How can a bank’s compliance department work with other financial institutions, governing bodies and technology partners to improve efficiency and measurability in the fight against financial crime? At last year’s Sopra Banking Summit, our subject matter experts discussed that in detail. Below, we explore the efficiency aspect further.

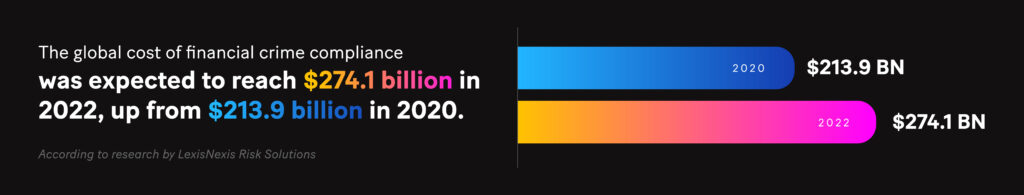

Financial crime poses one of the greatest systemic risks to the world economy. According to research by LexisNexis Risk Solutions, the global cost of financial crime compliance was expected to reach $274.1 billion in 2022, up from $213.9 billion in 2020.

Banks and their ecosystems are an integral part of preventing and detecting violations. With that in mind, the anti-money laundering (AML) and counter-terrorism financing (CTF) strategies of financial institutions must take priority. Implementing them involves working with external partners to capitalize on new technologies, data sharing and risk prioritization.

It’s about taking a sustainable approach that goes beyond regulatory requirements and focuses on efficiency.

Evolving anti-financial crime regulations

To tackle illicit financial flows, the European Commission (EC) created an AML/CTF Action Plan in 2020, highlighting six focus areas:

- Effective and harmonized application of existing rules

- Developing a single EU rulebook

- Creating an EU-level supervisory system

- Developing a cooperation and support mechanism for financial intelligence units (FIUs)

- Better use of EU-wide information to enforce criminal law

- Striving for a stronger EU in the world.

In July 2021, the EC outlined an ambitious set of measures to bolster the European Union’s (EU’s) existing AML/CTF rules and drive the Action Plan forward. The package included the following:

- Proposal to create a new body to target money laundering – EU AML Authority (AMLA)

- Regulation containing directly-applicable rules across customer due diligence and beneficial ownership

- Sixth Directive (AMLD6) to replace Directive 2015/849/EU, clarifying the powers of national supervisors and FIUs

- Revision of the 2015 regulation on Transfers of Funds, meaning crypto asset service providers fall under EU rules.

Financial Action Task Force Recommendations

In 2012, the Financial Action Task Force (FATF) published a “comprehensive and consistent framework of measures” to help combat money laundering and terrorist financing. The recommendations are regularly updated, offering international guidance on areas such as:

- Applying a risk-based approach

- National cooperation and coordination

- Financial institutions’ secrecy laws.

The FATF evaluates how well members implement their standards. Their methodology for assessing compliance with the recommendations and AML/CTF systems focuses on two pillars: effectiveness and technical requirements, with emphasis on the former.

When the FATF audited Germany in 2022, the results were disheartening: “There’s no clear policy or strategy for disrupting and sanctioning money laundering in a consistent and comprehensive manner.”

Strengthening the efficiency of financial crime compliance

To improve that situation, financial institutions across Germany and other European countries should share more crime and terrorism-related information, prioritize risk more effectively, and harness the power of technology and innovation.

Financial Intelligence

Mitigating and preventing financial crime improves when banks share data domestically and internationally. However, an intelligence-led approach is hampered by inconsistent data protection frameworks, the mismanagement of suspicious activity report (SAR) information and the secrecy of banks.

For example, financial institutions tend to adopt a defensive SAR stance, leading to a high volume of low-value reports and consumption of valuable resources that are better placed elsewhere. Moreover, an underdeveloped system of data sharing and cooperation between public and private sectors and cross-border means banks don’t necessarily know which SARs are a priority to FIUs.

To overcome these issues, banks, governments and FIUs should consider the following:

- Enriched SAR analysis by FIUs. Use this to set national financial crime priorities, helping FIs focus their compliance efforts

- More streamlined and automated SAR obligations. Reporters send high-level notifications of suspicion, with FIUs requesting additional information if the data is of interest

- Implement efficiency-inducing data utility models. These bring together siloed datasets via information-sharing utilities, applicable public-to-private and private-to-private. For instance, the Nordic region agreed on a “know your customer” utility approach via the Invidem platform

- Further development of public-private partnerships (PPP). Collaboration between financial institutions, law enforcement, policymakers and regulators is already in place to varying degrees, but more can be done by embedding PPPs within policy architecture and increasing information-sharing

- Ensure compatibility between AML/CFT, data protection and secrecy rules. This facilitates greater information-sharing between relevant parties, helping achieve compliance goals.

Risk prioritization

When countries establish national AML/CTF priorities, banks can shift from concentrating primarily on regulatory compliance toward a more risk-based, outcomes-focused approach to financial crime. Some nations are already firmly on that path: FinCEN – the USA’s Financial Intelligence Unit – published a priorities statement in 2021.

To identify, evaluate and mitigate risks associated with national priorities, financial institutions should adjust their risk assessment processes accordingly and refocus resources on high-risk clients and activities.

Technology and innovation

The widening sophistication of financial crimes requires greater use of cutting-edge solutions to deal with them. Adopting technologies like machine learning, natural language processing and advanced analytics in the right ways enhances efficiency by introducing reliable and flexible workflows to complex compliance tasks.

For example, an analytics solution applied by Bangkok Bank resulted in a 26% increase in suspicious cases investigated and a 40% rise in submissions of proven fraud cases for criminal prosecution. Moreover, PwC observed that “properly deployed technology” can lower compliance costs by between 30 and 50%.

A sustainable and efficient approach

Anti-financial crime regulations are evolving; to keep pace, financial institutions must adapt their approach to compliance. But it’s about way more than meeting rules and regulations.

Effective financial crime compliance needs a risk-based strategy that drives efficiency forward. It also involves an ecosystem of support via third-party technology partners, cross-border communication and intra-bank cooperation.

To watch the full on-demand video from our 2022 Sopra Banking Summit, please click here. For more expert content on industry outlooks and innovation, subscribe to our newsletter or visit our Insights page.