Digital banking has been having a big impact on both customers and financial services companies around the world. And its impact continues to be felt. As digital reliance grows, new players in the financial services industry are jumping on the digital banking bandwagon and creating a raft of new products and services with a focus on convenience, security and resilience.

But what is digital banking exactly? How was it developed? What are its benefits and shortcomings, and what can we expect from it in the future?

Let’s take a closer look.

Key subjects include:

– Digital banking definition

– Who are the major players in digital banking?

– The benefits of digital banking for consumers

– The benefits of digital banking for banks

– Challenges that come with digital banking

– What’s next for digital banking?

Digital banking definition

In short, digital banking means banking done through digital platforms, removing the need for traditional banking methods; for instance, paperwork like checkbooks, pay-in slips, etc. It is based on virtual processes that facilitate financial transactions using modern technologies, including apps, mobile phones, laptops and other hardware.

Generally, digital banking is split into two subcategories: online and mobile banking.

Online banking

Online banking means accessing a bank’s features and services via the internet. Each bank sets up a website with digitized banking services tailored to consumer needs, providing a convenient, secure space to go about daily financial activities. For many users, online banking renders visits to the local bank branch obsolete.

Online banking has proven incredibly popular with customers, who find its convenience appealing, as well as being able to access accounts at the click of a button, move money around and keep an eye on their bank balance and overdraft limits.

Mobile banking

Mobile banking is essentially online banking that takes place through a mobile app on a smartphone or tablet. It has changed the way consumers deal with their money, with on-the-go banking features facilitating and accelerating financial transactions across the globe at the touch of a button.

Digital banking

Digital banking implicates both mobile and online banking. It offers several digital services, including:

- Downloadable bank statements

- Cash withdrawals

- Transfers

- Account management

- Opening deposit accounts

- Loan management

- Bill payments

- Account monitoring

A brief history of digital banking

We can trace the roots of modern digital banking back to the early 1990s, but early forms of digital banking services go back to the 1960s, with the introduction of ATMs.

The arrival of the internet changed everything. Banks first used it mainly for internal operations, such as account monitoring and fund transfers, but by the late 1990s, customers were given the opportunity to access services directly from online digital bank platforms.

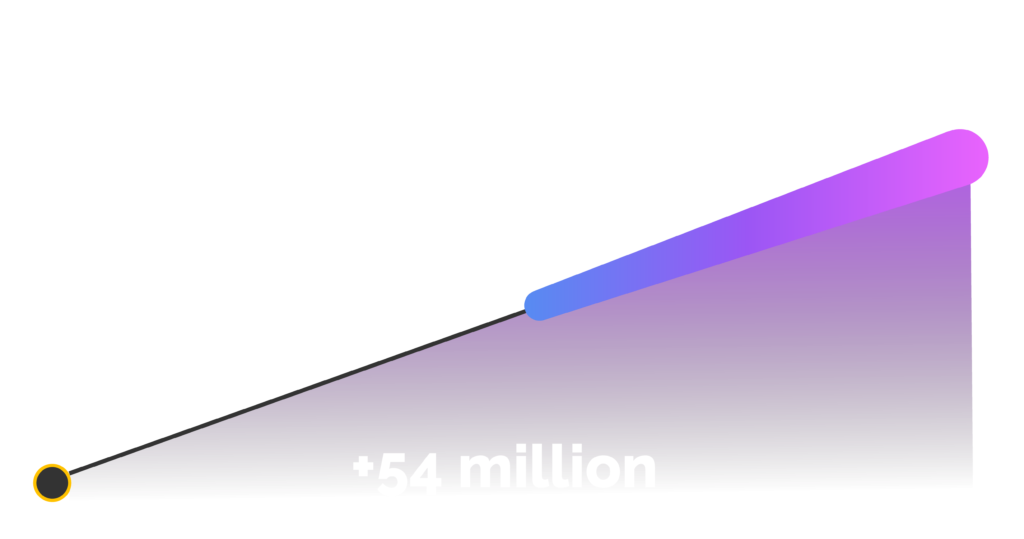

Between 2001 and 2009, the number of digital banking users jumped to 54 million in the US alone, aided in no small way by the introduction of the first iPhone in 2007.

As of 2020, as many as 1.9 billion users worldwide actively used online banking services, with the largest market being in Asia. That figure is expected to reach 2.5 billion by 2024.

Who are the major players in digital banking?

While all legacy banks offer digital banking services for their customers, the explosion of the digital age heralded the arrival of a plethora of fintech companies and online banks (neobanks or challenger banks), whose business models are focused on digital convenience, accessibility and security through mobile banking. These industry entrants often offer customers higher-than-average savings accounts yields and a modern, reliable customer experience.

Examples of neobanks/challenger banks include the German neobank N26, which offers free mobile bank accounts straight to a customer’s smartphone, or the UK-based Monzo – one of the earliest to challenge the hegemony of legacy banks.

Although some of these neobanks have affiliations with traditional banks that provide in-person services, many of them are online-only, offering reduced banking services, low-to no-fee structures and higher interest rates.

Other digital banks making waves include Quontic, Axos, Discover, Ally and NBKC. All are branchless and offer intuitive online and mobile banking experiences for minimal fees with reliable customer support structures.

Legacy banks, however, have proven to be more adapted to cope with the financial impact of the pandemic, and many digital-only banks have taken a hit over the past couple of years (Simple and Moved ceased consumer activities altogether).

The benefits of digital banking for consumers

Access and convenience

Digital banking has a number of benefits that facilitate day-to-day financial activities. First and foremost is access and convenience.

Round-the-clock access to bank accounts via a smartphone, tablet or laptop means that consumers are not beholden to traditional banking opening hours to manage their finances.

This means consumers have full control over their finances, especially thanks to the advanced features offered by mobile banking apps, such as push notification alerts and automated saving tools, which facilitate on-the-go banking.

Moreover, intuitive mobile banking apps allow users to go cashless, which is generally a more secure and safe payment method. This also allows for P2P payments and daily transaction monitoring, which means that consumers can keep track of their spending at the click of a button. Major proponents of this include Apple Pay and Google Pay.

However, creating a convenient and easy-to-use service is easier said than done. Banks of all shapes and sizes are competing to create the ultimate customer experience as a means to attract new customers to their products and services, and retain existing ones.

Reduced operating costs

Digital banks also generally offer better rates and lower fees. This is due to the reduced operating costs of digital infrastructure designed to eliminate the need for time-consuming and costly back-office processes. Online banks drive these fees down, giving consumers attractive choices beyond their local brick-and-mortar financial institutions.

Security

A further benefit of digital banking for customers is security. For most consumers, knowing that their money is safe, secure and protected from financial fraud is paramount when choosing a bank. Many believe digital payments and e-wallets to be far more secure methods of money transfer than traditional card-based payment systems.

Moreover, many mobile banking apps offer multi-factor biometric authentication systems to log in, including fingerprints, voiceprint and facial recognition software, which often help alleviate consumer concerns.

Financial inclusion

Finally, and perhaps most importantly, digital banking is expected to promote and encourage financial inclusion. Upstart online banks level the banking access playing field by reaching unbanked and underbanked communities that rely heavily on mobile phones but may not have access to physical bank branches.

Furthermore, the newfound connectivity in the digital age can help both increase financial literacy and play a key role in social issues such as generational wealth gaps and racial inequality. OneUnited Bank and Daylight have both launched schemes promoting financial inclusion.

The benefits of digital banking for banks

The digital revolution has turned the global financial sector on its head and, for banks, embracing digital banking is no longer an option – it’s a necessity. Failure to do so will risk disintermediation and losing customers and revenue.

However, digital banking needn’t be seen as an existential threat to legacy banks. Rather, it should be seen as an opportunity. Digital banking provides traditional banks with the chance to gain an edge on their competitors, by partnering with young and agile fintechs, for instance, and pushing innovation to create immersive banking experiences for customers.

And then there’s the cost-saving brought about by digital banking. Thanks to the digitization and automation of existing processes, banks that invest in digital banking will find that they spend less money and fewer resources on IT and HR infrastructure. This could be in reducing operating costs, hiring fewer people, streamlining back-end processes and minimizing mistakes.

Challenges that come with digital banking

Going through digital transformation is not without risk for traditional banking institutions. Investment, restructuring and cultural issues all present real obstacles to a smooth transition.

Appealing to a younger generation

A key part of transitioning to digital banking is finding ways to better appeal to native users. A whole generation of consumers has grown up knowing nothing but the convenience afforded to them by digital innovations, including online and mobile banking.

To engage with this demographic, banks must find a way to offer a vast range of smart tools that can be adapted and integrated into a variety of different financial services. And with neobanks, challenger banks and other fintechs already hot on the heels of these consumers, traditional banks will perhaps need a total overhaul to avoid lagging behind.

Adapting to new banking practices

Traditional banks tend to be large entities, deeply siloed and entrenched in old practices. Any shift can be difficult, especially digital banking, which requires wholesale change across the board.

Banks are particularly lacking when it comes to the development of cloud, data analytics, artificial intelligence (AI), machine learning (ML) and process automation, leaving them playing catch up to firms from other sectors who have become robust, agile and resilient.

Internal culture

Another important part of the move to digital involves a complete overhaul of an organization’s internal culture. Research conducted by Sopra Steria and Forrester Consulting suggests that a reluctance among employees to adapt and rise to new challenges pervades the banking sector, and may impinge the ability of legacy banks to digitize at scale and fast enough.

Outdated legacy systems

Building an innovative, digital culture means outlining a digital vision, and for legacy banks with outdated internal and external infrastructure this is certainly a challenge. Many traditional banks are running on legacy systems from the 1970s and ‘80s that are no longer fit for purpose, especially in today’s digital age.

The problem is that replacing these systems is a costly and time-consuming process. Many of these systems, being decades old, are ill-equipped to deal with the challenges of the digital era.

Regulation

The final problem for banks aiming for digital transformation is regulation. Unlike their non-traditional bank competitors, traditional banks have plenty of regulatory rules and requirements to fulfil, making the transition to digital banking difficult. Regulators, in turn, have to find the right balance between encouraging innovation and protecting consumers.

What’s next for digital banking?

The speed of digital innovation means banks and consumers alike will be kept on their toes. As consumer expectations shift in search of convenience and security, banks must adapt and find a way to ride the wave of constant digital innovation.

Banking-as-a-Service and embedded finance

Almost the opposite of BaaP, Banking-as-a-Service (BaaS) and embedded finance provide banks with a means to distribute their products and services through third parties. For instance, a bank might provide a financial third-party organization with the regulatory licenses, infrastructure and know-how to set up their own digital identity service. This disintermediates the banks to an extent, but it also provides them with a nice revenue stream.

For digital banking in general, this means that a wider array of businesses can offer financial products and services, by leveraging Banking-as-a-Service, increasing the rate and probability of innovation.

Banking-as-a-Platform

Some banks have already understood that the best way to do this is to partner up with fintech firms who have already developed Banking-as-a-Platform (BaaP) options for reaching new customers.

BaaP allows banks to forge new partnerships with organizations who offer unique and complementary products and services. The banks can then incorporate these product s and services into their own offers, thus improving the experience for the end-customer.

Open banking and open finance

Open banking has been a key tenet of digital banking for some time now, With the use of application programming interfaces (APIs), financial institutions and third parties are able to connect with one another and share customer data, leveraging it to create new products and services for end users.

Open finance is the next stage in this journey. Unlike open banking, open finance is not yet regulated by a legal framework, and as such covers a far broader range than open banking, including financial data related to pensions, insurance and tax.

AI, AR, VR, 5G/6G and IoT

The future of digital banking means the continued development of apps and online tools that facilitate money transfers, monitoring and investment in secure, convenient spaces, safe from fraud.

This often means using AI solutions, developing blockchain options and expanding the use of AR and VR. These customized digital solutions will be developed through quantum computing and will be intrinsically linked to 5G/6G network rollout and the IoT.

Social banking

Finding new, dynamic ways to build and foster relationships with customers is key for banks of all shapes and sizes. Of course, social media is a key channel through which banks can engage with users, and many banks are even going a step further with social banking – a bank-owned social platform that encourages a human connection between bank and customer, creating a customer community.

This type of engagement gives banks a unique opportunity to speak directly to end users, better understand their wants and needs, and offer them new products and services, tailored specifically for them.