- Under EU rules, the European Green Deal requires large and listed companies to publish regular reports on the social and environmental risks they face and how their activities impact society and the environment.

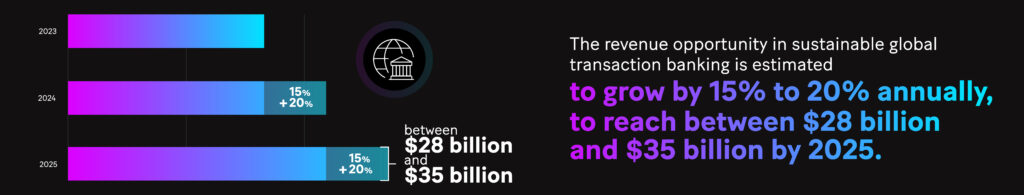

- According to McKinsay, the growth potential of sustainable global transaction banking (GTB) is significant. The revenue opportunity in GTB is estimated to grow by an impressive 15% to 20% annually, to reach between $28 billion and $35 billion by 2025. It also forecasts that market penetration will reach 25% in trade finance products and 5% in cash management products.

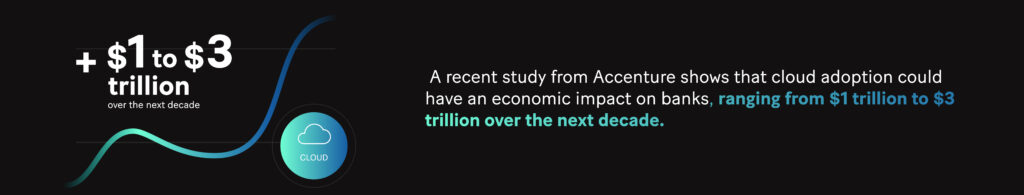

- Switching to open banking via the cloud is a solution for banks to become greener. The continued adoption of cloud computing could prevent the emission of more than 1 billion metric tons of carbon dioxide (CO2) from 2021 through 2024, while a critical factor in reducing CO2 emissions comes from the greater efficiency of aggregated compute resources, the IDC says.

As climate change concerns accelerate worldwide, the global banking sector is under pressure to adapt to changing times and the needs of customers.

Indeed, banks and financial institutions have a crucial role in leading environmental, social, and governance (ESG) initiatives to help the world meet the Paris Accord’s carbon-neutral target by 2050.

While retail banks have been integrating sustainable offerings for several years, the sector must become more proactive by implementing innovative technologies, green solutions, and strategies into their business models.

EU regulations you should know

However, becoming environmentally friendly is no longer a choice for large corporations and the banking sector in the EU after the introduction of new regulations such as the European Green Deal and Corporate Sustainability Reporting Directive (CSRD).

Under EU rules, the European Green Deal – which aims to make Europe the first climate-neutral continent by 2050 – requires large and listed companies to publish regular reports on the social and environmental risks they face and how their activities impact society and the environment.

The CSRD, meanwhile, came into effect in January and strengthened rules and transparency on how companies report their social and environmental information.

Meanwhile, the EU taxonomy is a classification system that indicates if a financial product or investment is environmentally sustainable.

Sustainability strategy and revenue

According to McKinsey, sustainable financial products can boost revenue growth for banks and contribute substantially to their progress in meeting global climate goals. However, success requires a strategic approach, it says.

While sustainable global transaction banking (GTB) is still in the early stages, its growth potential is significant, McKinsey says in an October report.

Indeed, the revenue opportunity in GTB is estimated to grow by an impressive 15% to 20% annually to reach between $28 billion and $35 billion by 2025. It also forecasts that market penetration will reach 25% in trade finance products and 5% in cash management products.

“Surprisingly, few banks today embed sustainability in their GTB products, handing market leaders an opening to capture a disproportionate share of the market. Banks should act now to build a sustainable GTB value proposition that enables them to defend existing relationships and expand their market share while staying ahead of customer demands and the expectations of employees, investors, and the public,” McKinsey says.

However, being ahead of regulations and reducing transition risks while being more competitive with new products and services can be a competitive advantage for banks.

Customers drive the sustainability push

The rise in climate-aware customers is also driving banks toward a more environmentally conscious approach, according to our annual global banking survey of nearly 800 senior decision-makers published in the Sopra Steria Digital Banking Experience Report 2022.

Customers want banks to accelerate their green transformation and offer environmentally responsible products and services. Our research found that nearly one-in-four customers indicate the fight against global warming is a crucial issue, and 55% say it is becoming more important than investment profitability.

Meanwhile, senior executives recognize their role in integrating environmental issues into their bank’s strategy. “They see it as a source of differentiation and an opportunity to strengthen customer confidence and reduce their environmental impact. The environmental priority is, therefore, on the agenda for 63% of banks,” according to the report.

ESG elements are also a crucial part of their future vision and roadmap, with 25% of banks’ respondents saying that using ESG elements in customer-facing products and services is their highest-ranked priority in the coming years. Most respondents say they plan to increase their investment in ESG over the next 12 months.

Younger generations are also playing an essential role in banks adapting to sustainable business models, with 49% of banking customers in Europe and 62% in Africa saying that fighting global warming is an important criterion when choosing a bank, our research found.

What can banks do to adopt greener initiatives?

Banks can start by enhancing existing products with ESG elements and introducing new sustainable products.

However, some retail banks have also embraced innovative initiatives, such as the UK’s Starling Bank, which operates on renewable energy and was the country’s first bank to introduce debit cards made from recycled plastic. It is also a Tech Zero task force member to cut carbon emissions and plant trees to reduce and prevent deforestation.

Amsterdam-based Bunq, which describes itself as the “bank of The Free,” has planted three million trees on its customers’ behalf and offers eco-friendly subscription plans, including a sustainable account that helps users become CO2-free in two years.

Meanwhile, Triodos Bank, also based in The Netherlands, only finances sustainable businesses and makes it a priority to publish on its website details of every organization it lends to ensure transparency.

Open banking

From a technology perspective, switching to open banking via the cloud is a solution for banks to become greener, according to a report by the International Data Corporation.

The continued adoption of cloud computing could prevent the emission of more than 1 billion metric tons of carbon dioxide (CO2) from 2021 through 2024, while a critical factor in reducing CO2 emissions comes from the greater efficiency of aggregated compute resources, the IDC says.

“The emissions reductions are driven by the aggregation of computation from discrete enterprise data centers to larger-scale centers that can more efficiently manage power capacity, optimize cooling, leverage the most power-efficient servers, and increase server utilization rates,” it adds.

Cloud computing is already helping financial institutions save money and reduce their environmental impact. A recent study from Accenture shows that cloud adoption could have an economic impact on banks ranging from $1 trillion to $3 trillion over the next decade.

As regulations continue to ease, banks can collaborate more with third-party vendors to extend their ecosystems through API platforms and provide access to open banking to improve the customer experience by personalizing their sustainability journey and creating innovative use cases to reach strategic targets.

This could allow customers to analyze their transactions, such as energy bills and shopping habits, to help them make better sustainability decisions.

For instance, customers at Germany’s Commerzbank are incentivized to reduce their carbon footprint through the lender’s CO2 carbon emissions calculator. They can monitor their spending and check their emissions, which they can reduce by changing their habits.

Based on our research, banks need to strike the right balance but also be proactive about how they will bring about change and move towards greener initiatives as part of their strategic business roadmap for the coming years.

Nevertheless, banks that embed ESG across their business models will be better positioned to understand and engage with clients on their own climate risks and sustainable transformations, enabling them to secure stronger business relationships with clients. This could become a competitive advantage – and a source of new revenue streams.

For more expert content on industry outlooks and innovation, subscribe to our newsletter or visit our Insights page.