The Indian used car market represents an exciting opportunity. Like used car markets all around the world, it is growing in line with an increasing desire among customers to own a private vehicle and financial pressures preventing customers from buying new vehicles.

And the landscape is particularly fast moving in India, where digitization and partnerships are allowing “organized” industry players to gain an edge on their competition.

However, this opportunity may well prove to be a short-lived one, and those wishing to take advantage of it will need to act fast.

Problems with the Indian car market

Across many countries around the world, the desire to drive in a private vehicle rather than use public transport remains high, due to continuing concerns around COVID-19. However, for many drivers in India, buying a new vehicle is becoming increasingly complicated. The BS-VI norms rolled out in 2020, along with other new manufacturing regulations, are driving up the price of new vehicles.

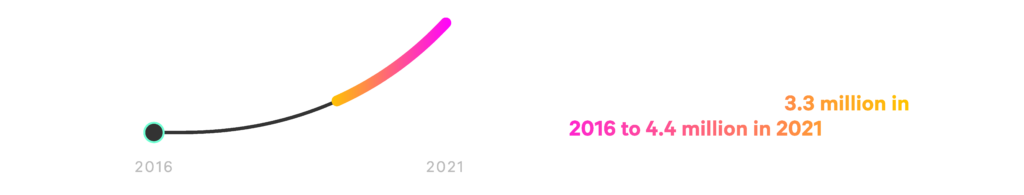

Studies show that an increasing number of drivers in India are looking at the used car market, rather than buying new. Indeed, the number of used cars sold has risen from roughly 3.3 million in 2016 to 4.4 million in 2021. And that number is only set to rise. Per research carried out by research firm Frost & Sullivan, and commissioned by Volkswagen India, used car sales will outnumber new car volumes by over 2:1 in the coming years.

This shift in customer purchasing behavior raises interesting questions about the future of the automotive industry in India, as well as opportunities for auto finance firms.

The state of used car financing in India

The current state of financing for used vehicles in India is a fragmented one. The market is dominated by customer-to-customer (C2C) transactions and “unorganized” players, i.e., dealers operating out of small outlets. Indeed, in 2021, they collectively made up 75% of the used car financing market in India (34% for C2C and 41% for unorganized players).

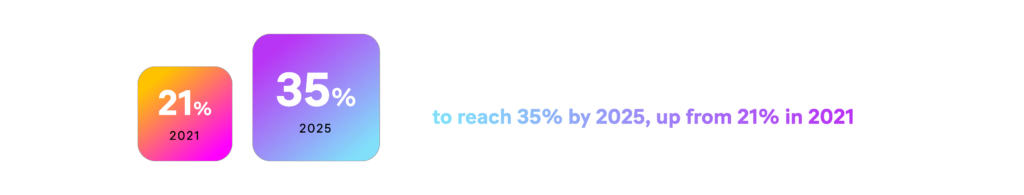

However, forecasts suggest that this will change. Per Frost & Sullivan’s report, organized dealers are expected to increase their stake to 45% by 2025. This is due to organized players finding new ways to differentiate themselves from the competition, offering customers more attractive and easier-to-access financing options.

An opportunity for automotive financers

The Indian used car financing market is projected to grow from USD 7.95 billion in 2022 to USD 14.87 billion in 2027. Furthermore, used car finance penetration is forecast to reach 35% by 2025, up from 21% in 2021. Clearly, there is opportunity for lenders willing to take advantage of the evolving landscape.

But in real terms, what can automotive financing companies do?

For a start, focusing on digitization is key. As we’ve already seen, the rate of organized used car financing firms is set to grow, in part because of a push toward digitization. Organized platforms are able to offer what many independent, “unorganized” companies can’t: a CX-friendly, online service, with personalized offers and deals.

And then there’s partnerships. We’re seeing OEMs, banks and Non-Banking Financial Companies (NBFCs) forge new partnerships across India to offer better, more competitive financing packages to customers.

By teaming up with an experienced partner like Sopra Banking Software, lenders can rest assured that they’re working with a platform that will allow them to meet all their financing needs. Our award-winning Sopra Financing Platform allows lenders to offer a seamless, CX-friendly platform for end-customers. And our Marketplace means that, by partnering with Sopra Banking, your organization will have access to a huge array world-beating services at the click of a button.

The used car financing market in India represents a great opportunity. But it’s a fast-changing landscape. Those wishing to take advantage of the changing paradigm will need to act fast, otherwise they may find themselves left by the wayside.