Agility is business critical. From the way people work, through supply-chain management, collaboration and technology, a lean, agile methodology is increasingly crucial. And as we emerge into a post-pandemic “new normal,” speed, flexibility, innovation, and the quality of execution and service will become increasingly important.

At the heart of this change will be a more effective business model – one that embraces collaboration without stifling innovation, a fresh approach to digitization can help organizations to grow together, meeting challenges and opportunities in a symbiotic way that works for all contributors.

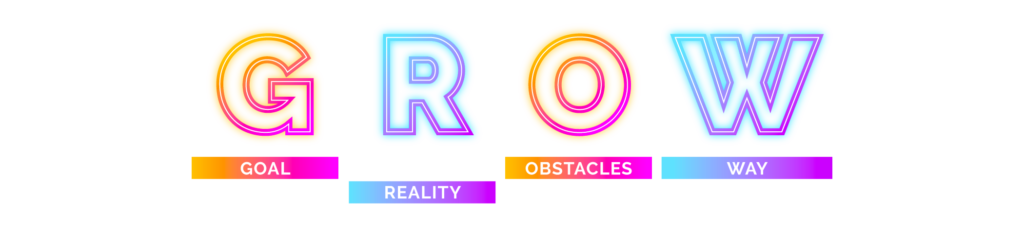

That business model is GROW.

A collaborative approach

The GROW coaching model was originally developed in the 1980s, as a way for individuals or organizations to clearly map out a plan from conception to completion, identifying potential obstacles along the way. Its appeal lies in its simplicity, and for us at Sopra Banking Software, it’s a model entirely applicable to collaboration.

In recent years, there have been several models and solutions touted as the key to collaboration. Operational and human resource costs drove outsourcing; alliances saw heavyweight formal relationships; and technology swapping, joint projects and equity stakes were all used to have a greater say in a partner’s innovation projects.

However, these solutions often fall short when it comes to agility and innovation – two key facets in the current digital landscape. GROW, on the other hand, encourages both agile and innovative practices. It allows organizations to grow together in a process where collaboration is part of the value chain, keyed into the planning and wider journey.

By working together with partners in our industry, we can better understand the market’s needs, moving with speed, and changing accordingly to best meet our customers’ expectations.

GROW as a software driver

Historically, the technology selection has often been a “Big Ticket” decision, where creating a “lite” product would risk leaving our partners exposed in the event of rapid change. Indeed, we have seen during the Covid-19 pandemic the potential risks of such an approach.

At Sopra Banking, we’ve used the GROW model to de-risk that. By developing our inventory management software as an enterprise solution, we have given ourselves a new level of flexibility. We can scale our software to grow with small emerging players in, for example, the electric motorcycle market and continue to support OEMs globally.

Central to this new operating approach is the creation of a collaborative, mutually beneficial relationship, where we can adapt with speed to the evolving landscape. And because our enterprise software is component driven, it means we can seamlessly scale our software’s capabilities to needs as they arise.

This has never been more apparent than now, during these challenging times. In order to reach the levels of scalability, innovation and agility demanded by today’s market, especially in the technology sector, organizations need to collaborate. And a model like GROW allows them to do that.

By coming to terms with, and sometimes challenging, Goals and understanding the current Reality, we can tailor our digital toolkit to optimize inventory management, but we always aim to be looking ahead to assess the Options for acceleration forward. The final part of this model is the Will. By working together closely, we ensure we can change when it is right for our clients. We have their backs and are ready and able to co-create value.