Boost your productivity: minimize latency, maximize results

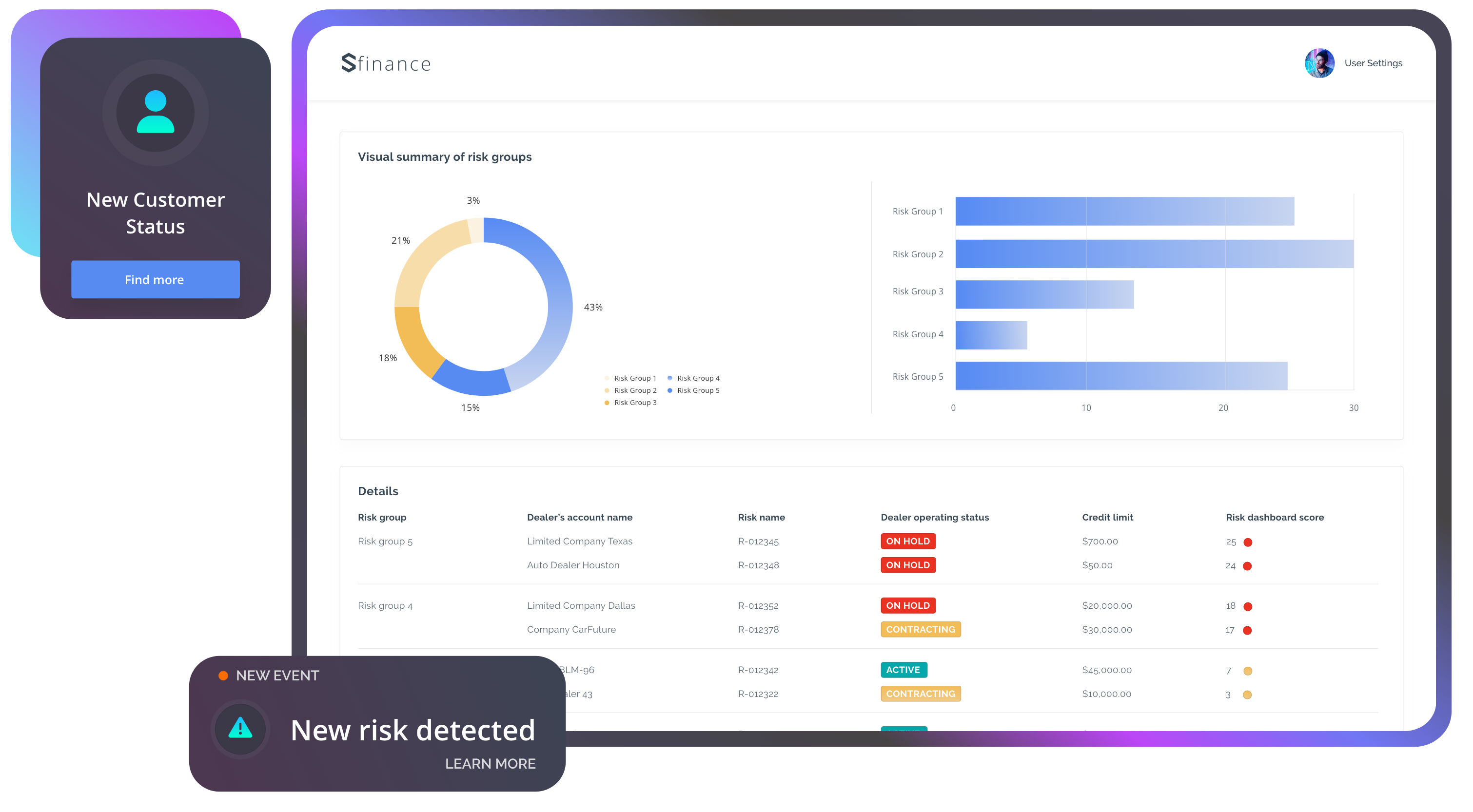

SFP Portfolio Management, built on Salesforce, enables swift customer onboarding and service delivery, enhancing overall customer satisfaction whilst maintaining the accuracy of credit decisioning.

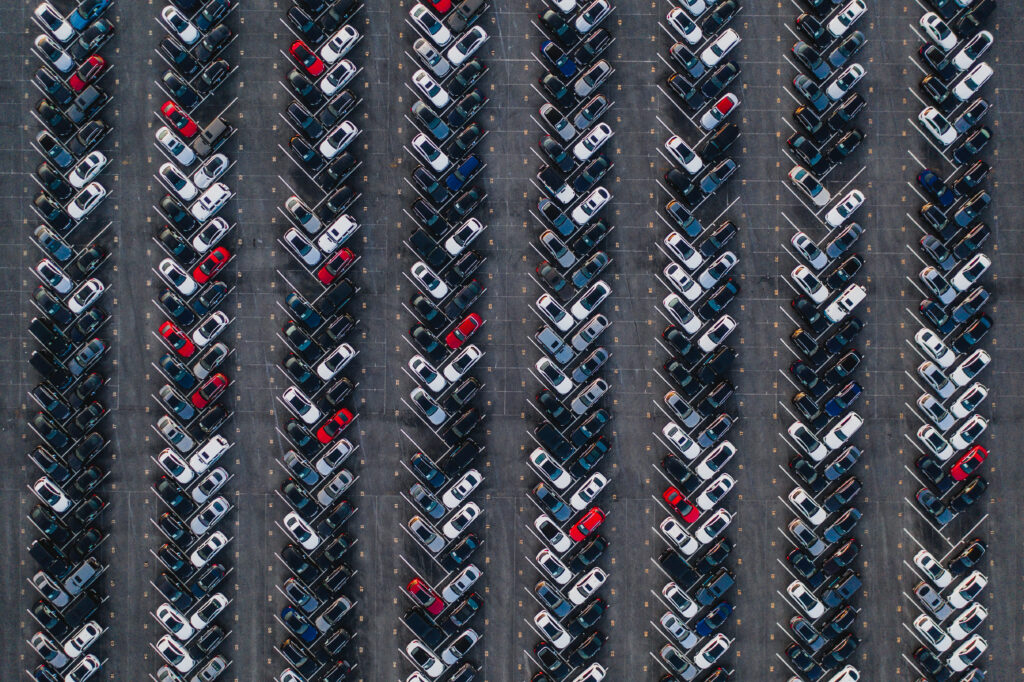

- Implement streamlined onboarding processes to integrate new dealers into your network

- Provide quick responses to customer inquiries and concerns

- Optimize the portfolio management to reduce the time to finalize deals

- Implement real-time monitoring systems to take proactive measures

- Provide personalized services and tailored solutions

- Cultivate a positive customer experience to bolster reputation in the market