Over the last decade, IT applications and software have developed at breakneck speed, and many businesses are having to re-think their implementation methodology. While there is a rich and established collection of sturdy monolithic software systems that stand on top of the most cutting-edge technologies, the concept of microservices – a single application developed from small, independent services – is swiftly gaining attention.

Modernizing legacy systems using microservice architecture

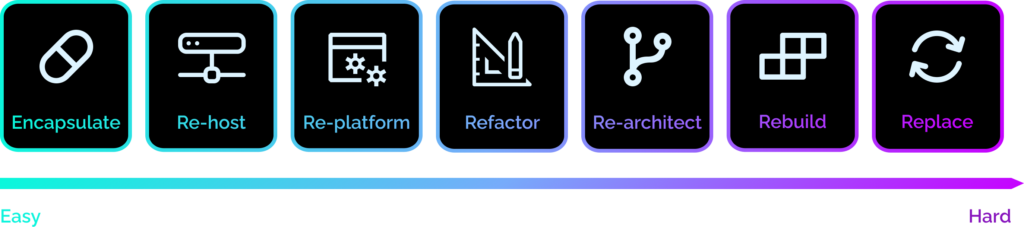

For businesses considering modernizing an existing system, Gartner’s 7 steps to modernizing legacy systems show the options, ranked from easiest to hardest in terms of implementation (though it’s worth noting that the more risk a process comes with, the more impact it is likely to have):

The move to microservice architecture can fall under encapsulation (migrating from monolithic architecture to API services), refactoring, re-architecting and rebuilding. As it’s designed to divide a monolithic application into the individual components that make up the user interface, database and server-side application, it may seem like a daunting task, but there are valuable benefits. Increasing speed and reliability of applications, flexible scaling and transformation, cost reductions, and increased agility and innovation are just some.

It’s worthwhile to note that while microservices may seem similar to the old style of Service Oriented Architecture (SOA) from ten years ago, that similarity is only superficial. Microservice architecture has definitely developed from the style of SOA and also learned from its mistakes.

Auto finance and application modernization

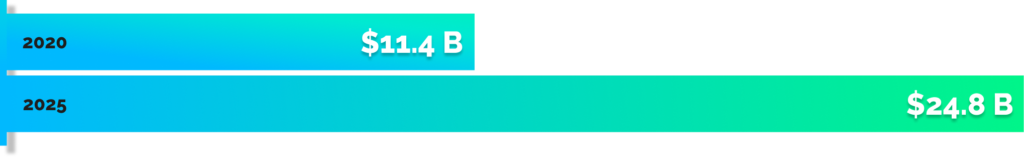

With the rapid speed that financial services markets are changing, application modernization may well be key to continued success. The global application modernization services market size is forecasted to show a Compound Annual Growth Rate (CAGR) of 16.8 percent between 2020 and 2025, growing from $11.4 billion to $24.8 billion by 2025, with the highest CAGR estimated to be in the APAC region.

The Covid-19 pandemic has drastically altered the landscape of the automotive industry, and a recent McKinsey report estimates revenues will continue to slow throughout this year, with auto leasing predicted to improve by the end of the year; but for auto finance, the expected recovery date isn’t until 2023 to 2024.

The Chinese market, however, is looking promising – and the automotive sector can look to China to see what’s working in terms of recovery (a subject previously written about by James Powell, Head of Global Automotive Strategy).

The Chinese auto finance industry consists of two types of organization, the first being finance companies backed by world-renowned auto manufacturers, doing business at very high volumes. With legacy lending systems that will have been running successfully for years, to complete just one business scenario they’re likely to need to talk to numerous peripheral systems. To change this might seem daunting in terms of the initial investment and risk levels of new implementation and integration, but factors like poor performance or speed issues are common in monolithic architecture. If a lending system is incapable of responding to business innovations at the speed and efficiency a company needs, something needs to change. For the other type of Chinese auto finance organization, independent leasing/consumer finance companies, the thought of completely changing their systems may be less daunting, but the resources might not be there.

Maintaining flexibility and agility with localization capabilities

The Chinese market understands that technology is a driving force in outrunning the competition. Whether or not they have the practical industry experience and knowledge, or indeed the resources to implement a fully-fledged “assembly-line” solution, auto finance companies in China look for ways to fill the gap and enhance their business.

Even without the added pressure of a global health crisis, the most innovative companies look at their current systems and ask, “Is it really good enough? What can we change, and what can we do to improve our legacy systems?”.

Monolith architecture doesn’t always have to be fully replaced, there are other options. Keeping the legacy application at the core, microservices can be developed using the monolith’s API, especially for temporary or specialized pages, such as limited time finance offers. The fact is that modernizing legacy systems is crucial for continued success, particularly in a fast-moving market like auto finance. Companies must remain competitive, and a large part of that is doing more than accepting change – it’s actively embracing it.