The last decade saw the rise of challenger banks – digital-first newcomers who leveraged technology to transform modern-day banking. And while some early observers may have questioned these industry entrants’ ability to take on traditional banks, such skepticism has since largely been assuaged, with the challenger banking sector set to grow at a CAGR of 48.1 percent from 2020 to 2027.

Given this meteoric rise, you could be led to believe that challenger banks have found a way to profit from the results of the pandemic, especially considering the adverse effect Covid-19 has had on legacy retail banks.

However, the truth is certainly less clear cut. While there are plenty of success stories among challenger banks – including how some leveraged their digital nous to excel in lockdown conditions – there are also signs of struggle and increasingly difficult times ahead.

Investment landscape

Despite the current economic uncertainty, there has been a wave of new challenger bank launches fueled by venture capital. Clearly, many investors are still willing to bet on the future of challenger banks, even in these difficult times.

At a glance, many of these startups’ offerings are recognizable: no-fee accounts, early access to wages, automated saving and credit-building tools. However, many of them intend to distinguish themselves by catering to niche customers — a bid to create a new style of a community bank, one based on affinity, not location.

The growing number of fintech players shows that the challenger bank is very much alive, but it doesn’t necessarily mean they are well. Some of these new competitors are likely destined to die on the vine. Specialization doesn’t guarantee survival, but this investment trend does signal confidence in challenger banks delivering in the long term.

The pandemic as an accelerator

Furthermore, we can point to examples of already-established challenger banks that are performing stronger than ever during the pandemic. According to one study, over 12 million US consumers are now utilizing Chime’s online-only banking services. During 2020, Chime’s early paycheck, early stimulus payments and no-overdraft fee features were extremely popular. Fintechs that cater to ecommerce have also been notable winners, with Checkout.com recently becoming Europe’s top unicorn after tripling its valuation.

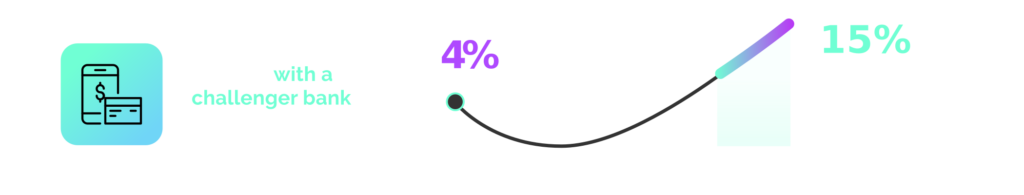

For some people (especially younger generations), getting a better offer from a challenger bank is worth the hassle and uncertainty of switching bank providers. A recent article by Forbes put numbers to this trend: “in January 2020, just 4% of US Gen Zers and Millennials considered a checking account from a challenger bank their primary account. By December 2020, that percentage had grown to 15%.” This is notable because, for many years, challenger banks were viewed as secondary or add-on accounts — fun to use with extra cash on the weekends but not trustworthy enough to deposit a paycheck.

Clearly, the digital requirements brought about by the pandemic have played into the hands of many challenger banks, who are enjoying a fresh wave of customers hungry for innovative financial products and services.

The economic downturn

Despite this, many challenger banks have been unable to avoid the wider financial situation. The global economy is set to shrink by 4.4 percent this year — the biggest contraction since the 1930s. In many countries, long-term unemployment rates have spiked, and people are fearful about their finances, driving an increase in risk-averse behavior. This tendency has seen some challenger banks’ growth rate slow. Particularly, some consumer-centric challenger banks have struggled. Indeed, abandoned product launches and revenue decline were commonplace in 2020. And to take one example, Monzo was even forced into significant layoffs.

The issue is that the business models of some fintechs are not well-positioned for such a crisis. For instance, firms like Starling and Revolut rely on card transactions to generate revenue. And the global lockdown has brought many use cases for cards — dining out and traveling, for example — to a grinding halt, subsequently affecting these companies’ momentum.

The issue of trust

Meanwhile, challenger banks in general are still struggling to overcome a perceived trust problem. Conventional wisdom says that the big banks are too big to fail, so customers feel safe with them.

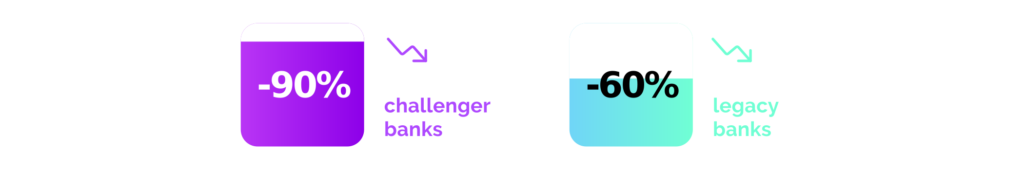

Indeed, recent reports in the UK, for instance, suggest that traditional banks are still used for four out of five purchases. And according to the same report, at the start of lockdown, the use of challenger banks fell “by around 90%, compared to just 60% for traditional ones.” In this crisis, people are largely battening down the hatches and using their existing accounts rather than experimenting with new services.

Even in good times, consumers are somewhat reticent to change banks, and as one survey illustrates, they are even less inclined to do so during a pandemic. With regards to their money, people want safety, predictability and security, and at the moment, many are finding this with legacy banks.

Looking ahead

The pandemic has forced more people than ever to start using digital banking applications. In the last year, these customers have grown accustomed to the convenience of digital banking, and they’re unlikely to look back. Arguably, this is bullish for the future of tech-oriented challenger banks, but if the pandemic taught us anything, it’s that their path is far from guaranteed.

Challenger banks have experienced vastly different fortunes in the last year based on variables like geography, positioning and customer focus. Going forward, some will go all-in on what’s working. Others will scramble to find a way to adapt, build customer trust and find new revenue sources.

As we look to the future, it’s clear that now is a pivotal time for both traditional institutions and new fintech players. The pace of innovation is quickening, and more nontraditional competitors are entering the space. The next decade will be a battle of efficiencies for acquisition and market share. And clear winners are starting to emerge among both challengers and incumbents, adding pressure to an increasingly crowded field of players.