In this series of articles, written in collaboration with our partners at Galitt, we take an expert look at the state of the payments, including what banks can do to remain relevant.

To get started, we will consider how the method of consumer payment is changing, shifting from physical to digital, and what that means for incumbent players.

While much of the financial services industry has struggled since the outbreak of the pandemic, the payments market has remained, by and large, rather resilient. The use of digital payments has skyrocketed, encouraging a wave of new and increasingly innovative digital payments methods.

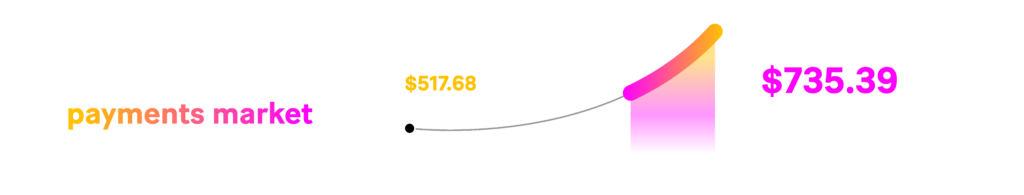

Indeed, it’s a market that’s been on the rise for some time, with global non-cash transactions surging by nearly 100 percent between 2014 and 2021, reaching a total of 840 billion transactions. And it’s a trend that’s set to continue. The global payments market was evaluated at $517.68 billion in 2021, and is expected to reach $735.39 billion in 2025, at a CAGR of 9.2 percent.

Clearly, payments are buoyant with possibility and opportunity. And yet, many incumbents such as banks are still struggling to maximize on this burgeoning market. These organizations will need to adjust and react quickly. Otherwise, they could find themselves left by the wayside.

A move away from traditional payment methods

The use of cash for making transactions has been on a steady decline for some time. Even before the pandemic in 2019, paper currency was used in just 26 percent of consumer payments, down from 40 percent in 2012. And, of course, that number continued to plunge during 2020 and 2021, due to the sanitary measures taken as a result of COVID-19.

It’s unlikely that physical cash will see a great revival, regardless of when and to what extent the pandemic ends. It’s anticipated that in the coming years, cash will lose a further 38 percent of market share, reaching just 12.7 percent of global Point-of-Sales (PoS) volume by 2024.

The global decline in cash, however, has not led to a decline in spending. E-commerce has been growing continuously for the last five years. In 2020, $4.6 billion was posted in transactions, a 19 percent increase on 2019.

So while paper currency has been left in the ATMs, digital wallets and bank transfers have been on the rise. In fact, it’s projected that non-cash transactions will reach 1.1 trillion by 2023.

Which payment methods are popular and where?

The fastest-rising trend in payments method is the digital wallet, accounting for 44.5 percent of e-commerce transactions in 2020, an increase of 6.5 percent from 2019. This includes the growth of the mobile wallet industry, as consumers increasingly turn to on-the-go payment methods such as Apple Pay or Google, a trend being particularly driven by consumers in Asia and North America.

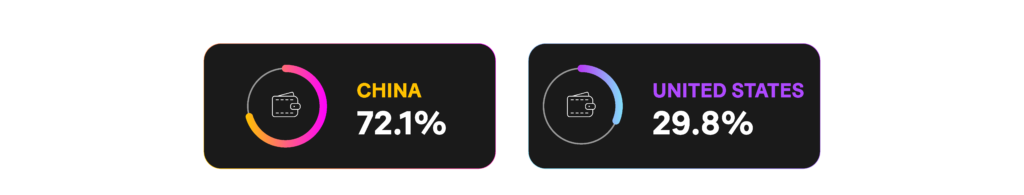

Around the world, Chinese consumers are the biggest users of digital wallets, which account for 72.1 percent of online purchases in the country; while in the United States, digital wallets now account for 29.8 percent of online transactions, an increase of 23.7 percent on 2019.

This widespread uptake of e-wallet transactions is expected to negatively impact the use of credit cards, bank transfers and cash on delivery. By 2024, it is anticipated that digital wallets will account for 51.7 percent of e-payment volume, with credit and debit cards falling to 20.8 percent and 12 percent respectively.

Banks lagging behind

It probably comes as no surprise that fintechs and digital-only banks are thriving among these new and upcoming payment methods, while their incumbent competitors are struggling. The younger, more tech-savvy enterprises often have the agility and in-house digital expertise to incorporate the latest solutions into their customer-facing offers; whereas larger banks and financial institutions – often hampered by legacy systems and regulation – can find it difficult to keep up.

According to one analysis, the valuation of fintech firms in the payments sector grew at an annual compound rate of 27 percent between 2016 and 2020, while banks’ market capitalizations declined by 1 percent.

With interest rates at historically low levels, widespread credit card losses and the pressures of regulation and competition, banks should perhaps look to rethink their current payments models if they are to stand any chance of bridging the gap.

Such an evolution would require a fundamental rethink of banks’ approach to payments in the digital age in order to create compelling and beneficial payment structures for consumers.

In the next instalment of this series, we’ll take a closer look at who exactly the incumbent players are competing with, why those new entrants seem to have the edge and what exactly traditional banks and financial institutions can do to keep up.