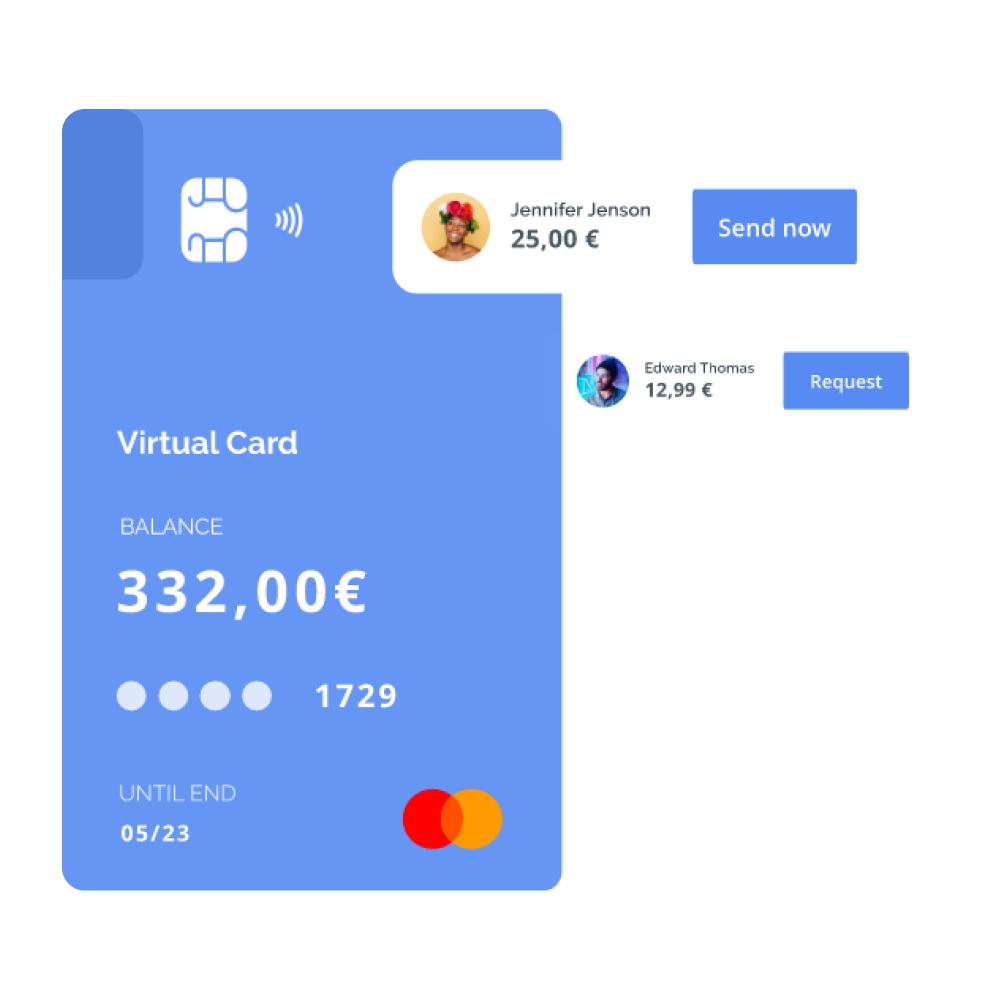

Request-to-Pay

Gain a competitive advantage

RtP fills a gaping hole in the financial services industry.

The new messaging service – designed to help businesses and individuals better manage their money – is the missing link that will bring with it new clarity with regard to cash flow and payment, as well as improved flexibility for users. Rely on our high-fit, state-of-the-art solution to make sure you are not left behind!