This analysis is based on our research and experience of working with multiple banks across several countries.

Instant payments can help banks grow their business. However, despite the benefits, challenges remain – exacerbated by strong regulatory pressure relating to the European Commission’s proposal to make SEPA Instant Credit Transfer (SCT Inst) mandatory for financial institutions (FIs) offering SEPA Credit Transfer (SCT).

In France, approximately 50% of banks don’t have an instant payments solution. Below, we review the difficulties they typically face when considering one.

Challenges managing transaction volumes

France recorded 108 million real-time – instant – transactions in 2021, expected to reach 1.2 billion by 2026. With that comes the need for elastic infrastructure, particularly when you factor in the erratic nature of payments. However, scalability and elasticity often come with performance issues.

Meanwhile, regulatory and competitive pressures mean banks are reluctant to pass transaction costs on to consumers and businesses. Thus, only volume can help FIs reduce costs and make a viable case for instant payments, augmenting the need for a consistently performant scalable solution.

This leads us to another challenge: the cost of instant payments solutions, especially for smaller banks with low transaction volumes. Let’s take a closer look.

Infrastructure cost challenges

An instant payment must be available 24/7, and banks must respond to requests within seconds. Therefore, a real-time engine and properly scaled underlying infrastructure are essential.

Our graph shows that on a five-year basis, as volume increases, the price per transaction decreases, and drastically so. Thus, long-term infrastructure cost decisions must be a priority.

Attention to cost impact

Our study compares an on-premise approach with a pure Service-as-a-Software (SaaS) model. With on-premise, the price per transaction is very high at the start (due to initial costs like the license), but decreases quickly.

With SaaS, the initial costs are much lower (because no license is required). So, although there’s still a decrease in price as transactions rise, it’s less visible.

After five years, the price per transaction is €0.029 for the SaaS model versus €0.026 for on-premise. The two approaches are therefore quite similar, with a slight advantage for on-premise on an absolute price-per-transaction basis.

However, if we look at the average price per transaction over five years, we see the SaaS model is less expensive: €0.039 versus €0.068 for on-premise. But what about the cost components: What does a bank pay for each model?

Pay attention to the cost component

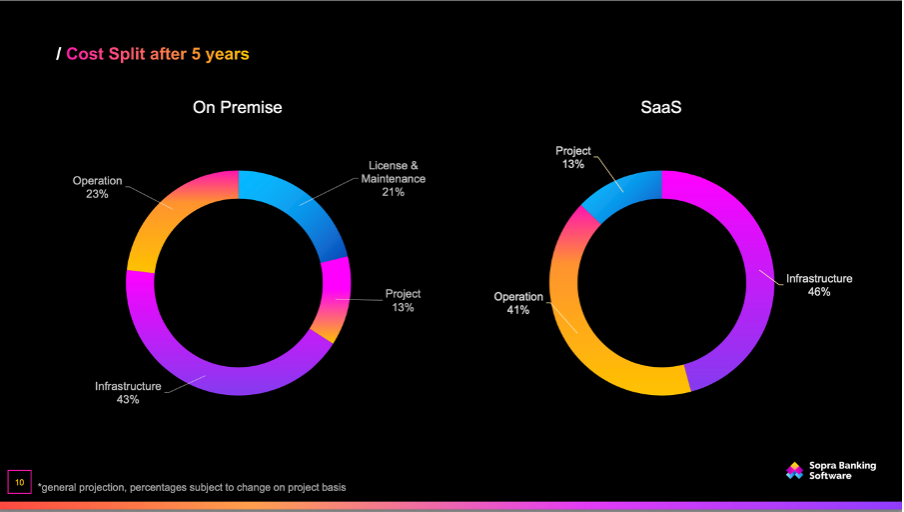

The above two graphs represent the total cost components after five years – on-premise on the left and SaaS to the right.

We can clearly see the following with both models:

- Share of software costs (license, maintenance) is quite low.

- Infrastructure costs represent approximately 45% of the total cost after five years.

If there’s a conclusion to draw, FIs should focus on reducing infrastructure costs and making the instant payments solution more affordable. To achieve that, they should use a cloud-native platform that’s self-scaling based on volume, or a shared solution – a worthy option for smaller banks.

Let’s move on to security aspects – more specifically, fraud.

Fraud challenges

It’s common to hear: “Instant payments mean instant fraud.” Since the official launch of instant payments in Europe in 2017, fraud-related losses have jumped.

Indeed, in 2021, France had a fraud rate of 0.0448% for SCT Inst versus 0.0019% for SCT. Also, fraud associated with instant payments continues to rise. While the SCT fraud rate showed a slight decrease between 2020 and 2021, the SCT Inst figure increased from 0.04% to 0.0448%.

This is understandable, because in the instant payments world, money disappears immediately, making it almost impossible to recall – exactly what fraudsters are looking for.

The above France-focused graph shows the change in fraud for credit transfers from 2020 to 2021 was 20 million Euros, and a large proportion – 12 million Euros – came from instant payments.

Therefore, banks need a real-time fraud detection solution to keep up with the pace of instant payments, while ensuring they meet the deadlines imposed by the SCT Inst regulation.

6 additional challenges and recommendations

There are other issues banks face when entering the instant payments arena, or those looking to upgrade their solution.

Resilience

The first is resilience. A traditional SCT and an SCT Inst aren’t interchangeable. When banks have a problem with an SCT, they must solve it before the cut-off time, ensuring it’s processed on the same day. But with instant payments, banks must operate in real-time, 24/7.

Account management

There’s also a challenge on the account management side of things. This is a strong constraint for some banks, because funds need to be available in real-time for customers.

Therefore, it’s important to follow the status of clients’ accounts in real-time. If a bank has batch accounting, it needs to start account management transformation before embarking on an instant payments project.

24/7 cash management

Currently, bank-side cash flows are managed between 8am and 4pm, via TARGET2 and so on. But with instant payments, FIs need funds available in the nostro account at all times. As a result, cash management takes place not only during working hours but also at night and on weekends. This changes the rhythm of cash management teams.

Interoperability and accessibility

There’s also the interoperability and accessibility of the solution to consider because banks need to be reachable at European level. This requires connecting to different clearing and settlement mechanisms (CSMs), and is even more important in the context of instant payments.

Reject rate

Tracking the reject rate of instant payments is also necessary. In some countries, the CSM checks the reject rate, ensuring that:

- Banks meet the turnaround time.

- There aren’t too many rejects for expiry (not ideal for the user experience).

A poor instant payments service has a higher reject rate.

Supervision

Finally, there’s supervision to factor in. With instant payments, banks must supervise 24/7, which is different from a standard SEPA Credit Transfer. With instant payments, the following is required:

- Employees are on call 24/7, in case of problems during the weekend or at night.

- Human Resources policy that takes labor legislation into account, developed with input from all stakeholders, before launching an instant payments project.

Sopra Banking Software’s Instant Payments Solution

At Sopra Banking Software, we’re aware of the mentioned challenges. Our mission is to help financial institutions overcome them, so they offer a first-class service to their customers while controlling their investments. We provide a cloud-native, auto-scalable instant payments solution with a microservices-based architecture that’s deployable via SaaS.

In Belgium, we provided a shared solution to five banks, reducing their costs by 40%, and there’s been zero service interruption. And in France, Sopra Banking Software’s solution processes 35% to 40% of all instant payments.

To find out more, visit our solutions page and ask to speak to one of our experts.