Next-generation lending

For financial institutions looking to cut lending costs, reduce risks, increase conversions and make more accurate credit decisions, finding the right loan origination software is key.

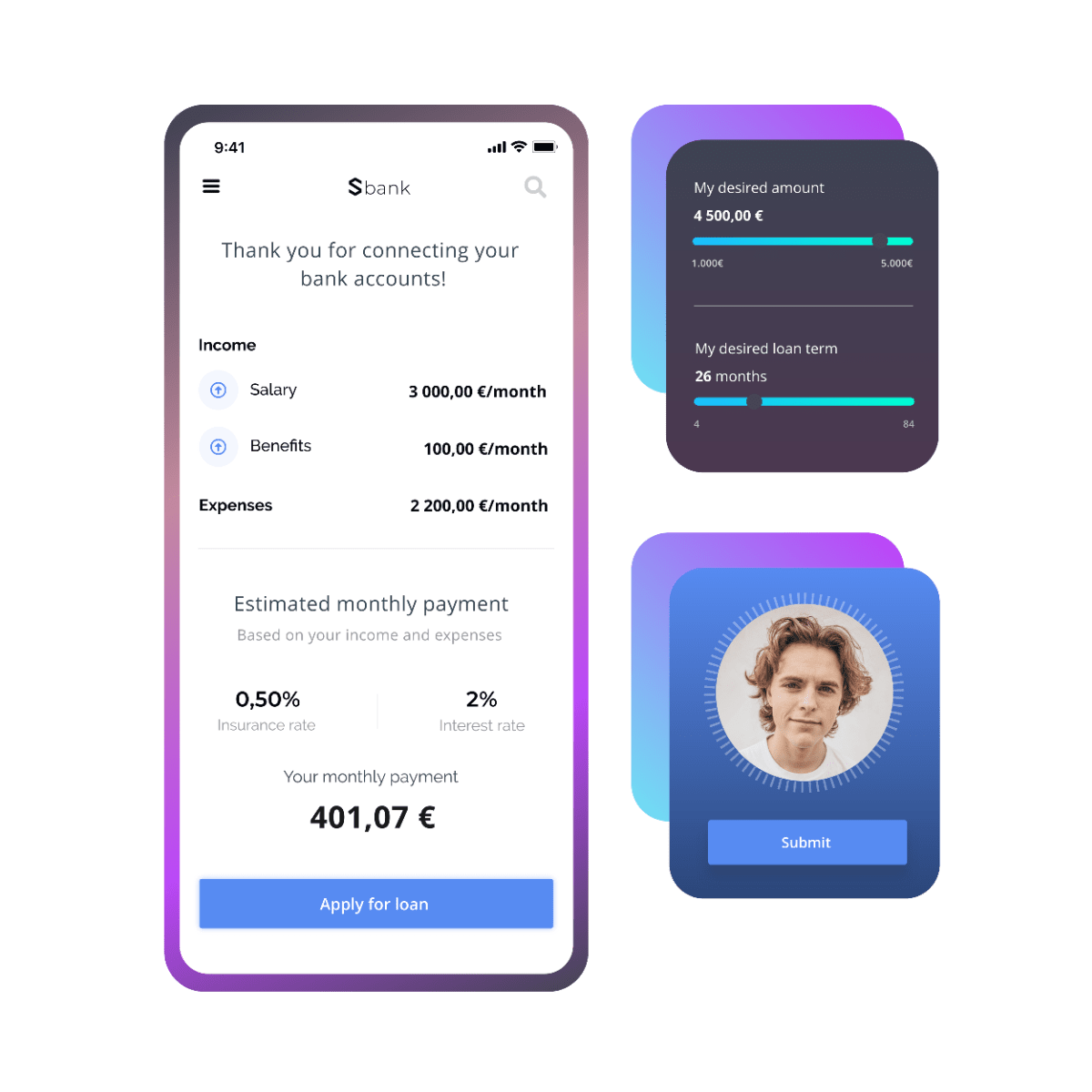

With SBS open banking platform, aggregate real-time transactional data from 3,400+ European banks, analyze it, customize loan proposals, and offer traditionally underserved customers a fully digital lending experience.

BENEFITS >>

Leverage the benefits

Capture the potential of open banking with data-driven insights.

Understand customers better

Make better decisions with greater access to your customer’s financial information.

Increase conversions

Improve conversion ratios with individual-specific, contextual loan offers.

Enhance customer satisfaction

Streamline the user experience, reduce friction, and delight your customers.

Decrease costs

Improve efficiency with pre-analyzed customer information and automatic data assessments.

Reduce errors and risks

Leverage data aggregation from new and trusted sources to limit downside risk.

Innovate

Gain quick access to other open banking use cases and additional services.

Account aggregation

Connect to 3,400+ European banks, access real-time transactional data from PSD2 and non-PSD2 accounts, and get a better picture of your customer’s finances.

Data enrichment

Manage the complexity of various data types. Refine, enrich, and continually improve data with machine learning. Achieve maximum accuracy with automated data categorization.

Smart financial overview

Analyze aggregated data and compute advanced insights to improve your loan decisions and decrease your risk.

KYC data autofill

Improve KYC processes and simplify your onboarding with auto-populated customer data from new and additional sources.

Analytics

Gain a better understanding of customer spending habits and improve the personalization of your loan offers.

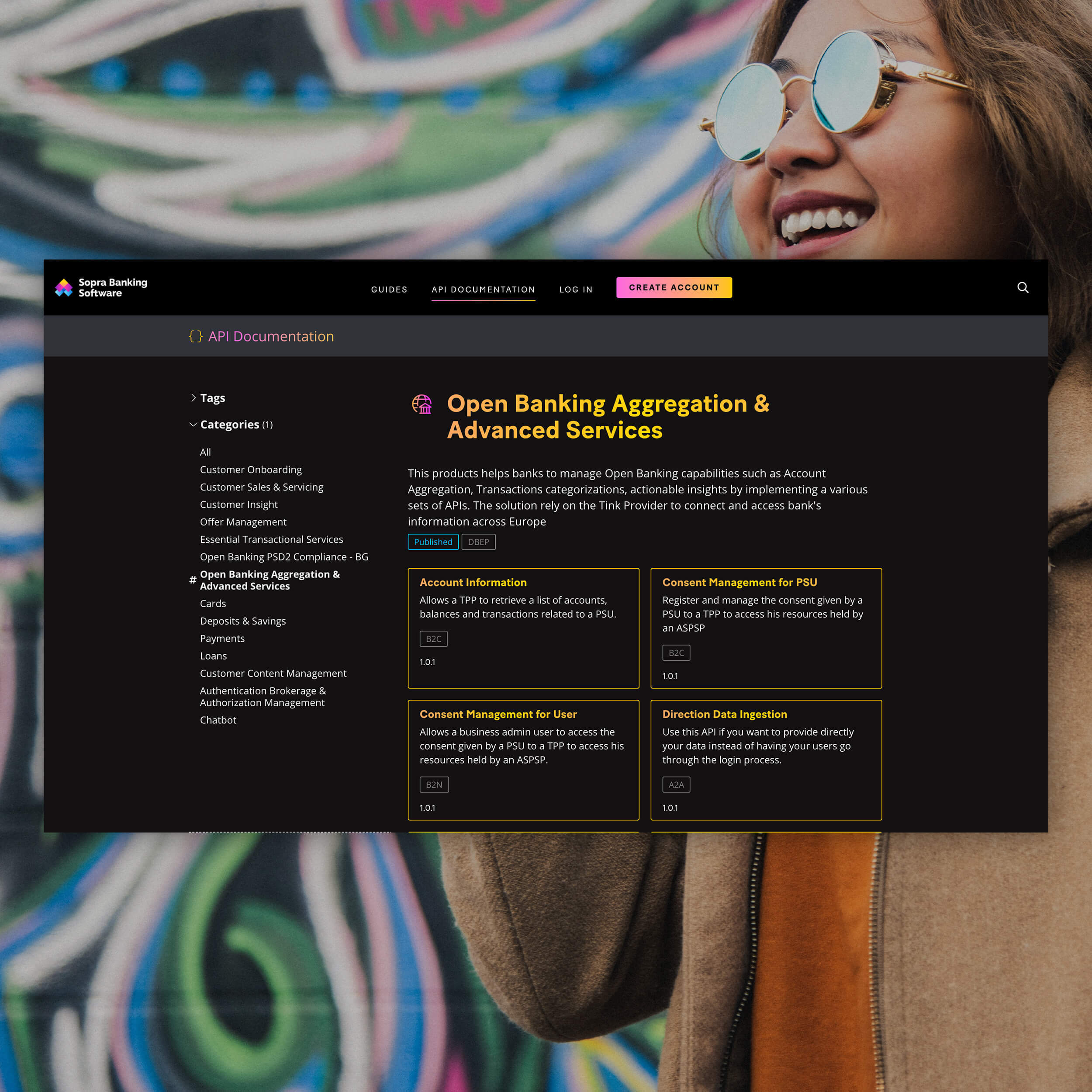

Developer portal

Take advantage of comprehensive guides, full API documentation, sandbox facilities, and enhanced developers support.

How it works

1. Become a regulated TPP with your eIDAS certificate or leverage Tink’s eIDAS certificate.

2. Choose the insights and advanced services that match your business needs.

3. In the API developer portal, select services and associated APIs and start using them inside

your banking app.