In the first installment of this series, we delved into the history of green finance and how financial institutions can benefit from being more eco-conscious. The second chapter took a global view of green finance, exploring the steps key players are taking to go green. Here, we explore the regulations and tools banks need to make sustainability targets a reality.

After the recent 26th UN climate change conference (COP26), it’s become increasingly clear that investment and financing will be key if world leaders are to reach sustainability goals, many of which were set in place during the 2015 Paris Agreement.

Indeed, during the summit, the EU launched a program worth 1 billion euros to finance breakthrough climate innovation; the UK government announced that financial institutions accounting for 40 percent of the world’s capital have signed up to 2050 net-zero goals; and 1.7 billion dollars was promised to support the conservation of indigenous forests and land; and that’s just to name a few.

If these goals are to be successful, financial institutions (including banks) will play a vital role, providing the funding to make these objectives possible. In order to do so, though, these organizations require significant short-term investment in commercial lending software, APIs and open banking solutions.

Unlocking a new economy

It’s clear that banks are increasingly committing to financing projects that empower the green economy. By example, 2021 is set to be the first year in history where green bonds and loans from the banking industry exceed the value of equivalent financing in fossil fuel-related projects, per Bloomberg.

Despite this significant shift, however, many banks and financial institutions still struggle to measure climate risk. A study by CDP revealed only 25 percent of 330 surveyed financial institutions report their financed emissions, with 49 percent failing to conduct any climate-related analysis at all.

For that 25 percent, reported financed emissions are over 700 times larger than reported operational emissions. Yet many institutions focus on the latter rather than the former.

There’s also climate-aligned finance to consider. To facilitate that, financial institutions are committing to aligning their portfolios with the 17 sustainable development goals (SDGs), which were agreed upon and adopted by all United Nations Member States in 2015. This is evidenced by the launch of the UN’s Net-Zero Banking Alliance in April 2021.

Meanwhile, UK Chancellor Rishi Sunak outlined plans to make Britain a net-zero financial center (although commitments aren’t mandatory). But despite these examples of progress, there’s still a way to go for many banks.

Encouraging institutions to shift finance towards the SDGs, the OECD lays out a three-step approach:

- Mobilization of financial institutions, including resources such as multilateral development banks and development financial institutions

- Alignment of finance and investment towards sustainable development

- Impact people’s lives – economically, socially and environmentally – to a greater degree

For that approach to work, action is required on three levels: coherent policies, harmonized standards and effective financial tools.

Assessing externalities fairly

From a regulatory perspective, governments are working on a set of standards regarding sustainable activities. That requires a common language and clear definitions, helping banks align, reach global targets, evaluate externalities impartially and halt on “greenwashing.”

These agreed rules are important from a business perspective too, creating a level playing field across banks and limiting the option to finance projects in countries with lax or zero regulations. What’s more, standardardized policies will reduce the possibility of projects being penalized because of stricter regulations.

European Union

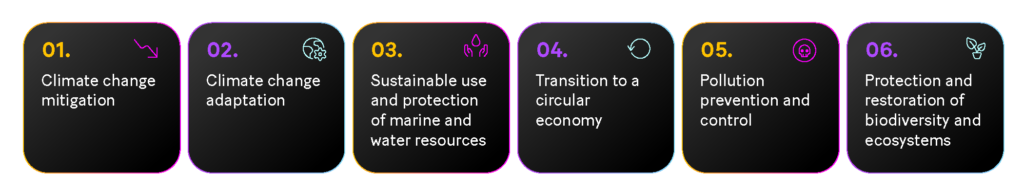

The EU’s action plan involves a host of regulations, marking an important move away from pledges to legal frameworks. Alongside the European Green Deal Investment Plan and the European Green Bond Standard, a classification tool has been developed, outlining environmentally sustainable economic activities. As part of that, the Taxonomy Regulation was enacted in July 2020, establishing six goals:

- Climate change mitigation

- Climate change adaptation

- Sustainable use and protection of marine and water resources

- Transition to a circular economy

- Pollution prevention and control

- Protection and restoration of biodiversity and ecosystems

Furthermore, the regulation sets out four conditions an economic activity must meet to qualify as Taxonomy-aligned:

- Substantial contribution to at least one environmental target

- No significant harm to other environmental objectives

- Satisfying minimum social safeguards

- Compliance with technical screening criteria

Developments are ongoing, with April 2021 seeing the approval in principle of a delegated act on sustainable activities for goals one and two above. A second delegated act for the remaining objectives is expected in 2022.

This ambitious approach has raised many questions, not least the treatment of nuclear power. Originally excluded from the list of sustainable economic activities, the decision has since been made to add nuclear energy in a complementary Delegated Act of the EU Taxonomy Regulation, with calls for that to come into effect by the end of 2021.

Rest of the world

The EU is at the forefront of sustainable finance regulations, but other countries are making headway. For example, the UK Government has put together a working group – The Green Technical Advisory Group (GTAG) – to help create a taxonomy. Meanwhile, the Financial Conduct Authority (FCA) has an environmental, social, and governance (ESG) strategy based on five themes: transparency, trust, tools, transition and team.

Over in the USA, the Corporate Governance Improvement and Investor Protection Act was narrowly passed by the House of Representatives in June 2021. Contained within that are the ESG Disclosure Simplification Act and the Climate Risk Disclosure Act, requiring security issuers to disclose certain sustainability-related metrics annually.

Asia-Pacific (APAC) markets are also following suit, with initiatives in Japan, Singapore, Malaysia, Thailand, Vietnam, the Philippines and Hong Kong.

The need for effective commercial lending software

As well as policies and externalities, reporting obligations associated with green finance regulations are a further consideration for banks and financial institutions. With ever-changing regulations and reporting data differing by asset type and country, organizations will need a strong, robust and agile project finance software for supporting varying requirements, as well as adapting to regulations as they advance and develop over time.

There’s also the question of measuring externalities and environmental progress throughout the lifecycle of projects. Organizations setting their sights on green-friendly financing strategies will not only need a software that carries out primary project finance processes, but one that will measure the environmental progress and impact of said strategies.

Because the landscape is evolving and will continue to do so, the best way to achieve that is via APIs and open banking solutions. As an example, Paris Agreement Capital Transitions Assessment (PACTA) for Banks is an open source tool used by BNP Paribas and other international banks, enabling them to measure how aligned their financial portfolios are with climate scenarios.

Again, by having agile software that they can plug into these open sources, banks and financial institutions can better measure how aligned their financial portfolios are against their green-friendly financing initiatives.

Managing the moving pieces

Investment and environmental goals aren’t mutually exclusive. To accomplish both, banks play a pivotal role, providing funds for SDG projects and assessing externalities. If they’re to fulfill these crucial duties effectively, financial institutions must become more climate-aligned.

Well-defined regulations and standardized reporting procedures come into play to facilitate that. At the same time, effective commercial software, APIs and open banking solutions bring the moving puzzle pieces together, integrating them seamlessly.