The original version of this article appeared in La Tribune (in French).

The current health crisis is compounded by a lasting economic slowdown that is already apparent. While French and European markets are particularly supported by institutions during times of crises, experts estimate that the amount of bad debt and non-performing loans could triple on a European scale once aide is suspended. In order to anticipate the risks, banks must prepare for an increase in bad debt and optimize their – often poorly equipped – collection services.

Solutions failing to address urgent needs

The European Commission does offer solutions, like creating “bad banks,” specialized in valuing and selling these non-performing assets. This solution would provide relief for traditional banks and avoid lending depletion. It is also a question of developing a secondary market and reforming legislation on insolvency.

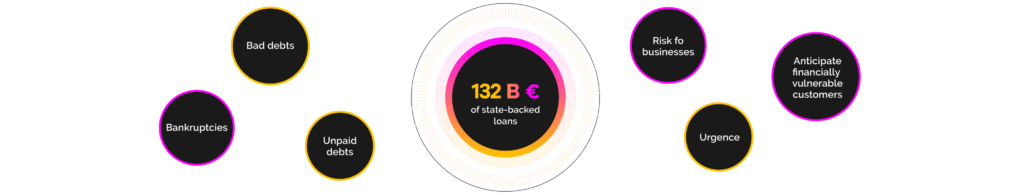

However, for banks it is a matter of urgency. Many financial institutions will soon have to manage a large about of unpaid debt and companies or trader bankruptcies. They will have to manage “bad debt,” including 132 billion euros of state-backed loans. On top of this, it will be important to anticipate financially vulnerable customers who do not settle their invoices and, as such, could jeopardize companies.

While the banking market and financial companies are rallying to ensure they have a collection solution, these services are often poorly equipped. Nonetheless, it is essential and makes sense to be proactive in this domain. All receivables collected are directly added to a company’s profits, and non-collected receivables represent direct loss.

An opportunity to rethink customer risk management

The crisis is therefore an opportunity to rethink risk management and optimize the sales-to-cash process, using several levers. Automating and digitizing collection tasks where possible would take the pressure off teams. Optimal collection procedures and systems will mean defaults can be quickly identified in order to envision 2021 results. To maximize the odds of repayment, several different areas can be developed:

∙Optimizing customer data

Improving the quality of contact information means invoices and reminders can be sent to the right person, thus increasing the likelihood of on-schedule payment

∙Digitizing

Sending reminders on digital channels and combining different means of exchange as part of collection strategies in order to optimize contact results and ultimately payment

∙Industrializing data processing

To tackle the number applications that arrive at the same time. Automating collection administration to accelerate flow management means customer receivables can be managed with a “just-in-time” approach

Therefore, it is worth having a collection solution that makes it possible to manage the different stages in a credit file, from creation to closing, including assignment of the various stakeholders and choice of strategy.

Customer segmentation makes it possible to personalize the customer relationship, by reinforcing reminders. Furthermore, it is important to draw on a 360-degree vision of the risk incurred in order to anticipate spreading risks in so far as possible.

Leveraging the business relationship

With regard to the business relationship, the idea is to opt for suitable communication. Helping companies that are struggling is a genuine investment in the future customer relationship. By supporting customers through this unprecedented crisis, banks will help to save a maximum number of businesses while also waiting for brighter days. Businesses that have been supported by their financial institutions will forge stronger ties with them and will be able to launch new investment with full peace of mind.

In the current climate, which has not left any sectors or industries unscathed, the expertise and professionalism financial institutions demonstrate during the collection process will make a big difference. To establish a trusting environment, a simple and tangible discourse is required, and one must demonstrate understanding.