Digitization and digital transformation have become increasingly important in recent years and have reached the point where successfully leveraging digital could be the difference between success and failure in business. Projections show the global digital transformation market will grow to $1.1 trillion by 2025. That impacts many industries, from healthcare and technology to media and retail. Automotive, too.

Advances in areas such as autonomous driving, virtual showrooms and predictive maintenance are revolutionizing the vehicle sector. Managing asset risk via digital auditing is another factor driving change, meaning physical asset auditing may become a thing of the past.

Vehicle audits

The shift to digital asset auditing has been a long time coming. However, the pandemic has accelerated interest in adopting a different approach to auditing assets in many lenders. For example, authorities discouraged or forbade large gatherings and unnecessary travel, making it tricky for auditors to satisfy the physical requirements of inventory inspection, pushing the digital agenda at an even faster pace.

With digitization, more useful data is generated. Used effectively, this data allows greater emphasis to be placed on risk identification and business insight. As a result, the contribution of the audit to risk management is evolving.

Looking ahead, there’s still untapped potential. Data produced by new and advancing technologies will propel audit digitization even further.

The problem with physical asset audits

Physical asset verification has always been an intrinsic part of the audit process. Asset verification checks:

- Condition

- Value

- Title

- Existence

- Location

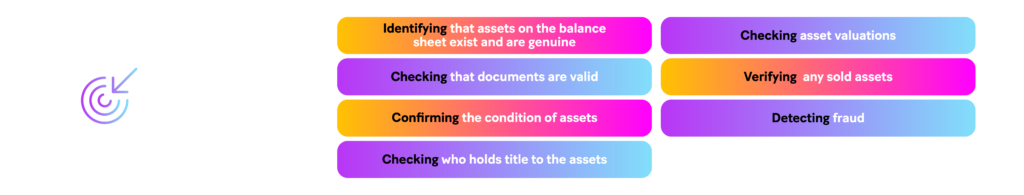

The objectives of physical verification include:

- Identifying that assets on the balance sheet exist and are genuine

- Checking that documents are valid

- Confirming the condition of assets

- Checking who holds title to the assets

- Checking asset valuations

- Verifying any sold assets

- Detecting fraud

Retail crime – either committed by customers or employees, through the supply chain and in warehouses – cost Europe and the US more than $60 billion in 2019, highlighting just one reason these checks are essential. But performing them physically is intrusive, disturbing the normal rhythm of a car dealer’s day.

For example, physical audit planning takes place in advance and is complex to manage. Audits are often rescheduled because of employee absence, work volume or bad weather. And when they do go ahead, the arrival of an auditor must be dealt with there and then by the dealer, which can be quite disruptive.

Solution: Digital self-audits

Digital audits can be undertaken in several complementary ways. One method uses NFC tagging as the car arrives at the dealer, with each tag uniquely associated with a vehicle identification number (VIN). NFC is the same technology used in contactless payment systems, and tags cost just a few cents per vehicle. Once synchronized to the audit website, an app can be used by the dealer to verify the presence of the vehicle, which also provides a GPS location, verifying the vehicle is at the expected site. Thereafter, the vehicle is self-audited by the dealer on demand until sold and the loan is paid off. Video stills, or video clips, can also be used to conduct more exact asset verification, adding flexibility to the audit program.

Video auditing takes asset verification up a notch, allowing exact model, interior trim and vehicle condition to be verified, along with, for example, an odometer reading.

To minimize data storage, video stills capture vehicle registration marks or VIN plates with date and time stamps. Stills also allow dealers to demonstrate the existence of relevant paperwork, such as purchase invoices and bank payments – a key task undertaken by physical auditors, particularly with used cars.

Benefits of digital auditing for automotive floorplan lending

Lenders schedule audits digitally, and they occur on an agreed date or within a short date range agreed with the dealer. There’s flexibility regarding when each vehicle audit takes place on the day in question, and it is also possible to self-audit in batches, if needs be. The audits can be risk-based in approach, with high-risk dealers audited more frequently.

Digital audits return the same core data as physical ones, allowing lenders to react quickly to missing assets and other discrepancies. In fact, digital audits can allow even faster reaction times if the audit platform is fully integrated into the lender’s back-office systems.

Furthermore, the end-to-end flow of digital information is seamless and secure. That ensures data integrity and offers lenders confidence each audit is satisfactorily closed off. Dealerships failing to comply can be subject to the usual sanctions or credit line hold, while remedial action is undertaken.

Critically, the cost per digital audit is less than physical audits, up to 30 percent or more depending on the exact audits being undertaken. That figure falls even further if greater audit frequency is required, as each physical audit comes at a set cost.

Looking to the future

According to KPMG’s global survey, 67 percent of organizations say they’ve accelerated their digital transformation strategy as a result of COVID-19. We note the trend had already begun long before the pandemic, gathering momentum for some time.

As part of that, digital floorplan audits are growing steadily in popularity. Seamless, secure, flexible, environmentally friendly (no auditor travel) and cost-effective, in so many respects they are superior to physical audits. And as technologies continue to evolve, the advantages are likely to increase further.