In recent years, the technology needs of banks have skyrocketed – staffing shortages, increased customer expectations, further competition from fintechs and ongoing effects brought on by COVID-19 have all created a real need for banks to step up and equip themselves with the latest digital technologies.

Despite a rather large influx in investment, retail banks are still failing to create meaningful change and development within their organization, but why is this the case? A recent study by Gartner investigated this topic in depth, surveying 847 senior leaders within the banking and investment services and insurance industry, across the US, Australia, Canada, India, the UK, Malaysia and Singapore.

While there is no denying that technological investment is needed to help equip banks with the proper tools to face future needs and challenges head on, not all digital initiatives should hold the same level of priority. It’s important for organizations to benchmark their technology investments, assess their digital business goals, and understand their most pressing needs.

Why do banks need to invest in new technologies?

As it stands, many retail banks have legacy systems in place that can no longer be scaled or updated in the manner needed to support their organizational requirements. Due to this, 52% of technology decision makers within retail banking have indicated that large-scale investments to either replace or upgrade these current systems are planned. What’s more, with the online retailer market growing at record speed, many banks are realizing their current technological capabilities are not sufficient enough to meet the needs of online retailers and shoppers alike, and require extensive changes to remain usable.

Retail banking organizations and the financial services sector are aligned when it comes to their top four technology-led priorities. These are: developing new products and services or improving existing ones to meet changing needs, improving operational agility, speed to market and the customer experience, as well as risk management and regulatory compliance.

In regard to digital banking platforms, 41% of respondents from Gartner’s study indicated that they planned to upgrade technology, while 19% believed they would have to replace it entirely. Similar figures were found across a range of digital technologies. For example, in terms of mobile and digital payment solutions, 41% indicated they would be upgrading the technology, while 15% believed they would have to replace it entirely.

Which digital technologies are banks currently interested in?

When it comes to retail banking-specific technologies, all eyes are on artificial intelligence (AI) and the cloud. It’s no surprise that within mobile digital payment systems, roughly half of all executives are expecting to increase spending by up to 7%, with about 25% believing their technological investment spending will increase by more than 7%. As it stands, a considerable number of resources have been invested in developing these digital capabilities, especially for cloud, digital process automation, and the Internet of Things (IoT) technologies.

51% of decision makers within retail banking specified that cloud technologies for both the public and private sectors have been invested in or are already deployed, while 29% have indicated they will be rolled out within the next 12 months. Respectively, 45% of decision makers indicated that they have already deployed technologies for digital process automation (RPA, Low Code/ No Code, BPM), while 30% plan to release them in the short term (within 12 months); finally, 43% have indicated that IOT investment has already taken shape with another 30% admitting to actively experimenting with IOT technologies.

Challenges banks face when implementing new technologies

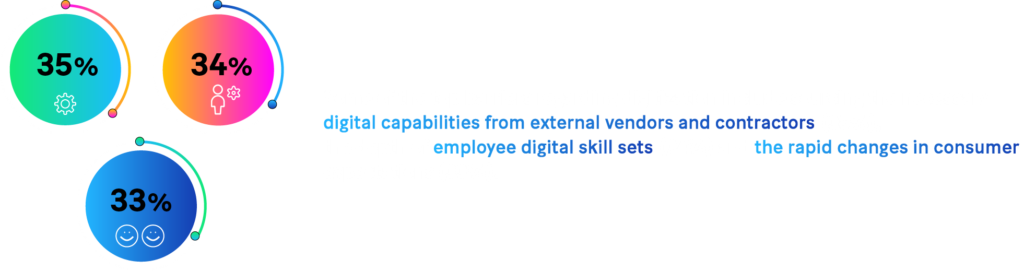

Retail banking organizations face numerous challenges when implementing technology-led initiatives. Some of the top barriers regarding digitization include sourcing the necessary digital capabilities from external vendors and contractors (35%), the depth of employee digital skill sets (34%) and the rapid changes in consumer expectations (33%).

These barriers differ drastically from those experienced by the financial services sector, which are predominantly internal, relating to a shortage of necessary staff skills and a lack of business alignment.

Furthermore, retail banking organizations are facing a moving goalpost – with consumer preferences constantly changing, and at record speeds, such initiatives may have to be consistently re-defined. This is exhausting in terms of both the time and resources needed.

Further challenges are related to the actual investment required – the necessary changes needed to push banks into a strong future position are deep and extensive, which means they require a large amount of funding in terms of both manpower and money. Huge core system overhauls and cutting-edge technological investments are incredibly costly. For smaller banks, this may not be feasible.

How successful are retail banking initiatives?

Per the Gartner study, 74% of technology decision makers within the retail banking sector expect to see an ROI on digital business initiatives within three years from initiation; only 12% expect to see a ROI within one year.

Ironically, retail banks are actually the most successful with initiatives they believe to be the least critical to their business. This can range from cost optimization to business model transformation and employee experience. The top three initiatives where banking retailers’ established goals have been exceeded include the employee experience, business model transformation, as well as cost optimization and improving the customer experience. However, these three initiatives are consistently indicated as the lowest priority by such organizations. What is clear is that banks are succeeding, just not where they necessarily intended.

Recommendations for retail banks to make the most of their investment

One of the problems that retail banking leaders can face is, of course, the constant wave of new trends, especially when it comes to digital technology. Knowing which trends to take seriously and which to be cautious of is easier said than done. As an example, a recent Forrester report entitled “Blockchain Has Not Reshaped Core Banking” highlighted that despite its lofty expectations, blockchain technology has not become the foundation of blockchain technology, and it is unlikely to do so anytime soon.

To avoid simply chasing down the latest trends, but also not being left behind, it’s important for retail banking leaders to first identify their top digital business priorities, and afterwards the technologies that can best support these. In this way, time and monetary resources are used in the most efficient way possible. This involves the liaising of internal stakeholders to understand whether it’s best to build, partner or buy these new technologies. Involving internal stakeholders in the early stages also prevents one of the largest barriers, which involves the need for management to support the necessary changes. For example, when it comes to artificial intelligence (AI) and analytics, 42% of survey respondents indicated that they prefer to build this technology in-house, in contrast to technologies pertaining to APIs, microservices and the Internet of things (IoT), in which 41% indicated that they would prefer to buy them.

It’s advisable for retail banks to furthermore take a look at what competitors are doing — how much are they spending on new technology initiatives and in which areas are they investing, i.e., business vs. consumer needs? How does this apply to their own organizational needs?

At this stage, retail banks don’t have a choice— if they fail to implement new digital technologies, they will fall by the wayside, allowing more adaptable fintechs to gain a larger market share. While there is no doubt that technology opens doors to an entirely new world of possibilities and innovative experiences, it’s up to retail banks to understand which technological initiatives will benefit them the most. With the right preparation, they will be able to make the best digital investments to meet their future goals.