons, including the tool’s flexibility, as well as our diverse customer base, experience in Africa, tangible knowledge of the banking sector, and forward-thinking approach.

- CCC Plc. Cameroon’s Community Credit Company has used Sopra Banking’s Software for over a decade and seen turnover double. Since adopting our solution, CCC moved from number 15 in the sector to consistently ranking in the top five, because it’s “more secure, quicker, extremely flexible, user-friendly, and interfaces with other software with no difficulties”.

Forging ahead with financial inclusion via microfinance

Offering microfinance effectively and serving the unbanked population requires an adaptable and open end-to-end solution that allows key players to reach people, even in the most remote areas. Moreover, the platform should offer tailored journeys and evolve with customer needs. By collaborating with trusted third parties, MFIs, banks, and other businesses play a key role in improving financial inclusion.

For more expert content on industry outlooks and innovation, subscribe to our newsletter or visit our Insights page.