- A study by MHP reveals that 72% of car owners can imagine replacing their private vehicles with shared autonomous mobility solutions.

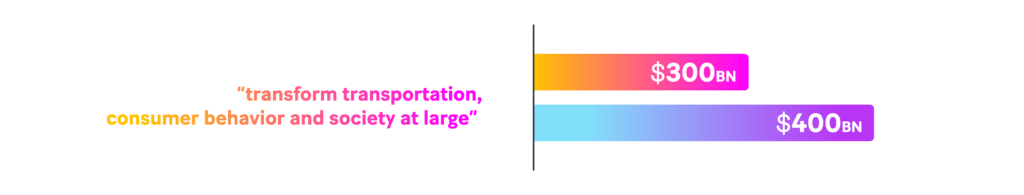

- According to research by McKinsey, autonomous driving could amass $300 to $400 billion in revenue by 2035, with the potential to “transform transportation, consumer behavior and society at large”.

Mobility ecosystems – an increasingly hot topic – were discussed at the 2022 Sopra Banking Summit. The session covered four key issues: customer-centric market trends, how dealers are repositioning themselves, technology shifts and challenges, and setting priorities in the ever-changing environment. Below, we dive further into each of those themes.

With the financial outlook of the automotive industry continuing to decline, mobility companies are responding by developing an organized and collaborative ecosystem. By working together and sharing data, participants improve their performance and provide an integrated customer experience (CX), strengthening the entire sector.

A more varied and partnership-focused mobility landscape brings new technologies and innovations, plus joint R&D investments that reduce risks. Regulators and societal movements also steer initiatives, with increased eco-awareness and associated laws driving change.

Customer-centric mobility trends

Car manufacturers traditionally compete on hardware engineering capabilities. However, although driving performance and reliability still matter, it’s increasingly about the customer experience.

Stephan Reeve, Managing Director of Financial Services at Mazda Motor Europe, explains: “Different types of interactions – ordering, CRM, marketing automation – need to move from being car- to customer-focused.”

That’s already evident with tech-led, digital-forward, customer-centric electric vehicle manufacturers like Tesla and Car-as-a-Service (CaaS) offerings.

But it’s about more than just cars. Marcus Willand, Partner at MHP (a Porsche company), states: “Freedom of choice will be a central point for convenient mobility offerings in the future.” A recent study by MHP supports that, revealing 72% of car owners can imagine replacing their private vehicles with shared autonomous mobility solutions.

People want greater independence, so the market is moving from a car-centered understanding of mobility to a network-focused situation. As a result, many players interact with each other for the sake of the consumer, be it sharing, subscription or micro-mobility services or platform-based companies like Uber.

To facilitate that, Willand believes “Customer data needs to be shared between mobility providers, original equipment manufacturers (OEMs), public transport suppliers, and so on.”

Moreover, the European Union is driving the sentiment forward via policies like the European Strategy for Data and the Data Act. Those initiatives unlock potential by opening up the mobility market to services based on vehicle data.

Emergence of new business models

To meet changing customer demands and move the ecosystem toward a more economically sound and efficient operation that puts CX first, embracing the omnichannel experience is vital. As part of that, OEMs and dealers are repositioning themselves by adopting an agency sales model.

OEMs have historically been more business-to-business (B2B) than business-to-consumer (B2C), relying on dealers to manage customer-facing interactions. But to truly own the CX and adapt to a more digital-first environment while maintaining physical touchpoints during the customer journey, the OEM/dealer dynamic must change.

That involves OEMs transitioning from a B2B to a direct-to-consumer model, where they hold the inventory and set more consistent pricing across sales channels – online and showroom – reducing traditional cost-based competition between dealers.

Meanwhile, rather than being the endpoint of a consumer’s journey, dealers become an “experience center” that’s part of a set of interconnected touchpoints – an “agent” acting on behalf of the OEM and customer, offering in-person interactions, test drives and vehicle handover.

Stellantis-owned Alfa Romeo, DS, and Lancia are set to switch to an agency distribution model from mid-2023 onward, with the ambition to be “number one in customer satisfaction in all markets, in products and services”. Volkswagen, Mercedes, Audi and Volvo are also looking to make the transition.

Additionally, Hyundai and Amazon announced a partnership in 2021, creating the Hyundai Evolve digital showroom, where customers configure vehicles, estimate the sale price and search for real-time inventory matches, before being directed to local dealerships to complete the purchase.

José Muñoz, President and CEO of Hyundai Motor North America, said: “Our mission is to be the leader in a seamless, digital and transparent retail experience in collaboration with our dealer body.”

“The integration of formerly separated roles of distributor and retailer will allow to redesign the entire value chain from factory to customer”, explains Markus Collet, who leads CVA’s AutoMobility Platform. “Customer benefits such as simplicity will add to a lower cost base and additional margin through new activities such as mobility.”

Software and technology partnerships

Alongside evolving consumer preferences, a firm focus on the customer experience and changing business models, software and technology have a role to play in the mobility ecosystem. Indeed, the digital experience offered by a vehicle is becoming as important as its physical aspects.

The notion of a “smart” vehicle where people can work, socialize and be entertained has taken hold. To keep pace with that, OEMs and suppliers are developing new strategies, investing in their own capabilities and acquiring technological prowess by partnering with third parties.

For example, Mercedes injected more than €200 million into their Electric Software Hub, and Capgemini and Audi launched a joint venture – XL2 – to “support the automotive industry in digital transformation tasks”. Additionally, Honda and Sony have created Afeela, an “inter-vehicle relationship where people feel the sensation of mobility by utilizing sensing and AI technologies.”

Partnerships are also happening around autonomous driving: Bosch and Volkswagen Group subsidiary Cariad are sharing investments in technology and expertise, as are Argo AI, Ford and Walmart. Collaborations like these give OEMs access to specialized skills and services, enabling faster and more significant progress.

According to research by McKinsey, autonomous driving could amass $300 to $400 billion in revenue by 2035, with the potential to “transform transportation, consumer behavior and society at large”.

Seizing the mobility ecosystem opportunity

To leverage the ecosystem effectively, mobility companies should keep abreast of market trends, particularly around customer preferences and CX. Other considerations involve data sharing, transitioning to an agency model and investing in software and technology to improve the digital experience offered by vehicles. Collaboration and repositioning create a stronger market, benefiting all players.