Empower your bank with composable cloud-native strategy

Leverage our fully open, secure, and high-performance core banking software to run any type of bank. Run your banking operations on regulated markets, unlock new business opportunities, and embrace challenges in a quickly changing market.

Trusted by 1,500 + financial institutions

Reduce time to market

Differentiate yourself from competitors, launch products and services faster and compose your bank operations based on your needs.

Protected scalability

Anticipate changes, fuel growth, and manage your daily transactions and customer data efficiently and securely.

Reduce total cost of ownership

Boost the performance of your bank—monitor, manage and control your operations and improve decision making.

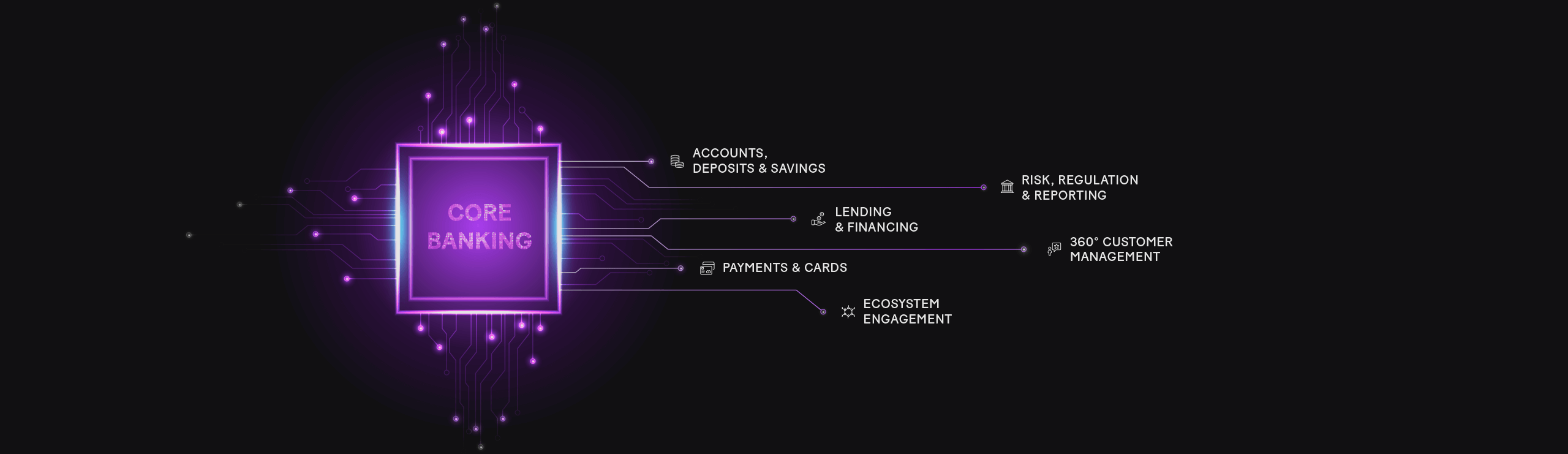

Extensive banking functionality

Run the bank operations of the future

Open architecture and API-first

Run an open bank and expose your operations to your partners & ecosystem with a robust API platform.

Cloud core banking

Gain peace of mind with our secure cloud technology and choose from our multiple flexible delivery models from BPaaS to Cloud to SaaS and on-premises.

Localized in 80+ countries

Deploy your bank fast in the market from risk, regulatory and compliance solutions, to a model bank fully localized.

Real-time secure operations

Leverage high volume transaction scalability in real-time. Our core banking software offers advanced security, fraud prevention, and a performance-proven solution.

Advanced functional coverage

Build your bank from financial product operations support to client and partner management to accounting, enterprise support, and risk management.

Composable core banking

Design the bank you want with our pre-integrated modules or components that can be used stand-alone—allowing you to set your own path.