According to our recently published Consumer Perspectives banking report, written in collaboration with Sopra Steria and Ipsos, nearly 40% of customers use an online bank. The appetite for these financial institutions – which differ from traditional banks in their operation and service offering – is growing year on year. In Europe, 29% of banked people are customers of both a traditional bank and an online bank, and 5% of them are exclusively customers of an online bank.

Who are the major players that make up these online banks, and why are they so successful? What are their objectives and what challenges do they face? And finally, how should traditional banks respond to this apparent threat to their market share?

What are online banks?

Online banks differ from traditional banks in that they do not have physical bank branches. They are uniquely active online, accessible via websites or mobile applications. They allow users to perform a large number of operations offered by traditional banks, such as the opening and managing of online bank accounts, and transfers and payments. They can be subsidiaries of traditional banks or completely independent entities.

A rising trend, growing year-on-year

Online banks want to revolutionize the user experience by reducing transaction times and by adapting to new consumer patterns and behaviors. Furthermore, they often have better prices than many traditional banks, CX-friendly subscription and usage, instant account opening, limited fees when using bank cards abroad, and innovative digital products and services. These services are usually free of charge, while banking fees charged by a traditional bank amount to an average of 200€ per year.

Connected, active customers

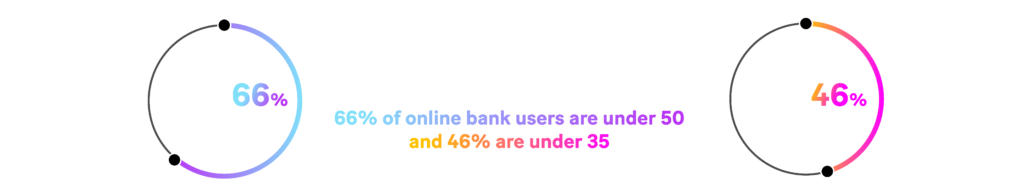

It’s not surprising that the public has taken up these offers with enthusiasm. Our Consumer Perspectives report points out that customers of online banks are more active, younger and more connected than those of traditional banks. 66% of online bank users are under 50, and 46% are under 35. They invest more in cryptocurrencies (21% compared to 11% of traditional bank customers) and consult their accounts online more often: 37% connect at least once a day.

The report also shows us that customers who combine online and traditional banking are the most active: 45% invest in cryptocurrencies, 46% are sensitive to ecology and 43% consult their accounts daily.

A worldwide success

Finally, online banks are not only succeeding in Europe; indeed, they are attracting new customers from all over the world. In the United States, for instance, 8% of customers are exclusively use an online bank, and 38% combine online banking with traditional banking.

The goal of online banks: to go from being a secondary bank to a primary one

Expanding banking and product solutions

Some online banks are not backed by a physical network and cannot, therefore, allow the deposit of checks and cash. Not all of them offer the same guarantees to their users as traditional banks, and do not offer as many credits, loans and insurance products. As a result, only a third of customers currently use their online bank as their primary bank. Online banks, therefore, need to broaden their range of products and solutions to keep up with customer expectations.

Sustaining the business model

Another condition for online banks’ success is continuing to inspire confidence. For the time being, online banks rely on the transparency of their pricing information, while banks differentiate themselves by maintaining a high level of trust among their customers.

Online banks will also need to balance their business model by offering value-added services, as part of their revenue currently disappears in welcome offers and aggressive marketing to attract more customers. They can then continue to conquer new markets in France and abroad.

Some challenges still make online banks vulnerable

The cyberattack that targeted Revolut in September 2022 is just one recent example that shows how online banks are not yet ready to compete with traditional institutions, especially on cybersecurity issues. A quarter of consumers say they are willing to pay more to ensure the security of their data. They must also comply with regulations, innovate and strengthen data security.

Technological and strategic innovation

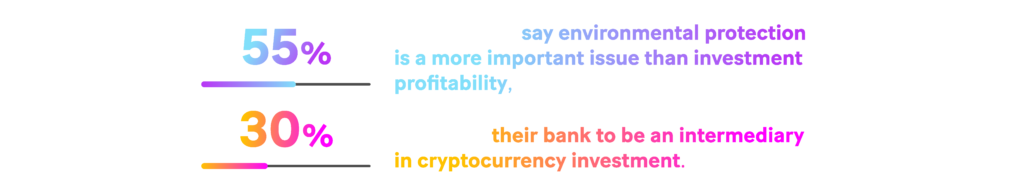

Online banks must take into account new customer concerns, such as environmental protection at a time when 55% of customers say it is a more important issue than investment profitability. The growing interest in cryptocurrencies also needs to find its place in online banks’ product offerings, as 30% of customers say they would like their bank to be an intermediary in cryptocurrency investing.

Online banks also need to address fraud and cybersecurity, and to be on the cutting edge in terms of open banking and open finance. If they want to gain market share and brand awareness, online banks will need to strengthen their synergies with various partners in the banking ecosystem, accelerate digitization, improve their risk management and establish strategies for cryptocurrencies.

Traditional banks, forced to react to consolidate their position

New offers

Some traditional brands have already launched their own online banking offers, such as Boursorama and Kapsul (two subsidiaries of the Société Générale group), Hellobank! (backed by BNP Paribas) and Fortuneo (Crédit Mutuel). These online banks allow traditional structures to respond to a changing market without jeopardizing their core organization. It also allows them to improve the customer experience and take advantage of the fluid status afforded to online banks, therefore encouraging innovation and the development of new services, while gaining market share.

Traditional banks reinventing themselves

Rather than seeing online banks as an existential threat, traditional banks should relish the challenge and see it as an opportunity to renew and enhance their approach. Traditional banks have already had to react and adapt to these newcomers, while completing and modernizing their solution and product offers. They now have to continue to observe the ever-changing nature of the sector, react accordingly, and in turn become more competitive to stay ahead as the sector’s leading banks.