This article includes data and research taken from a 2021 Gartner study Banking Market Emerging Trends 2021-2025

The impact of COVID-19 on the global banking industry has been substantial, but while banking may have struggled compared to many other industries, the pandemic has been a performance catalyst for much-needed change – with digital experience racing to the top of organizational priorities.

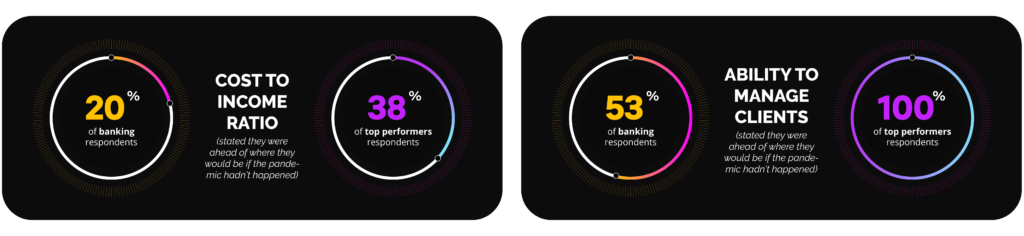

According to a recent Gartner report, the banking industry as a whole lagged behind top performers in commercial business in key metrics, including cost to income ratio (20 percent of banking respondents stated they were ahead of where they would be if the pandemic hadn’t happened, compared to 38 percent of top performers) and the ability to manage clients (53 percent of banking, compared to 100 percent of top performers).

Banks in the Middle East and North Africa (MENA) region, in particular, have struggled with digitization, during and before the current pandemic, as discussed in our recent white paper. However, the MENA banking industry is evolving, and we’re seeing a surge in digital banking products and services.

Despite these challenges, now could be the perfect time for banks in the MENA region to prepare for a post-COVID world, and to seize the opportunity.

The rise of digital maturity

Research shows banking is on the threshold of “digital adulthood,” with Gartner predicting the number of businesses describing themselves as digitally maturing to have risen above 50 percent by 2022. Pandemic-driven changes in customer engagement and client management are expected to increase into 2021 and beyond, with factors including the use of digital channels to reach customers, self-service functionality, demand for new digital products and the degree of customer engagement all on the rise. According to Salesforce research, the pandemic has vastly elevated customers’ expectations of businesses’ digital offerings, with 88 percent expecting an acceleration of digital initiatives post-COVID.

Indeed, cutting-edge technology seems to be at the heart of digital transformation for banks, with nearly 60 percent of the Gartner report respondents mentioning artificial intelligence, data analytics or cloud as the most influential tech going forward. For artificial intelligence, the three biggest opportunities areas within financial services are transactional data, client interactions and segmentation.

Adjusting focus areas

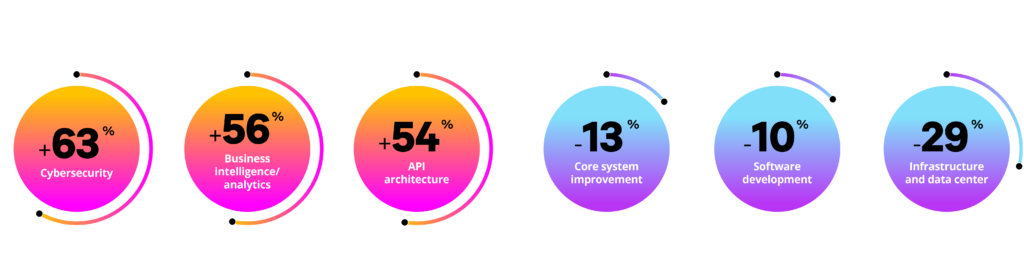

With new opportunities and challenges having arisen from the pandemic, it’s no wonder that priorities are changing. Gartner asked respondents where projected spending had changed in 2021 compared with 2020, and the results are interesting.

Increases

• Cybersecurity, 63 percent

• Business intelligence/analytics 56 percent

• API architecture, 54 percent

Decreases

• Core system improvement, 13 percent

• Software development, 10 percent

• Infrastructure and data center, 29 percent

With more of a focus on innovative technology advancements than on basic functionality, it’s apparent that digital transformation will be at the heart of improved CX in the banking industry.

COVID-19 and the future of the MENA banking sector

Since the fall of oil prices following the COVID-19 outbreak, the market and banking sector in MENA haven’t fully recovered. Currently, the picture in MENA is uncertain, with the region caught up in a huge amount of economic turmoil. Even before the pandemic, the region was in a low growth environment with high expected credit loss.

We see the same global trends, the need for valuable digital experience, playing out in MENA. The question is, does its banking industry and infrastructure have what’s needed to support digital transformation?

The pandemic revealed that many incumbent banks in the region don’t have a digital framework or skeleton that’s ready for 21st-century digital banking or remote work. While this is certainly changing, there’s still considerable ground to cover.

Could a flourishing fintech ecosystem be key?

Despite the potentially lacking infrastructure, the MENA region has consistently seen a surge in the use of fintech and related technologies during the pandemic. With an increasing local focus on fostering a cashless economy, the potential for even further fintech growth is promising.

For existing financial institutions, the economic conditions in MENA are certainly challenging, with an urgent need to expand their digital capabilities and update systems to cope with higher velocity and an increased number and frequency of transactions. Banks in MENA are also exploring new distribution channels through cross-industry collaboration and cooperating with other non-bank companies like technology startups, telecom companies or even retailers. The Commercial Bank of Kuwait (CBK) collaborated with telecom company Zain to drive its plans for digital transformation, and the Union of Arab Banks (UAB) is working with Codebase Technologies along similar lines, for example.

Open banking, AI, and the importance of digitization

The importance of digital experience to future competitiveness in the MENA banking industry can’t be underestimated. Take open banking, for example. While the region as a whole has been slow to pass open banking regulations, one country, Bahrain, is speeding ahead. All retail banks there had to comply within six months of regulations being passed, a record amount of time compared with many other markets that still don’t have all banks in compliance.

The application of artificial intelligence (AI) is also an area the MENA is embracing, with the IDC reporting a 2019 spend of $12.68 billion on technology, including AI. Any kind of automation, like AI, is crucial in meeting customers’ increased expectations in the wake of global crises, while continuing to thrive and grow as an industry.

While there may have been question marks hanging over the future of the MENA banking industry since even before COVID-19, its willingness to adopt of digital products and artificial intelligence to improve client interaction demonstrates the same potential for growth we’re seeing across the globe.