In the world of digital banking, it’s clear that offering top-class customer experience (CX) is non-negotiable for retaining a competitive edge. But when an online service doesn’t meet consumers’ increasingly high expectations, a CX gap emerges. With that in mind, banks are under pressure – especially from digital-native consumers – to deliver the quick, personalized, omnichannel experiences they expect.

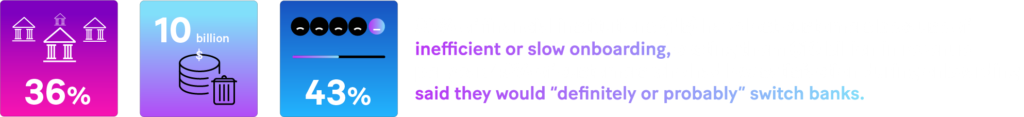

According to financial technology company Fenergo, 36% of financial institutions (FIs) have lost customers because of inefficient or slow onboarding, costing them $10 billion in revenue per year. And as per Digital Banking Report’s Account Opening and Onboarding Benchmarking Study, 43% of customers who had low satisfaction during onboarding said they would “definitely or probably” switch banks. Meanwhile, research by Signicat revealed that 68% of European customers abandoned a finance-related onboarding process in 2021, up from 63% in 2020.

Onboarding is an opportunity to win customers over, laying the groundwork for a strong and long-lasting relationship, where additional sales journeys may well come into play. With that in mind, onboarding processes should be fast, seamless and intuitive.

As a result, banks are seeking ways to provide stellar experiences and maximize conversions – particularly pertinent given the average customer acquisition cost for incumbent banks is over $300, a figure that’s on the rise following the impact of Covid and the saturation of digital channels.

Below, we’ve collated five key ways banks can create a frictionless onboarding and digital sales experience.

1. It’s all about personalization

Today’s customers expect tailored digital experiences: relevant content, end-to-end customized journeys, hyper-personalized ads and bundled offers. Research by Sopra Banking Software and our sister company cxpartners backs that up, with customized onboarding processes outperforming a generic control experience by significant margins.

Personalization involves leveraging customer insights gathered from user data. On top of that, FIs should jump on board the open banking train and the wealth of data it provides to individualize and enhance CX even further.

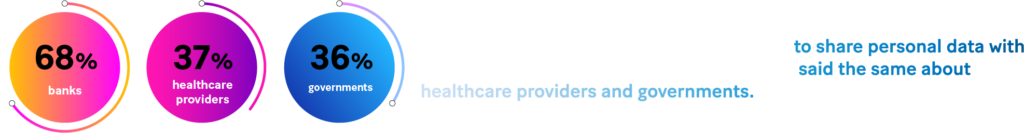

What helps here is the fact that many customers are okay with the idea of sharing personal data with their banks – 68% of consumers surveyed by IBM, for instance, indicated they’re willing to do so. By contrast, only 37% and 36% said the same about healthcare providers and governments respectively.

2. An omnichannel experience is vital

As well as curating personalized journeys, an omnichannel experience is crucial, particularly with online and mobile banking so prevalent. For example, online banking penetration is 96% in Norway, 93% in the UK, and 61% in the Euro Area.

In Africa, banks are now pushing for a mobile-first strategy, with features such as virtual assistants. Meanwhile, 50% of consumers interact with FIs via mobile apps in the Middle East, India and South-East Asia, and that number is on the rise.

As a result, banks must offer prospects the convenience of onboarding and banking where and when they want: the option to start the onboarding or digital sales process on one device, before seamlessly moving to another to complete it. Achieving that requires a platform that allows real-time data synchronization across all channels – online, mobile, chatbot, phone and face-to-face.

3. Speed, fluidity and stellar UX

Consumers aren’t just demanding bespoke and omnichannel experiences; they also expect to open accounts instantly and be onboarded in minutes. To do that, FIs need to simplify, automate and streamline digital banking journeys, while ensuring they’re robust, secure and intuitive. Features to incorporate include:

- Forms pre-populated with known information, quickly moving the customer along and reducing frustration

- Advanced AI and machine learning technologies, enabling easy upload and update of ID documents and quick verification for fast know your customer (KYC) review

- Human-centered and user-friendly interfaces, helping guarantee frictionless onboarding and sales journeys.

4. Back office: configuration over customization

Alongside customer-facing initiatives, there’s a behind-the-scenes factor to consider, too. To that end, a fully digitized back office founded on configuration over customization is critical.

Historically, enterprise software design has focused heavily on customization, but now, with off-the-shelf solutions, this is rarely seen as good enough.

When focusing on configuration rather than customization, there’s no tailor-made code and associated maintenance. This is particularly important when there’s a need to quickly update the customer workflow based on analytics gathered through monitoring customer onboarding (for example, editing an aspect of the process based on insights gathered about drop-off points). Moreover, if requirements or technology change, it’s possible to quickly update workflows, ensuring continuous improvement of onboarding sales processes.

A user-friendly back office also offers:

- Drag and drop low code workflows enabling order change, the addition or removal of steps, and the set up of custom fields

- The ability to configure multiple processes for different channels, segments and sectors, ensuring an omnichannel experience

- Customer service as and when required, where employees are armed with relevant information, meaning they can easily help people complete onboarding or sales processes.

5. Easy ecosystem expansion with an open platform

The final piece of the frictionless puzzle is harnessing the power of open banking to partner with specialist third parties. That requires an API-friendly platform with easy connections.

Once in place, open banking gives FIs the ability to offer customers hyper-personalized and localized products, while adhering to regional rules and regulations. An open solution also supports plugins for features like digital signatures, video ID checks and document management, allowing fast and secure onboarding. By broadening their remit, banks enhance the customer experience even more.

A frictionless onboarding process is essential for banks

We’ve already seen the power and importance of a smooth and seamless onboarding process, and we’ve also seen that it’s an area where organizations, including banks, can struggle.

The financial services industry has now reached a point where competition for customers is fierce, and banks need every advantage they can find. Many banks will have employed one, two or even more of the approaches we’ve outlined above, but that will often not be enough when it comes to providing a world-beating CX.

To create a truly frictionless onboarding experience, and to gain a significant edge on the competition, banks will need to action all five of the suggestions outlined in this article, and they’ll need to do so effectively.

Working with a trusted and experienced partner, like Sopra Banking Software, can help. Click here to see how you can revamp your onboarding and digital sales experience today.