Over the past decade, many initiatives have been undertaken on the African continent to promote financial inclusion. Regardless of the type of specialized financial institutions – microfinance, meso-finance, payment institutions, telecom operators or even traditional banks – there is a desire to increase banking access for certain socio-professional groups. These groups include women, young workers and students, as well as people living in rural areas far from large cities and, consequently, from the network of sales outlets or physical bank branches.

However, despite significant investment, the unbanked population on the continent still numbers in the millions, even though the average penetration rate of banking services has increased from 5.7 percent to 15.7 percent in ten years. By way of comparison, in Tunisia, the rate is 60 percent, in Morocco 45 percent and in France 99 percent.

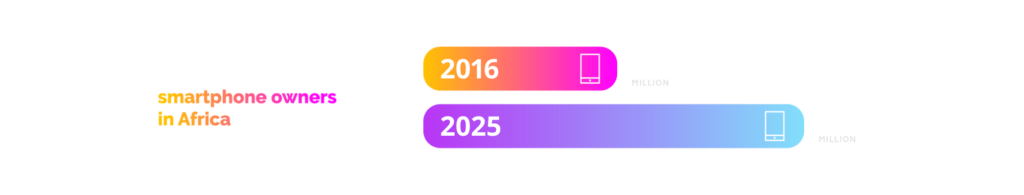

Most countries have initiated concrete actions to accelerate financial inclusion on the continent, supported by global organizations, such as the World Bank. These actions include providing access to basic financial services for all – such as accounts, payments and savings – as well as granting financing with real-time decision-making processes. This movement now seems inevitable, especially since it has been facilitated by the digitization of financial services, now accessible via mobile. Moreover, the number of smartphone owners in Africa is on the rise. As of 2016, there were 336 million. In sub-Saharan Africa alone, this number is set to rise to 678 million by the end of 2025, demonstrating the African population’s progressive and not insignificant attraction to digital technology.

These initiatives imply a massive movement of a new generation of bank users over a relatively short period of time (three to four years). This observation raises concerns about how banks will react to this wave of new customers and poses a simple question: are they ready to manage the situation?

Responding to demand

If financial institutions want to succeed in this challenge, they must now assess their capacity to handle the needs of several million new customers, such as enrollment, complaints, information requests, financing requests, advice, and product and/or service subscriptions.

They must be able to:

- Provide customers with high-quality services adapted to their real-life needs

- Participate in and contribute to the financial education of newly banked young people, who are, for the most part, used to handling cash exclusively via informal channels

- Establish and maintain a relationship of trust between the customer and their bank

In addition to meeting the digital demands of the next wave of banked retail customers, financial institutions must also anticipate the demands of professionals through adapted products and services, as well as various digital offerings. Given that most banks today are set up for handling retail business, several questions are emerging in light of this fundamental shift toward digital when it comes to financial services and practices for mass customers. A purely human response will no longer be sufficient to meet all needs.

- Will banks be able to adapt their current organizational structures, which are still largely based on human resources, to meet the influx of new bank customers?

- Will banks have the human and financial resources to make such an investment (recruitment, training and skills upgrading, equipment for new recruits, etc.) in such a short timeframe?

- Finally, will banks be able to absorb the growing administrative burden imposed by regulators to respond to the constant stream of requests from the ever-increasing number of new clients and to avoid penalties for compliance management failures?

These questions demonstrate that only planning for a human response will not address the various issues described above. Banks will inevitably have to equip themselves with digital solutions and technologies, not only to manage the volume of customer interactions but also to respond to real market demands.

Digital solutions

Today, there are multiple digital solutions available to banks to improve their offerings and ensure a high-quality customer experience. Among the most well-known, we could mention:

- Artificial intelligence (AI): manages decision making related to credit applications. It is based on a highly industrialized scoring mechanism that controls risk while offering a real-time service

- Machine learning: feeds a knowledge base and compiles volumes of data from different sources. This data will be used to analyze customer behavior and to implement automated decisions

- Chatbot: provides assistance and advice 24/7 to people living in areas far from physical branch networks

- Biometrics: establishes a relationship of trust between the bank and its new customers by guaranteeing the security and protection of their data

- EDM/electronic (paperless) document management: manages the storage and automated control of documents and credentials (national identity card, proof of address, etc.) required for compliance by regulators. Electronic documents – such as payslips and salary receipts – are also necessary to access financial services

- APIs: offers “omnichannel” end-to-end digital solutions that link mobile applications and legacy systems (or CBS) in order to meet the challenges of automation, thereby reducing banks’ Total Cost of Ownership (TCO)

- Mobile first: initiates and provides a complete “mobile-first” customer experience in the relationship between the bank and its new customers, who in most cases will only use a smartphone to manage their relationship with the financial institution

- BPM: designs process-centric solutions to ensure the definition and evolution of the bank’s processes; provides tools for managing and monitoring the workflows of these processes; meets the needs of management and agility; provides solutions for time-to-market issues; and, finally, enables the bank to be competitive

While ten years ago the widespread use of technology did not seem essential to developing a relationship between the bank and its customers, it has now become a necessity in Africa as elsewhere. Banks can no longer afford to ignore the tools that their competitors are already using at the risk of losing the upper hand in their own field. In the booming sector that is the African continent, financial inclusion will soon become the greatest challenge, requiring banks to successfully transition to digital without jeopardizing their relationship with their customers.