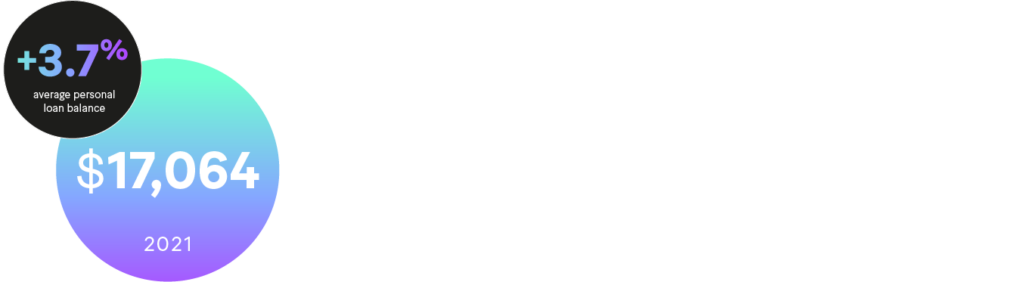

- According to a 2022 Experian report, the average personal loan balance rose by 3.7% in 2021 to $17,064, and 25 million consumers currently rely at least one loan account.

In recent years, a portion of the population has found themselves experiencing financial challenges. Many of these challenges have been brought on by circumstances beyond their control, such as the COVID-19 pandemic, rising inflation, and job loss. According to a 2022 Experian report, the average personal loan balance rose by 3.7% in 2021 to $17,064 and 25 million consumers currently rely at least one loan account.

As consumers have adapted to uncertainty within the economy, they sought security from lenders to ensure they could keep up with their financial obligations and make ends meet. Financial uncertainty such as rising energy costs has led to an increase in individuals, who need for support navigating commitments. For some, this added financial security has been the lifeline they needed to get them through dark days. For others, this debt has become an additional burden to their finances and has added another hurdle to overcome.

Approaching a lender for help

Speaking to lenders about a change in circumstances can be a daunting task for many consumers facing an uncertain financial future. The thought that waiving a white flag and asking for help might negatively impact their credit score or that their lender may persist and demand the initial agreement is maintained can prevent many people from ever contacting their lender, to begin with. Some may ignore their situation, burying their heads in the sand, and hoping the problems go away. This leaves banks, building societies, and other lenders in a challenging position. The process of debt recovery internally can be a huge investment, both in time and financially. Enlisting debt recovery techniques can also have a significant negative impact on the overall experience, leaving customers feeling that the lender doesn’t care about or understand their circumstances. External debt recovery agencies can charge anywhere between 20–40% depending on the amount, age, and complexity of the case. This results in an often expensive but necessary exercise.

When customers find themselves in a situation where they are struggling with their repayment agreement, there are several ways that this can be addressed. Lenders can proactively review the customer’s income and expenses via open banking and make some assumptions about what could be more affordable. Alternatively, lenders can contact their clients and have a conversation about what is achievable based on their current financial situation and commitments. By automating as many processes within the collection process as possible, staff can now focus on finding the best solution for the customers most in need of personalized support. Businesses offering products and services across multiple countries will also face the challenge of offering a collection solution that meets the regulatory requirements of various regions that also offers visibility across all regions for streamlined reporting.

Debt collection is a challenging and, at times, emotionally charged process. Customers often need to be handled with care and each case treated and reviewed individually. Consumers burdened by financial debt may feel overwhelmed with stress and anxiety about their future. How a lender responds to what a customer sees as a unique situation they find themselves in, can be make or break to fostering trust and building a strong relationship. There’s not a one size fits all solution to address customers’ needs, but there is, in many cases, a fair compromise.

Empathetic lending

Making a commitment to empathetic lending involves putting your customers at the heart of your lending model and prioritizing the support needs for those struggling with debt. There are many ways that a financial organization can approach this, including regular training for staff to identify vulnerable customers and how to best approach a conversation with them. This can involve signposting customers to internal or external debt support solutions and taking the time to fully understand their circumstances in an effort to better understand what is and is not achievable for the customer.

Another way lenders might approach empathetic lending is to adjust their internal systems and processes to create agile lending products and agreements, contact certain customers through different channels (combination of SMS, email, digital portal, letter, or phone), and respond faster to changes within the marketplace. If banks, building societies, and other lenders can identify customers viewed as ‘at risk’ based on analytical information to hand sooner, they can proactively contact those customers, offer support, and in some instances, renegotiate terms. This will enhance the customer experience and leave the organization in a greater position to recover loans, without implementing the debt collection process.

Empathetic lending isn’t just about listening to the customer and empathizing with their situation. It is about proactively finding ways to make a customer’s experience better, by understanding what agreement is likely to be more realistic and manageable if their circumstances have changed. This will ultimately reduce the likelihood of the customer defaulting on their agreement and make them more likely to recommend the organization to others. Statistics show that word-of-mouth is responsible for 13% of all sales. What impact would growth or loss of 13% have on your organization?

How do we achieve this?

Realistically, your organization may be held back from offering an enhanced experience such as this on the latter point due to outdated systems or processes that drive your lending operations. Utilizing a software partner such as Sopra Banking Software (SBS) would enable your organization the flexibility to respond to customer needs faster, implement time-saving processes that free up your staff to complete other tasks, adapt your product and service offering based on customer data, identify marketplace trends, and ultimately enable you to offer competitive lending products on your terms. Contact Sopra Banking Software to speak with one of our experts to see how our solution can help your bank, building society, or lending organization offer innovative and market-leading products and services, or click on the link to learn more about our lending lifecycle solutions.