With promises of greater payment flexibility, “Buy now, pay later” (BNPL) remains an in-demand payment option, with usage only on the rise. Providers are popping up around the world, claiming to offer the greater convenience and comfort that come with delayed payment options, without all of the complexities traditional lending entails.

And it’s no surprise. BNPL actually offers both merchants and consumers a very useful service. During the pandemic, some shoppers could only afford to pay for necessary goods due to BNPL’s ability to split payments into smaller installments. In a period where many were suddenly jobless or working less hours, BNPL provided some much-needed relief.

Now, BNPL is starting to appeal to more businesses, but for a different reason. Some are still facing cash flow issues caused by a combination of factors, including worsening economic conditions and supply chain issues. In this day and age, being able to receive money faster and through more flexible means is incredibly appealing to businesses.

In our previous article on BNPL, we talked about why the payment method is under scrutiny for the possible unethical spending habits it encourages. Despite the fact that 62% of BNPL users believe it will eventually replace their credit card, growing concerns are causing increased government involvement. The question is how to get the most out of what BNPL has to offer while improving customer protection and transparency.

So where does that leave us today? We must determine how to handle the ethics surrounding BNPL balancing on the fine line between ensuring customers don’t become overburdened with debt while making sure they still have access to a flexible payment option.

How do we go about doing that? The answer might lie in open banking.

What are the ethical limits of BNPL?

While BNPL is often criticized for leading its users into unmanageable debt, BNPL can also provide its users some much-needed financial breathing room when used correctly.

According to research from Barclays and StepChange, BNPL credit could prevent as many as 876,000 Brits from getting into uncontrollable debt in this year alone. If UK retailers demanded their lending partners adopt more responsible practices, like performing full credit checks or even partnering with regulated finance providers, people who couldn’t afford to make such large purchases wouldn’t be allowed to use BNPL in the first place, thus helping them avoid unmanageable debt.

With 36% of consumers finding BNPL lending attractive, partly due to rising inflation and energy costs, consumers in the UK are now paying off an average of 4.8 purchases, up from 2.6 in February 2022.

With increased interest, it’s important to make sure that only those who can truly afford to do so make use of this lending method. Considering 23% have admitted to having used BNPL to buy something that they couldn’t comfortably afford, getting better control over this unregulated form of lending should be a top priority for merchants and regulators alike.

How open banking could help

A key aspect of BNPL’s success involves the customer journey. When consumers are checking out and selecting BNPL financing, they expect the entire process to be quick and seamless, from start to finish. They need to know what they are getting and how much it will cost.

Open banking could help assess whether consumers are qualified to make certain purchases, which would result in far fewer people getting involved in unmanageable debt. Open banking allows for real-time access to a customer’s credit history, making it easy to understand who should and shouldn’t be approved for BNPL financing.

With open banking, lenders have insight into a customers’ bank transaction history, which they can use to better understand creditworthiness and to determine if they can really afford the BNPL financing plan. This also helps to avoid loan stacking, where a consumer takes on several BNPL financing plans within a short period of time, often leading to the rapid accumulation of debt. BNPL providers are able to set various parameters surrounding approval, like spending limits in line with a customer’s profile.

While many believe open banking would reduce the number of approvals, this isn’t actually the case. Sometimes, BNPL providers reject qualified consumers due to over-prioritizing criteria; for instance, the type of credit card, shipping address, order total or a lack of order history, even though these consumers are clearly creditworthy.

Indeed, research from Opinium indicated that if lenders had access to more applicant data, up to 80% of rejected loan applications could have been accepted without increasing the lender’s risk. In fact, the overall risk remains low if affordability checks are given in the medium term. Therefore, by utilizing open banking, retailers won’t lose out on these revenue streams.

Reduce risks and avoid defaults

As it stands, the current usage of BNPL is somewhat risky, operating in a way that largely encourages the likelihood of default – something both providers and users of BNPL would prefer to avoid.

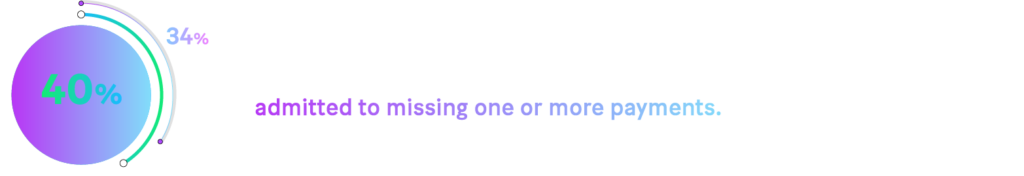

BNPL default rates are on the rise, with 40% of Americans having used BNPL financing and 34% of those have admitted to missing one or more payments, resulting in their credit scores dropping and them being contacted by debt collectors.

And things aren’t much better in the UK. 30% of Brits have made use of BNPL, and 31% of those have admitted that the repayments associated with this form of lending have become unmanageable.

While uncontrollable debt is a clear stressor on those who are being chased by debt collectors, it has another side effect – with growing losses and a lack of debt repayment, lenders are less and less likely to make loans. Credit checks associated with open banking are a great way to prevent, if not drastically lower, the resulting customer defaults, while also helping consumers avoid unaffordable debt. What’s more? This credit check can be re-done periodically to ensure the clients are still able to afford their purchases. Essentially, open banking has the opportunity to make BNPL more sustainable.

The data provided from open banking provides real-time accurate data that can be re-checked up to four times a day, for up to 90 days from the initial connection. With this, BNPL providers can not only better understand someone’s current liquidity, but also understand the other potential commitments they have to other BNPL providers.

Curious about the other ways in which open banking can improve BNPL products? Next to credit checks to determine affordability, open banking can also be used to reduce fraud by identifying questionable customers.

The future of BNPL and open banking

While BNPL providers are under plenty of pressure with evolving economic conditions and a probable looming recession, they also are in the privileged position to improve their products to benefit both BNPL providers and users. Easy credit products like BNPL aren’t going anywhere – increasing costs of living and interest rates are only amplifying its demand. Regulatory entities and governments are therefore focused on ensuring consumer protection, while continuing to provide access to flexible payment financing. While open banking cannot solve all of these issues, it has the possibility of being a large part of the solution.