Stay at the forefront of innovation in automotive finance with #1 auto lending software

Develop and nurture deep relationships with dealers and customers

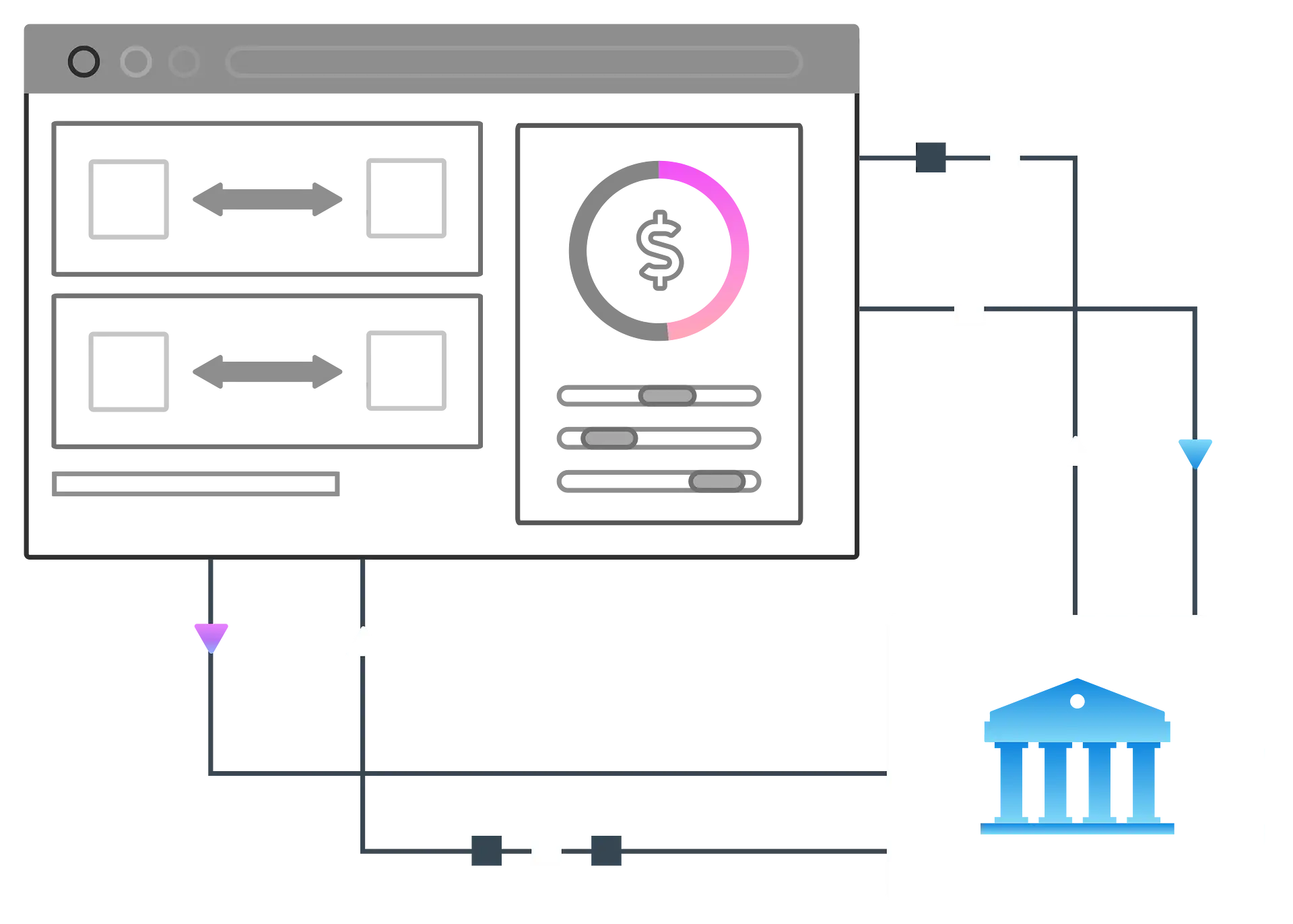

Auto lending software is the engine of an automotive finance business.

Sopra Financing Platform for Automotive Finance is specifically designed for the asset-based and specialist finance needs of auto lenders. It offers fully cloud-based solutions that can stand alone or be combined, extending the business capabilities of the auto lender, while achieving a reduced time to market, faster time to value, and improved control of dealer and asset-linked credit risks.