The financial services sector is rapidly evolving, resulting in traditional banks facing multiple challenges to meeting customer needs and adapting to market changes.

One solution worth considering is composable banking – an agile, flexible, and cost-effective approach that enables financial institutions to seamlessly propose and update business services in a fully adapted IT solution.

Composable banking empowers banks to add value for customers and scale back their IT costs. At the same time, it can also create new business models and simplify IT landscapes at a speed and scale previously impossible with legacy IT infrastructure.

Composable banking: a definition

Composable banking is a new approach that allows financial institutions to break down their services into smaller, independent components that can be easily combined with other business modules to create custom banking solutions.

This approach makes it easier to create new products and services and to adapt to changing market conditions and customer needs.

With composable banking, financial institutions can quickly and easily create new offerings without extensive development or IT resources. This can lead to increased innovation, agility, and scalability and help financial institutions stay ahead of the competition.

The creation and evolution of composable banking

The concept of making banking solutions “composable” is not a new one. Financial institutions have been working on standardizing and future-proofing their information systems architecture since the early 1990s. These include a business capability and service model, a global banking data model, and an application architecture model.

However, since the outbreak of the COVID-19 pandemic in 2020, digital banking has rapidly accelerated, and various new use cases for banking services have emerged. As a result, there has been a growing interest in composable banking, and the financial services sector is being urged to take the composable banking issue seriously.

Despite still being in its infancy, the evolution of composable banking is becoming increasingly critical due to global macroeconomic and geopolitical uncertainties, competition from non-banking players, and financial and regulartory risks.

From an IT point of view, banks’ existing legacy systems are no longer suitable, as they are too slow and costly to upgrade.

What should financial institutions consider when adopting composable banking?

Some experts have compared traditional banking systems to jigsaw puzzles, but unfortunately, the pieces cannot be rearranged or replaced. This lack of flexibility and agility can hinder banks’ ability to make necessary system upgrades.

When choosing the composability option, there are numerous factors that banks need to consider. Here, it’s worth mentioning that the “composability perimeter” concept applies to the entire information system, including all of its business domains, and not just the traditional core banking system.

This includes transverse repositories, which encompass all the various components of a bank’s information system, such as organizational structures, legal entities, employee profiles, identification and authorizations, third-party individuals or entities, customers and prospects, partners, distribution channels, and the bank’s product and service offering catalog. Additionally, this repository also includes the storage of customers’ contracts.

Customer engagement is another critical factor for both sales to new and existing customers, resulting in new contracts for various products or services, such as deposits, savings, payments, cards, or credit. After-sales activities, such as managing contract amendments or mandates and day-to-day operations, are also part of customer engagement.

Financial institutions must consider the execution of daily operations in composable banking, regardless of the type of products or services offered, including the production of event and inventory reports for the accounting system.

Enterprise management should also be factored into composable banking. This focuses on accounting (general and auxiliary), regulatory reporting, internal reporting, and data and analytics for improving the bank’s performance in terms of revenues and costs.

These aspects work together to ensure the bank operates efficiently and effectively while providing exceptional customer service.

What challenges do financial institutions face when deploying a composable banking solution?

For retail banks, maintaining or increasing market share, revenues, and profitability, reducing costs, and controlling operational and regulatory risks are vital challenges that require a global approach.

These challenges are present regardless of the bank’s size, customer demographics, or product offerings. Customer engagement, processing, and enterprise management are all essential aspects of banking operations that work together to ensure efficient and effective performance while providing exceptional customer service.

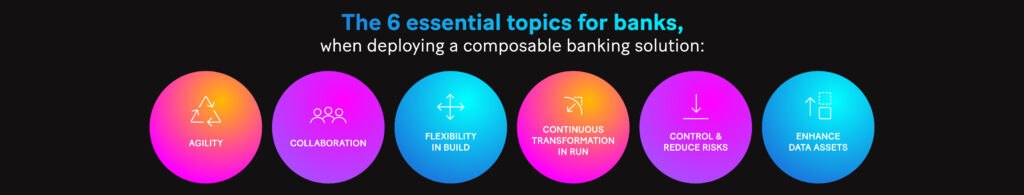

We have identified six essential topics for banks when addressing these challenges:

- Agility: To increase agility, retail banks can focus on time-to-market, hyper-personalizing day-to-day customer services, and implementing incremental changes within their IT solutions. This approach allows for real-time product and service offerings, efficient management of accounts and loans, and avoids the tunnel effect of complete replacement.

- Collaboration: Banks can collaborate with businesses or technical partners through ecosystems or marketplaces to open up new economic and technological possibilities. Examples of cooperation include expanding the offering catalog, implementing open banking/finance, providing digital access for banking, and ensuring cyber-security.

- Flexibility in build: To limit costs and optimize transformation programs, it is essential to master the necessary business scope and consider the bank’s priorities and business model. A “Big Bang” model should be avoided due to results and cost control uncertainty.

- Continuous transformation in run: To maintain an up-to-date transformation program while limiting costs, it is recommended to consider cloud solutions in a SaaS approach for regular and seamless updates. A “pay as you use” approach can also optimize consumption costs based on day-to-day activity variability.

- Control and reduce risks: To mitigate risks such as financial, security, and regulatory compliance, it is essential to implement a resilient and upgradeable IT platform with sustainable architecture. Cybersecurity issues and the risks associated with non-compliance to regulatory constraints should also be addressed.

- Enhance data assets: To improve performance, it’s crucial to enhance data assets by considering a global data architecture that allows for ownership and necessary analysis, including AI tools. All use cases should be considered, including customer knowledge, satisfaction, the bank’s offerings, operational efficiency, and regulatory compliance.

How Sopra Banking Software can help

Composable banking is becoming increasingly necessary for retail banks to remain competitive and control costs and risks. Although it may not yet be a top priority, it is critical for long-term success.

Sopra Banking Software offers a composable banking solution tailored to any financial institution’s size and ambition. We have set up a Service Store focused on banking operation execution and plan to expand it to include customer engagement and enterprise management services.

We aim to help clients optimize and prioritize their composable banking transformation decisions and deadlines, drawing on our decades of experience in the retail banking market and partnerships with business and technical experts.

For more expert content on industry outlooks and innovation, subscribe to our newsletter or visit our Insights page.