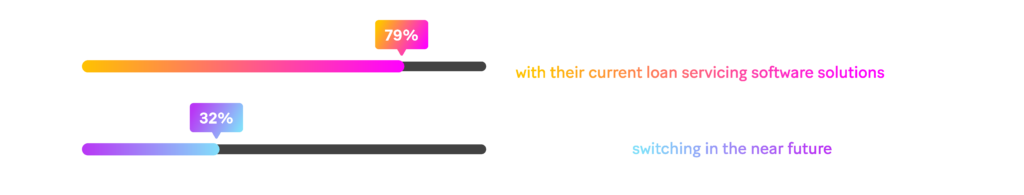

Given the importance of loan servicing operations, it’s surprising how many North American lenders are unhappy with their current software solutions. A study commissioned by Sopra Banking Software and undertaken by advisory firm Aite-Novarica Group found that the majority of US lenders with assets of more than $30 billion were either “dissatisfied” or “very dissatisfied” with their current loan servicing software solutions. Despite that overwhelming majority, just 32 percent were considering switching in the near future.

Behind that is an aversion to risk, a reluctance to change and a “better the devil you know” mentality, creating a vicious circle where incumbent software vendors are secure but underperforming. Breaking the cycle requires lenders to take the plunge and invest in a modern software lending platform that will enable transition to a digital business, support advanced collaboration and deliver market-leading customer experiences.

A strong system: the beating heart of a lender’s business model

Loan servicing operations could have a significant impact on the borrower experience, yet the sector tends to be an underappreciated part of the commercial lending ecosystem workaround. However, its importance shouldn’t be underestimated. Loan servicing isn’t easy: terms are often complex and errors can lead to borrower distrust and a damaged reputation for the lender.

To help loan servicing run smoothly, a robust system is essential, with vendor software an integral component. At Sopra Banking Software, the goal is to automate even the most complex loan management. Our flexible financing platform is:

- A single solution for managing the entire lending portfolio

- State-of-the-art, with a customizable industry-standard technology stack

- Digital-forward, with an extensive API library

- Cloud-ready, enabling operations to scale securely and globally

- A multi-currency powerhouse, with support for myriad products and structures

- Driven by a powerful rules engine that streamlines workflows and ensures compliance

Combined, these features improve efficiency, lower risk and costs, and speed up time to value, as well as advancing the lenders’ digital transformation journey. But archaic software solutions may lack some (if not all) of these attributes, causing frustration with these legacy systems’ ability to service loans with accuracy and scale. Compounding that is extensive customization, over-reliance on slow human processes and slow adaptation to changing market needs. Hence, a majority of lenders (79 percent) aren’t happy with their current software.

Risk aversion among lenders

But even though many North American commercial lenders feel irritated with the status quo, only a minority surveyed by Aite-Novarica Group are thinking about switching software solutions. Driving that is risk aversion in four areas:

- Operational. Lenders fear disruption to system uptime, procedures and reporting will impact the borrower experience and loan administration accuracy.

- Reputational. If the operational issues impairing service quality are severe enough, they may harm borrower perception, damaging the lender’s reputation.

- Credit. Concerns that a transition may unsettle loan servicing personnel, leading to issues such as missed credit red flags and lost collateral perfections.

- Financial. Changing software solutions may impact data quality and credit-reserving calculations, leading to inaccurate reserving and the potential for regulatory issues.

Posing an unpalatable amount of risk, lenders describe “a fear bordering on dread regarding a potential loan servicing transition.”

Reluctance to dismantle loan servicing ecosystem workarounds

Further fueling the resilience of incumbent software vendors are the robust ecosystem workarounds many commercial lenders have built to support their loan servicing systems. With vendor platforms often having gaps in capabilities, features and functionality – the reason lenders are dissatisfied in the first place – lenders develop an ecosystem of workarounds and complementary processes. These include internal custom code to compensate for a software’s shortcomings, and specialized human workflows for complex processes unsupported by the solution.

Entrenched over time from an operational perspective, lenders are reluctant to change software and give up the workarounds they’ve come to rely on. “We do this instead of just ripping the Band-Aid off,” said a surveyed lender.

Because the ecosystem workarounds become organizationally embedded in the lender’s loan servicing, the incumbent vendor lacks motivation to close the capabilities, features and functionality gap.

With little pressure to change because they know they’re safe, there’s an absence of innovation, with many software solutions simply papering over the cracks to meet changing market needs, rather than striving for excellence. A vicious circle ensues, with both lenders and software vendors lacking incentive to change.

Loan service excellence

For those willing to take a risk and switch software solutions, however, there’s a competitive edge to be gained. A compelling minority are breaking the mold: according to Aite-Novarica Group’s study, 32 percent of commercial lenders have achieved excellence, characterized by:

- Understanding the business case of transitioning to a modern, digitally driven software solution

- Willingness to spend across loan servicing operational teams

- Support from senior management regarding budget and a culture of excellence

- Continual customer feedback, with modifications to technology, procedures and training to improve the borrower experience.

A risk worth taking

Dissatisfaction with incumbent software is rife, yet few commercial lenders are willing to transition because of risk aversion and deeply entrenched compensatory practices. But with 64 percent of lenders facing end-of-life system decisions, the time is now to take a chance. There are tech-savvy companies out there offering game-changing, future-proofing solutions. Lenders willing to take the innovative leap will reap the benefits in the long run, and gain that all-important competitive edge. And those that don’t may well be left behind.

Find out more about how Sopra Banking Software can help you by visiting our Commercial Lending solutions page.