Cloud usage in the financial services industry is on the rise, with 91 percent of financial institutions actively using cloud services or planning to use them soon (as of 2020). This is double the number since the same survey was conducted in 2016.

For banks, cloud computing has five major benefits:

- Scalability and flexibility

- Cost optimization

- Increased process efficiency

- Agility and innovation

- Enhanced data security

The adoption of cloud-based banking in Africa, however, lags behind other parts of the world due to infrastructure reliability, cloud point of presence (POP) and regulatory regimes, all of which can vary significantly between different parts of the continent.

Despite this, Africa has a large, young, tech-savvy population and is primed for the growth of cloud services. Major structural investments in the infrastructure are on the rise, and plenty of actors aim to be part of the growth.

Combine these factors with the development of ever-more affordable smartphones, and it’s clear that a digital boom is on the horizon. Cloud technology is central to this boom as it can help African banks achieve economies of scale, resulting in cost savings, improved efficiency and a greater ability to extend access to financial services.

Yet, it’s clear that Africa needs more data center capacity than is currently available. While the effort to build the infrastructure is well underway, it’s worth surveying the landscape to understand where we are and where we’re going.

Data centers: Home to the cloud

Given that Africa lacks data centers, growing this capacity is key to enabling African banks to benefit from the cloud — maximizing their ICT spend, improving business continuity and expediting development cycles.

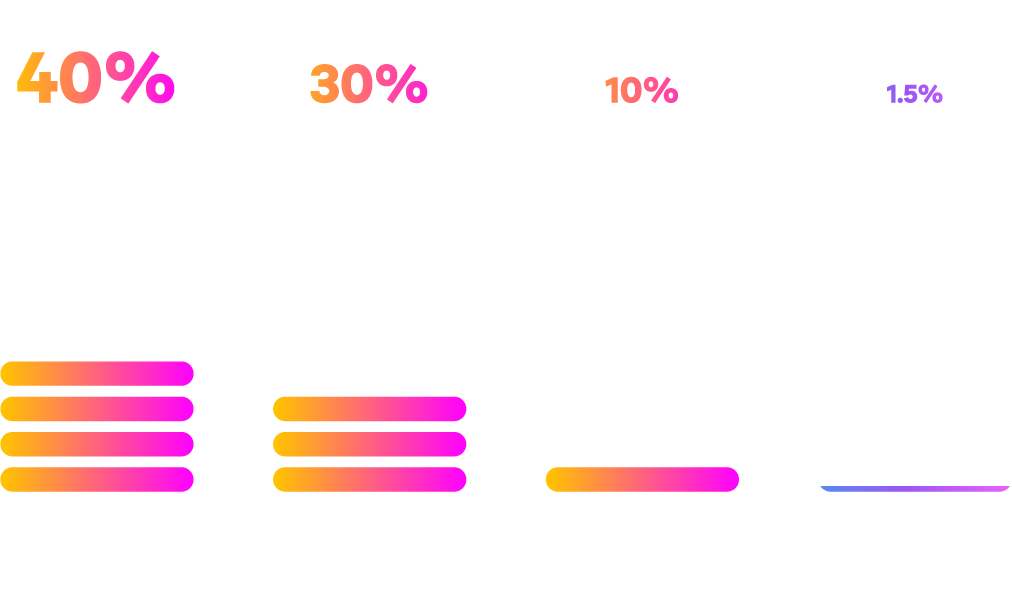

In 2020, it was estimated that only about 1.5 percent of the world’s data centers are located in Africa, while the US, Europe, and Asia respectively had 40 percent, 30 percent, and 10 percent of the total.

Despite rapid data center construction, the pandemic-boosted pace of digital transformation has exposed critical gaps in Africa’s digital infrastructure.

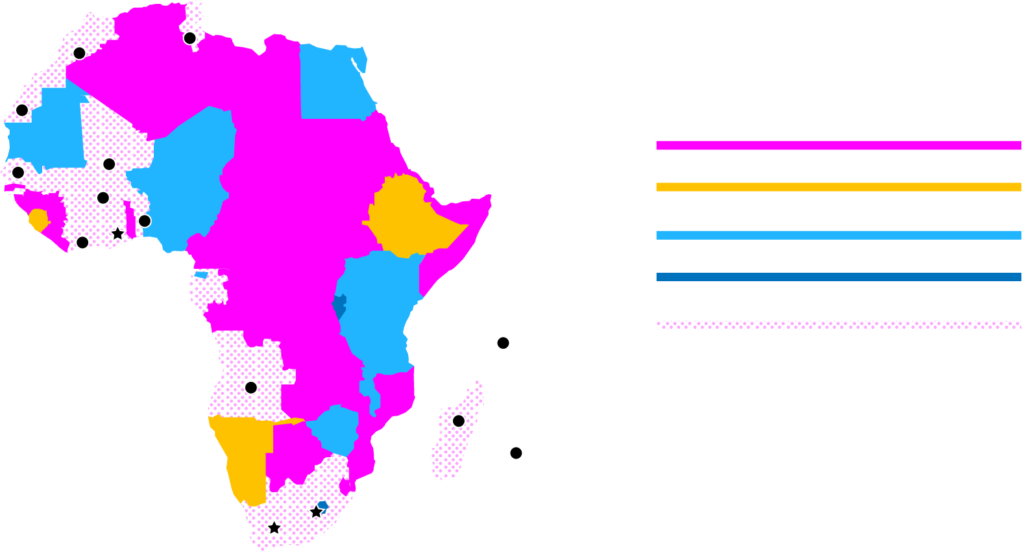

More than 30 Tier III multi-tenant data facilities have come online in Africa since 2016. However, of the continent’s 80-plus metropolitan areas with a population of more than 1 million people, only about 33 percent have at least one such data center.

Africa’s data center facilities are unevenly distributed and do not satisfy the quickly growing demand.

More than 65 percent of the continent’s capacity as in South Africa in 2020, and just a handful of countries account for the bulk of the rest.

According to one estimate, nearly half of Sub-Saharan Africa’s economic output and broadband connections are served by only 10 percent of the continent’s data centers.

Cloud adoption hinges on data center infrastructure. But in order to work, data centers need particular conditions, some of which are hard to find in Africa:

- Geographic proximity to the customers that use and produce the data

- Moderate risk of adverse weather or natural disasters

- A dependable power grid and internet cables with high bandwidth

- A good water source for cooling and low seismic activity

- Internal and external security plus political and economic stability.

Network infrastructure

Connectivity has become ever more essential in the wake of the pandemic, and the existing level of internet service in Africa presents another pain point for cloud banking.

Many cellular networks in rural parts of Africa are 2G and 3G or 4G in urban areas instead of more developed markets where 4G is the default. And 5G connectivity is quickly becoming available.

For banking applications that use AI, big data or cloud computing, there needs to be adequate broadband network coverage or expanded terrestrial fiber networks.

Investment in the continent’s connective capacity is being made:

- Over the past five years, the cost of a gigabyte of mobile broadband data has dropped 60 percent, to 4.3 percent of average monthly income in Africa

- Chinese firms like Huawei, ZTE and China Telecom are investing in core systems of new ICT infrastructure across Africa to provide better and cheaper access to the internet

- Facebook is partnering with some local telecom companies to build an undersea cable to provide faster internet to 16 countries in Africa by 2024.

Cloud providers

In the last few years, hyperscale providers like Amazon and Microsoft have opened data centers in South Africa. However, the current infrastructure situation and low demand mean that neither has a strong presence in other parts of the continent.

- Both Gartner and Forrester indicate that they don’t expect hyperscalers to add significant investment in Africa until 2025

- When these giants make their move, they are likely to locate close to their existing user groups in places like Kenya, Nigeria or Egypt.

Hyperscale data centers and traditional enterprise data centers are typically compared in terms of scale and performance.

Although they may not match the size or custom engineering of the biggest players, there is an increasing number of other cloud providers in the market — for instance, Africa Data Centres, VMWare, IBM and Cloud Africa. Others include:

- Orange offers some of the best network coverage in Africa with a series of POPs, partnerships, and local data centers. In 2020, they signed on with Google Cloud to accelerate the transformation of their IT infrastructure

- A leader in pan-African cloud services, Liquid has a footprint of data centers in population hotspots like Nairobi, Harare, and Kigali. The company has also invested $400 million in network connectivity and data facilities in Egypt

- Oracle is delivering public cloud services through OCI (Oracle Cloud Infrastructure). They don’t currently have a data center in Africa, but two are located in the Middle East, with more planned, including one in South Africa

- Huawei Cloud allows organizations operating inside South Africa and some of its neighboring countries to access their services. They also partner with local providers and have plans to expand into other countries and regions.

Regulations

Beyond a lack of infrastructure, regulations are another adoption roadblock. African governments have an essential role to play in enabling banks to roll out cloud services.

Apart from South Africa, few African regulators have taken a definitive stance on cloud banking and data security or proposed a guiding regulatory framework.

In this sense, barriers include:

- Limited technical knowledge of officials

- Special taxes and licensing fees

- Corrupt practices among regulators

- Complex license procurement procedures

The lack of a regulatory regime makes many African banks hesitant to take action due to a lack of assurance from financial regulators that cloud usage will be permitted.

Data privacy

Only 30 percent of African countries have data privacy legislation in place, a problem that financial regulators will need to address.

Without data privacy guidelines for cloud computing that cover aspects around jurisdiction and location of data, availability of services, incident handling, and recovery, banks are left to operate in a gray area.

The handful of African countries with data privacy-protection regulations also restrict cross-border data transfers, a serious obstacle for future cloud usage.

In addition to data privacy, regulators will need detailed policy positions on data sovereignty, cybercrime and intellectual property rights specific to the cloud.

Catalyzing economic transformation

For the African banking sector, cloud is the biggest trend since mobile payments. From financial institutions looking to adopt platform-oriented architecture and accelerate product rollout to startups launching innovative, all-digital products, cloud-powered models are poised to transform Africa’s productive capacity.

However, in many cases, regulations hamper African banks’ ability to utilize cloud services to optimize their technology infrastructure. The solution is more growth-friendly policies, e.g. fast-track business registration, transparent licensing processes, and mediation for regulatory regimes.

In effect, the development of infrastructure and the success of cloud banking depends on the right partnerships being struck, and whether regulators give the green light—without these, Africa’s digital transformation is likely to be much slower.

Click here to find out how our cloud-based banking solutions can revamp your business, with better and more efficient banking systems.

This article uses statistics and figures taken from our recent white paper on cloud adoption in Africa. To view the full report, click here.